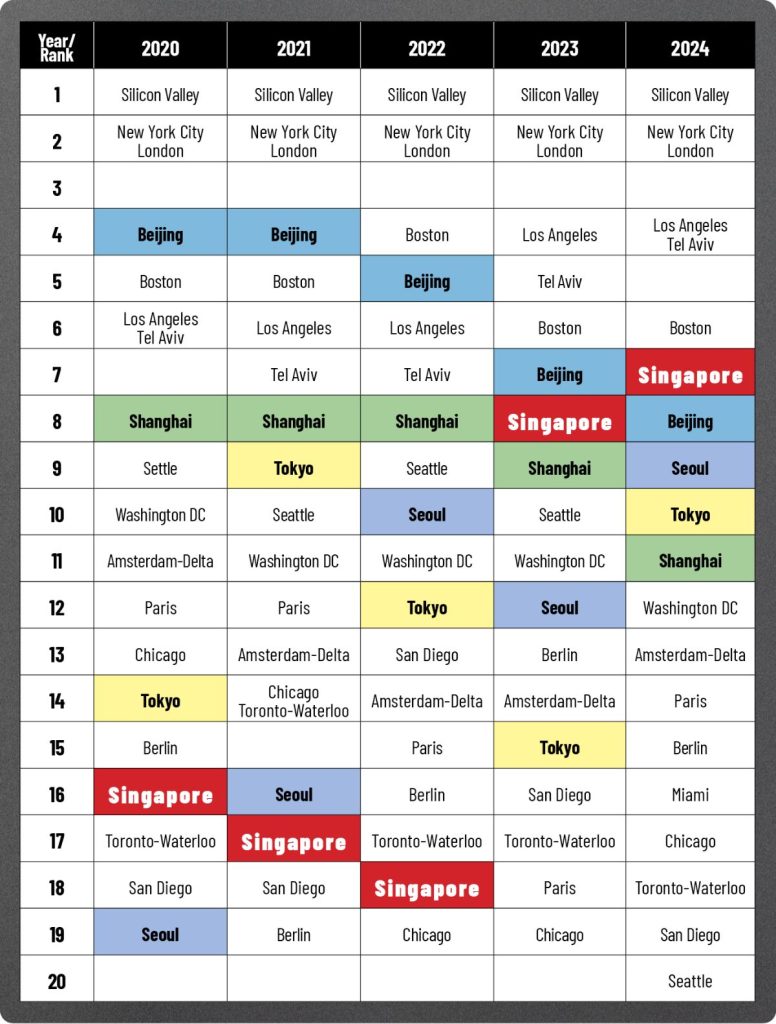

Singapore climbed one spot to seventh, in the The Global Startup Ecosystem Report 2024 – the only startup ecosystem hub in Southeast Asia to make it into the global top 10 list, and ahead of the Asia ecosystem hubs of Beijing, Seoul, Tokyo and Shanghai.

The report by StartupGenome, now in its 12th year, provides insights into the world’s leading startup ecosystems, emerging trends, and key challenges facing entrepreneurs. It is based on extensive research and analysis of data from 4.5 million startups across 300 global ecosystems and over a decade of independent research.

In the 2024 edition, unsurprisingly, Silicon Valley kept its top spot for its excellent startup ecosystem, followed by New York City and London in joint second – positions they have commandeered from 2020 to 2024.

Startups require the right infrastructure to flourish and, in this respect, Singapore’s vibrant and dynamic innovation and enterprise (I&E) ecosystem provides fertile ground for businesses. The city-state’s conducive environment for innovation is globally recognised. In addition to its Asia top placing in The Global Startup Ecosystem Report 2024, Singapore has also maintained the top podium placing for being an innovative nation in the regional grouping consisting of Southeast Asia, East Asia and Oceania, in the Global Innovation Index (GII) by the World Intellectual Property Organization. In the latest 2023 GII index, Singapore was fifth overall, after Switzerland (first) and, respectively, Sweden, the US and the UK. The GII uses 80 indicators to track innovation trends across 132 economies.

Singapore, with its pro-business environment and strategic location to access regional and global markets, is a leading startup ecosystem that brings together a network of players from around the world. In 2023, Singapore dominated the regional tech funding landscape, capturing 63.7% of the region’s deal volume and 73.3% of its deal value, with investments totalling US$6.1 billion (S$8.5 billion) across 522 transactions, says The Global Startup Ecosystem Report 2024. A year earlier in 2022, Singapore had secured more than US$8.11 billion in equity funding, for its over-500 deals, according to StartupSG, an Enterprise Singapore initiative.

Given Singapore’s commitment to research and development (R&D) and I&E over some 30 years, the city-state has developed an environment which is welcoming and conducive especially for startups. Through StartupSG, they can easily gain access to a wide range of local support initiatives as well as a platform to connect on the global stage. Statistics from Enterprise Singapore show that today, Singapore is home to 4,500 tech startups, 400 venture capitalist firms, and 240 accelerators, venture builders and incubators, which lays a strong foundation for a globally competitive startup ecosystem.

Steady and sustained investment in R&D is a key pillar of Singapore’s economic strategy. In 2010, Singapore’s R&D strategy was expanded to span research, innovation and enterprise (RIE), moving breakthroughs from the research stage towards commercialisation. Consequently, the RIE2015 and RIE2020 plans included translation, commercialisation and innovation strategies, to tap on the growing pipeline of promising research outputs. For RIE2025, Singapore has committed 1% of its GDP – the most substantive R&D budget in the country’s history – signalling once again the importance of research and innovation (R&I) for the economy.

Deep tech, featuring technology-intensive products rooted in extensive scientific research, is an area of innovation that Singapore has been nurturing for over 30 years or so. The investments have translated to a strong scientific research base of almost 40,000 researchers, scientists and engineers, supported by a strong intellectual property regime. The latest statistics reveal that in 2023, Singapore’s commitment to R&I has garnered a 31% year-on-year increase in deep tech deals (159), with 25% of total deal value invested in deep tech startups. The numbers are significant as they came amid a global downturn in funding, as markets continued their course correction from the pandemic-fuelled boom, says Enterprise Singapore. According to Crunchbase, 2023 saw Asia’s lowest venture funding value since 2015, and also marked a five-year global low. Comparatively, Singapore’s total deal value, while showing a year-on-year decline, had remained relatively resilient, remaining 33% above the 2020 level.

The share of early-stage funding increased in 2023, accounting for 94% of deal volume and nearly 50% of total deal value, up from 90% and 44% respectively in 2022. In contrast, global trends saw early-stage deals being the hardest hit, with a 40% decline year-on-year, says Crunchbase. This shows the robustness of Singapore’s startup ecosystem, where more nascent startups, particularly in deep tech sectors where capital requirements are much higher, were able to better weather the funding winter compared to their global counterparts.

Last year in Singapore, a promising 24 local startups progressed to Series A funding, while 10 startups moved on to Series B funding, demonstrating investors’ confidence in the prospects of these new businesses.