TAKEAWAYS

Generative artificial intelligence (gen AI) will be a gamechanger for the finance and accounting functions: that’s what 72% of business leaders in Singapore agreed with, as the technology is expected to augment existing functions, increase productivity, and lower costs.

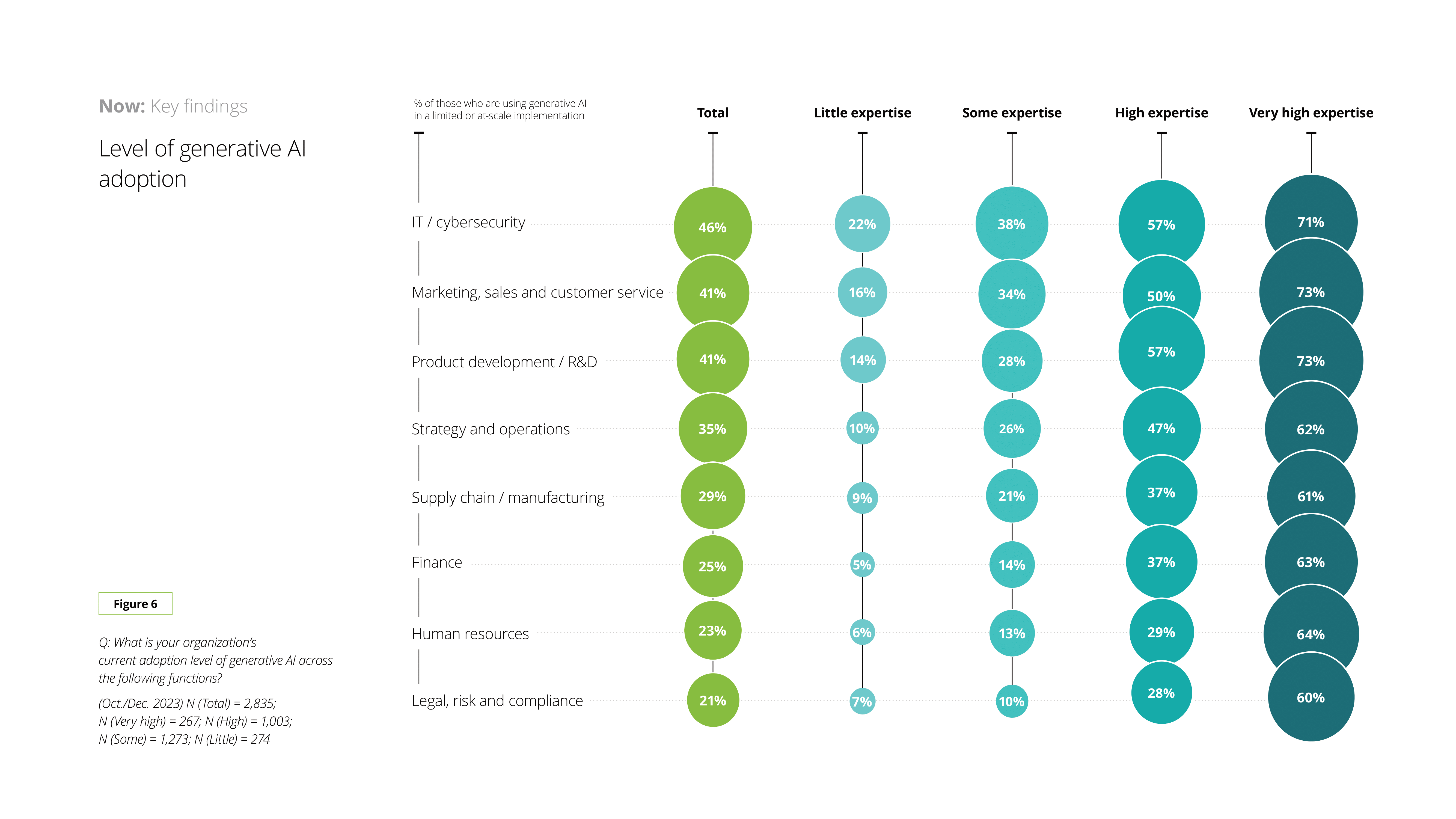

However, the adoption of gen AI in finance and accounting-related functions is still nascent. In a 2023 ISCA survey, respondents indicated that limited to no resources had been allocated to AI initiatives, and less than 25% of employees are AI literate. This is similar to global trends. A Deloitte survey finds that companies with only little to some expertise in gen AI were least likely to adopt the technology in their finance, risk and compliance functions. On the other hand, companies with very high expertise adopted gen AI relatively uniformly across functions.

Figure 1

There is much at stake for companies trailing behind in their AI investments and competencies. Sustaining competitive advantage in today’s rapidly evolving business environment requires finance functions to have a long list of competencies, including generating almost real-time data insights, robust risk assessments of increasingly complex business transactions, harnessing the value of businesses and assets in a competitive investment environment, meeting sustainability goals, and staying one step ahead of sophisticated financial criminals in anti-money laundering.

All these require superhuman speed and the ability to synthesise a wide range of data, which will likely need some form of AI or automation. Gen AI provides the potential for a reimagining of accountancy careers; for instance, the ISCA AI whitepaper, Artificial Intelligence for the Accountancy Industry: What Lies Ahead, suggests that we might see the emergence of “super accountants” who can cover more areas across multiple accountancy fields with fewer resources.

How do we nudge finance leaders to take concrete action? While the benefits are clear, it can be daunting for them on where to start. Deloitte’s gen AI survey found that lack of trust is one of the biggest barriers to large-scale adoption and deployment of gen AI, namely (1) trust in the quality and reliability of gen AI’s output (supported by improved transparency and explainability), and (2) trust from workers that gen AI will make their jobs easier and won’t replace them.

Inhouse accounting professionals do not just play crucial roles as strategists and gatekeepers, they fundamentally perform a very human role: to motivate people around an organisation towards its goals and purpose. By presenting data and, more importantly, trusted assurance of an organisation’s performance and health, they influence organisational and societal behaviour.

This is where human-centred AI becomes crucial. Accounting is a very human endeavour: the products of the accounting and finance function are ultimately for human consumption, to facilitate and improve decision making.

Human-centred AI is AI which centres the design, use and intention of the AI tool for the human user. It focuses on elements such as the importance of human oversight, intervention and control, and insists that these elements must be infused into the thinking of AI systems from the very beginning. Human-centricity is not just an end state but also the journey of getting there – ensuring workers of varying AI literacy are supported in the adoption of these technologies and not left behind.

Focusing on the journey also gives leaders time to build trust, both in the technology and from workers. This reduces the pressure to show immediate return-on-investment (ROI). Any short-termism will end up counterproductive to enterprise-wide adoption because many of the critical elements for successful deployment (for example, data infrastructure, talent development, AI governance and risk controls, and experimentation) need time to develop.

AI can automate many of the repetitive and mundane tasks of the accounting role, augmenting as much as 60% to 100% of critical work functions across Assurance, Financial Accounting, and Management Accounting tracks.

The technology can, for example, track KPI indicators, review supporting documentation, and even generate a report on findings and make relevant recommendations. But what if there were extenuating qualitative circumstances? What if there were a mistake in interpreting the inputs? How would the error be detected? How do we ensure that there was a fair representation of activities? How do we ensure the recommendations do not unfairly punish or reward organisational units?

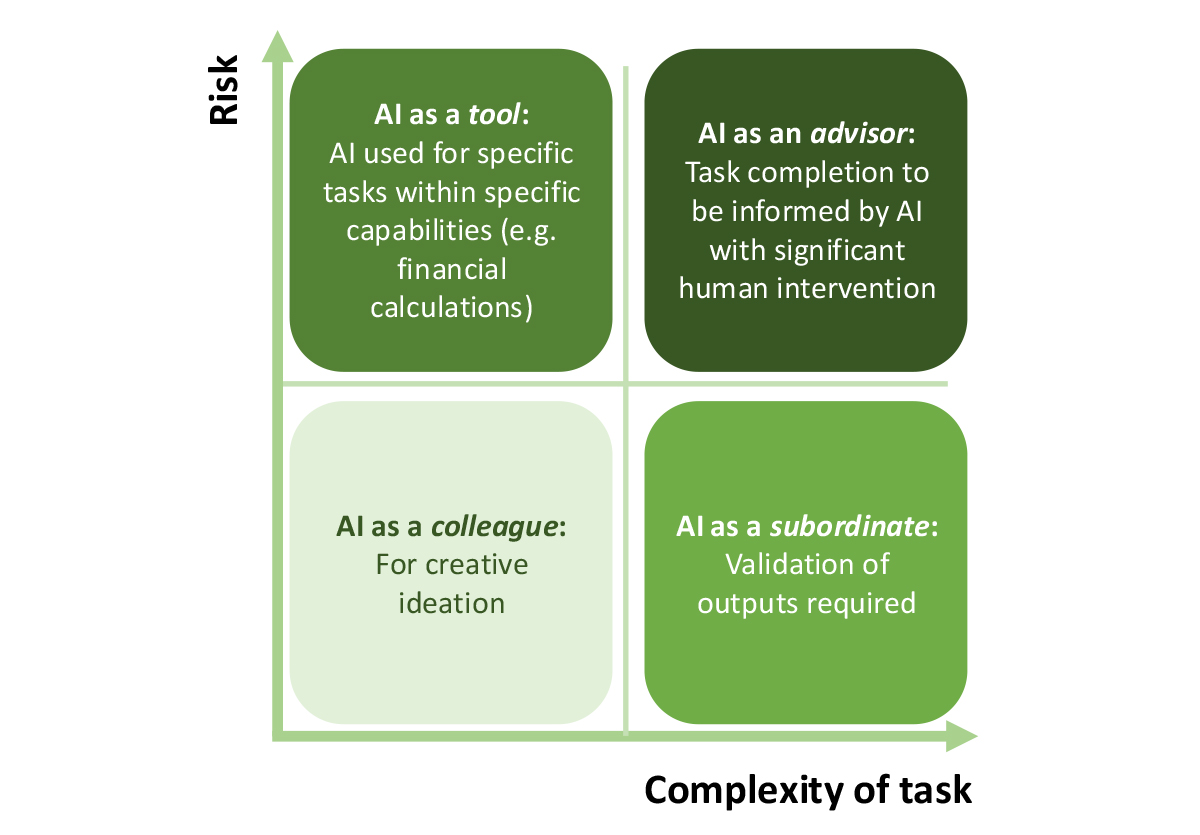

To aid companies in deciding which aspects of their tasks and businesses should be augmented by AI, and to what extent, we have developed a simple framework across two parameters – risk, and need for accountability. This framework can help organisations envision the end state of human-centred AI, recognising that some tasks are inherently more suited to the strengths of AI than others.

Figure 2 Identifying opportunities for AI augmentation

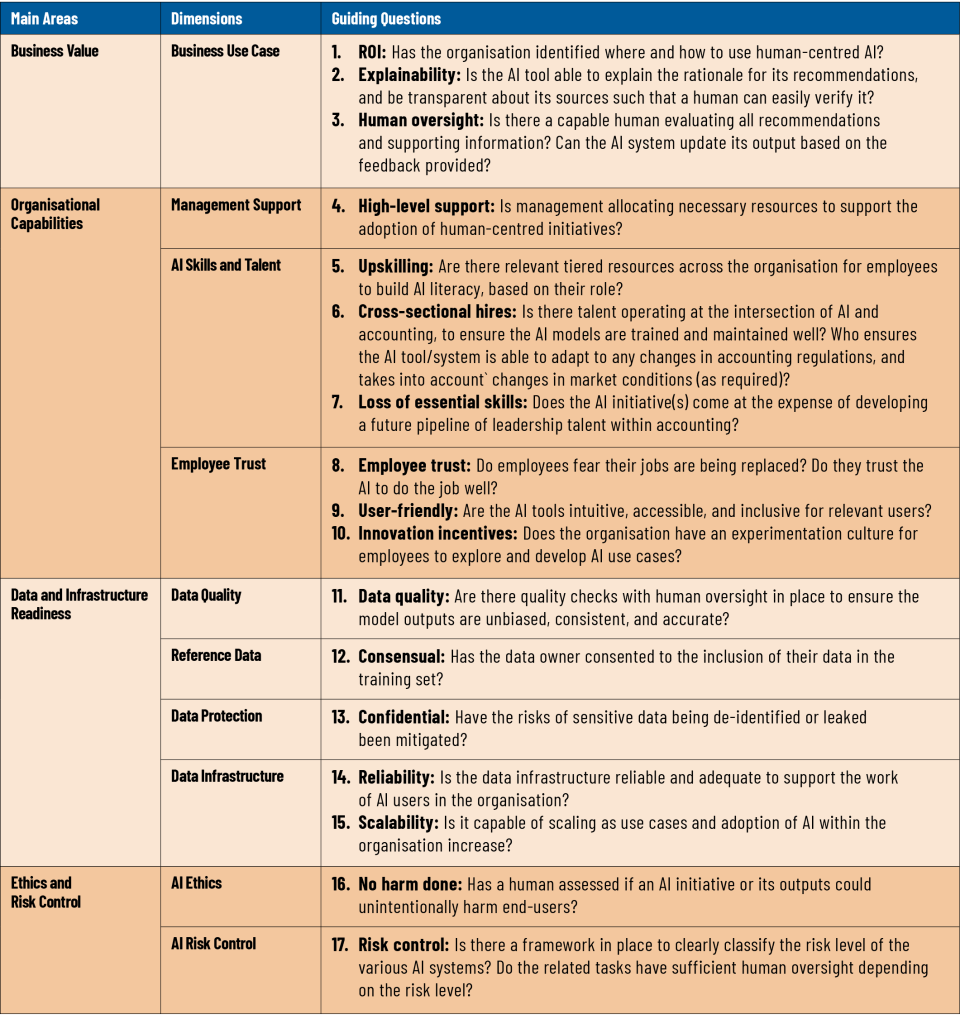

Subsequently, we put forth a framework of questions to help accounting and finance leaders’ journeys to their end state and adopt human-centred AI.

This is a work in progress, and we welcome feedback from industry and individuals. In a followup whitepaper, we intend to flesh out case studies of these dimensions in action.

Table 1 Key questions for the adoption of human-centred AI

Adopting a human-centred approach to AI in accounting is crucial for harnessing the full potential of AI while preserving the essential human elements of the profession. By prioritising collaboration between AI and human accountants, organisations can achieve greater efficiency, accuracy, and innovation in their accounting functions. This approach not only addresses the ethical and professional concerns associated with AI, it also positions accountants as strategic partners in the digital transformation of the industry. Embracing this human-centred framework will enable the accounting profession to navigate the challenges and opportunities of AI, ensuring a future where technology and human expertise work hand in hand to drive success.

This article was contributed by ISCA Insights & Publications Department, and Deloitte’s Center for the Edge (Southeast Asia), in collaboration with Deloitte Southeast Asia CFO Program.