TAKEAWAYS

Let’s face it – finance professionals are still being asked to deliver predictability in an increasingly unpredictable world.

Whether it’s forecasting next quarter’s cash flow, defending a three-year business plan, or navigating sudden funding cuts, the pace of change has outgrown our traditional ways of working. Forecasts become outdated before they are even approved. Budgets are locked in place while the business continues to pivot. And while teams are asked to “be agile”, finance is still operating on a slow annual rhythm.

If you have ever thought, “There must be a better way to support the business”, you are not alone.

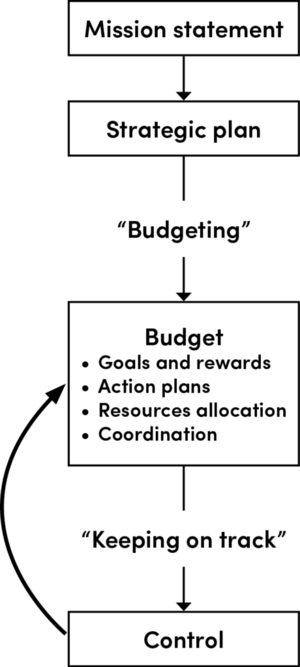

Figure 1 The traditional budgeting process

The problem is not finance; it is the system we are stuck in.

The budgeting cycle was designed in an era where change was slower, information was more linear, and control was king. That world no longer exists.

In fast-paced environments:

Yet, we are still expected to answer modern questions with old tools:

If your answer still depends on manual variance reports and disconnected spreadsheets, it may be time to rethink the process.

Benchmarks are meant to stretch performance, encouraging teams to reach for innovation through external or cross-functional collaboration or comparisons. But this is at odds with the logic of traditional budgeting, which often prioritises “realistic” and achievable targets for the budget year.

As a result, the gap between what is possible and what is planned becomes invisible. Short-term financial goals dominate, and any ambition to strive for best-in-class performance is quietly sidelined.

Because budget reports create a sense of control, the effort to explore relevant benchmarks is rarely made. And, even when benchmarking is attempted, it can backfire – seen as a disciplinary tool rather than a means for improvement, especially in organisations where performance is not measured against real external competition.

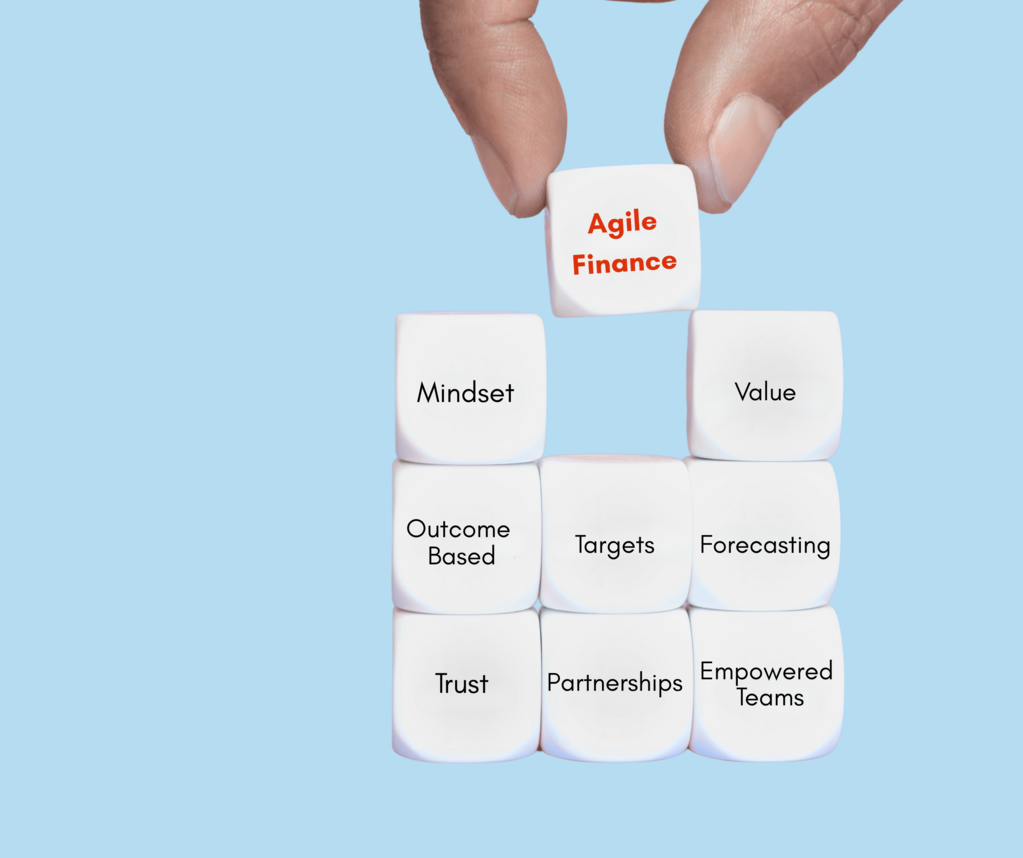

Agile finance is not a buzzword. It is a mindset and method designed for adaptability, transparency, and speed. First popularised in software development, agile principles are now being adopted across industries from technology to healthcare, manufacturing and, increasingly, in finance.

It asks:

In practice, this means shifting from rigid control to guardrails – defining strategic intent, boundaries, and triggers for change rather than enforcing static rules.

This is not hypothetical.

Roche’s finance team overhauled its forecasting and budgeting process by:

At Roche, finance teams were spending eight to 10 months each year on budgeting and planning cycles before shifting to rolling forecasts, freeing up significant time to support innovation, strategic decision-making, and value delivery.

The result? Faster time-to-market, tighter alignment with innovation, and a finance function respected for its strategic value.

If agile finance can thrive in one of the world’s most regulated and risk-averse sectors, like healthcare (at Roche), it is proof that this model is viable in even the most complex environments.

Honestly – change is hard, especially when:

Yet, the cost of doing nothing is far greater:

The good news? We do not need to reinvent everything. We just need to learn how to apply “agile” within finance, in a way that still meets governance, risk, and performance needs.

One of the most overlooked shifts in becoming more agile is recognising that budgeting often tries to do too much at once. It blends three very different purposes, namely, setting performance targets, forecasting what’s likely to happen, and allocating resources in a single rigid process.

These are fundamentally different conversations. By separating aspiration from prediction, and prediction from investment, we open up space for faster decisions, clearer accountability, and more effective resource deployment – all without losing control.

If you have been feeling the strain of outdated finance systems, or wondering how to support innovation without sacrificing oversight, you are not alone. And, it starts with asking better questions:

Whether you are a finance business partner, FP&A lead, or CFO dealing with complexity in an organisation, the shift to agile finance is already underway. The only question is whether we are ready to lead it.

Agile finance is not just about new tools or faster reporting cycles; it’s about a mindset shift, where finance steps out of the back office and into the strategy room. It means working side-by-side with the business to shape direction in real time, not just track results after the fact.

Curious about how a value-driven approach could reshape your finance function?

Explore how agile principles can transform the way you plan, fund, and deliver impact – with speed and confidence.

Discover practical frameworks and tools for making agile finance work in your organisation. Learn more in the Certified Agility in Finance programme.

Clarice Tan, CA (Singapore), is an ICAgile Certified Agility Finance (ICP-Fin) and Project Management Professional (PMP).