TAKEAWAYS

Five days. Four countries. One mission. What started as an intense sprint during the ISCA Global Talent Programme (GTP) became a cross-cultural collaboration that not only earned us the Audience Choice Award but also put our prototype in front of the DBS Consumer Banking Product Team. Here’s how we turned an idea into impact, and built a bridge between generations along the way.

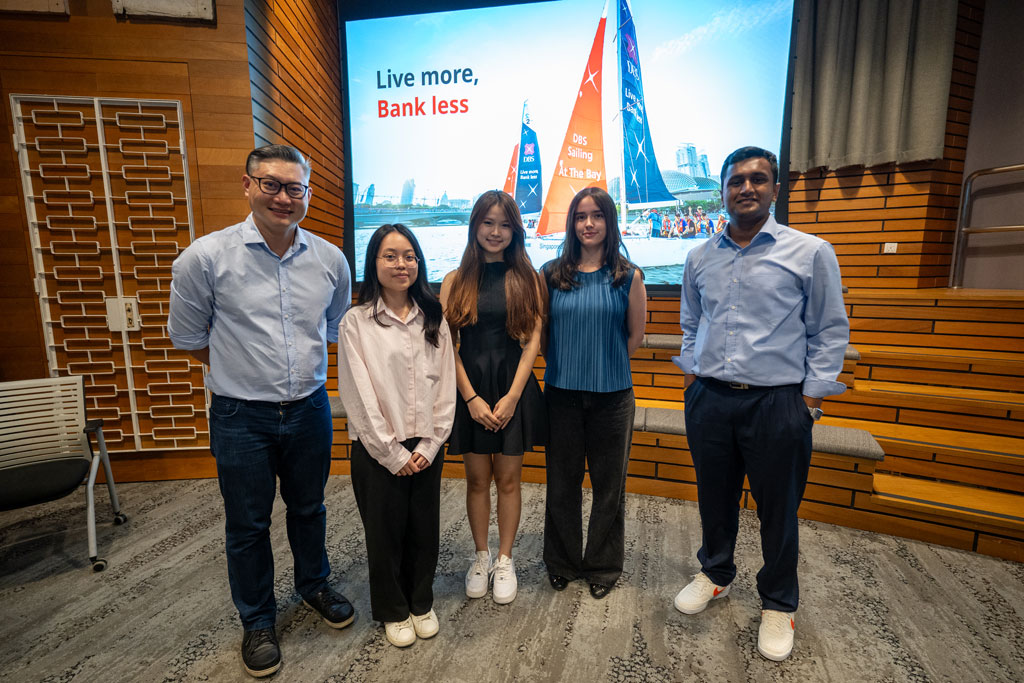

Our team, comprising Anant from India, Ariana from Canada, Mint (Phitchayaporn) from Thailand and Constanz from Singapore, came together during the ISCA Global Talent Programme (GTP) with a problem statement: to design a financially empowering solution that creates sustainable business value for DBS while improving the lives of Singapore’s older adults. The diversity in our backgrounds was not just a point of interest but a strategic advantage. By combining varied cultural perspectives, problem-solving approaches, and professional experiences, we were able to analyse the problem from multiple angles and enrich our solution with depth and breadth.

From the beginning, we recognised that the challenge went beyond teaching older adults how to use technology. It was about building confidence, fostering trust, and ensuring they felt included in an increasingly digital financial landscape. For many, digital banking is not inherently unwelcome, but the unfamiliarity can be intimidating. Our goal was to make that unfamiliar terrain accessible, engaging, and safe to explore.

To lay a strong foundation, we first immersed ourselves in understanding DBS’s existing programmes, systems, and initiatives for older adults. This helped us pinpoint opportunities where our proposal could complement and enhance current efforts. At the same time, we conducted market research to see how other organisations, both in Singapore and internationally, had approached similar challenges, noting successes to emulate and missteps to avoid. This dual research process ensured our ideas were relevant to DBS’s context while informed by global best practices.

Armed with this understanding, we developed an empathy map to capture the experiences, needs, and emotions of older Singaporeans adapting to fintech. We explored their perspectives in detail, namely, what they see and hear, what they think and feel, and what motivates or discourages them. A recurring insight emerge – resistance was not to the change itself, but to the unknown. This meant our solution needed to demystify digital banking, providing not only the “how” but also the “why” behind each feature, in a way that felt approachable.

We also drew lessons from other ageing societies such as Hong Kong, where combining education with interactive engagement has proven highly effective in raising digital literacy. This reinforced our belief that any learning solution for older adults should be paired with community support to encourage adoption and sustained use.

As our ideas began to take shape, we leveraged the strengths of each team member, whether in research, creative design thinking, communication, or analytical problem-solving. We tested early concepts through user feedback sessions with GTP peers, ISCA members, and professionals from different industries we met during the programme. Their insights were invaluable in refining our approach. With guidance from our mentor, Mr Adrian Tan, Senior Vice President, Head of Innovation Accelerator, DBS, we identified gaps, reworked features, and ensured that our final proposal would be both practical and impactful.

Our solution, aptly named “Buddy Up”, integrates technology with intergenerational support. At its core is an interactive learning application that uses visual demonstrations to guide older adults through DBS’s digital banking features. Instead of relying solely on written instructions, users can watch step-by-step examples and practise in a safe, simulated environment until they feel confident. This hands-on approach builds familiarity, reduces anxiety, and allows them to learn at their own pace.

To complement the application, each older adult is paired with a younger buddy who offers real-time help and encouragement. This relationship turns the learning process into a social and enjoyable experience. Both participants are rewarded for their involvement – older adults for actively engaging in learning, and younger buddies for contributing their time and knowledge. The reward system encourages continued participation while reinforcing DBS’s commitment to being the best bank for a better world.

Beyond technical skills, Buddy Up fosters meaningful conversations about financial literacy. Younger participants can start and gain an appreciation of the importance of saving early, while older adults can feel more confident when navigating DBS’s banking features to find the products that suit their needs. This two-way learning creates value for both generations and strengthens community bonds.

Executing the project in just five days was one of our biggest challenges, especially as we could only start working on it after our GTP sessions, which often ended late in the evenings. Within this intense timeframe, we not only developed the idea but also created a working prototype, and crafted a compelling presentation.

Our efforts culminated in the team winning the Audience Choice Award, an honour given to the best team presentation. We were also given the opportunity to demonstrate our proposed solution to the DBS Consumer Banking Product Team.

Time constraints demanded efficiency, clear division of responsibilities, and disciplined communication. Our limited familiarity with Singapore’s older adult landscape and DBS’s internal systems meant we had to rely heavily on targeted research and interviews. Technical challenges also arose when experimenting with different presentation formats, but quick troubleshooting and collaboration enabled us to keep moving forward.

The constraints ultimately shaped our growth as a team. We learned to adapt when initial ideas met with roadblocks; identified blind spots by seeking constructive critique; and remained open to diverse perspectives. We also saw firsthand the value of iteration – every round of feedback and refinement made our solution stronger and more relevant.

Through rigorous research, user engagement, and cross-cultural collaboration, we developed a solution that is both practical and socially meaningful. Buddy Up is not just a digital literacy tool, it is a bridge between generations, a catalyst for confidence-building, and a platform for shared financial empowerment. By making technology approachable, creating opportunities for mutual learning, and fostering community connections, it has the potential to transform the way older adults interact with digital banking while inspiring younger generations to take ownership of their financial future.

In working together, we discovered that the heart of innovation lies in empathy, adaptability, and the courage to refine an idea until it truly meets the needs of those it serves. For us, this journey was more than a project; it was a lesson in how diverse minds can come together to create lasting impact.

Have you read the other five parts of this six-part article? Do check out Parts 1, 2, 3, 4 and 5, right here on CA Lab.

Anant Gupta is in Year 2, Accounting and Finance (Commerce) & Bachelor of Commerce (Honours), Delhi University, India; Ariana Eilonwy Rodriguez Reed is in Year 3, Bachelor of Commerce, University of British Columbia, Canada; Phitchayaporn Tanpetcharat is in Year 3, BBA in Finance, Chulalongkorn University, Thailand; and Constanz Wee Wang Qi Yi is in Year 2, Bachelor of Accountancy with Honours, Singapore Institute of Technology, Singapore.