TAKEAWAYS

Goods and Services Tax (GST) registration obligations have always been a significant compliance risk area for businesses. As financial professionals and tax practitioners, effective GST registration advisory requires a good understanding of the rules governing both retrospective and prospective registration obligations. Assisting clients to systematically monitor their taxable turnover and identify registration triggers early ensures timely compliance and avoids costly penalties associated with late registration.

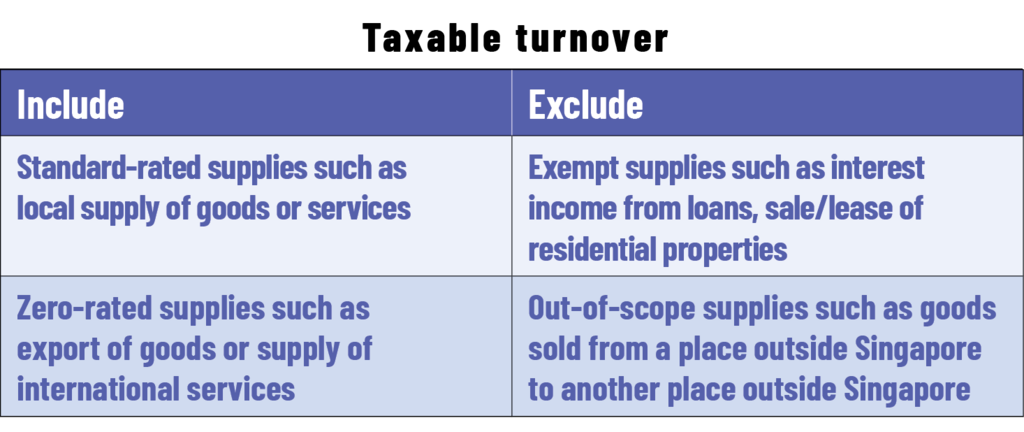

Under the GST Act, businesses must register for GST if their taxable supplies (that is, taxable turnover) are:

Retrospective view

The retrospective view considers the business’ taxable turnover at the end of the calendar year (that is, 31 December). If the business’ taxable turnover exceeds $1 million at the end of the calendar year, the business must apply for GST registration within 30 days, that is, by 30 January of the following year, and GST registration will take effect on 1 March.

Prospective view

The prospective view, on the other hand, considers the business’ taxable turnover at any point in time when one can reasonably expect that the business’ taxable turnover will be more than $1 million in the next 12 months. For example, you have accepted quotations or confirmed purchase orders from customers that support your forecast value of $1 million. In this case, the business must apply for GST registration within 30 days after the date of the forecast, and the GST registration will take effect two months from the date of forecast.

Exception

There are circumstances where businesses are not required to register for GST even if their taxable turnover exceeds $1 million.

The business must nonetheless continue to monitor its taxable turnover at the end of the next calendar year.

Different business constitutions require different approaches to computing taxable turnover. Understanding these distinctions is crucial for accurate GST registration assessment.

Failure to register for GST is an offence under Section 61 of the GST Act. Your clients may face serious consequences for late GST registration:

Despite heavy penalties, many businesses are still late in their GST registration. An example is a business in the service industry that failed to monitor its taxable supplies. When audited by the Inland Revenue Authority of Singapore (IRAS), the business was found to be late in GST registration by five years. This resulted in the business having to absorb $1,150,000 in GST that it was not able to fully recover from its customers. In addition, the business had to pay an additional $55,000 in penalties for the late registration.

Another example is a business in the construction industry that claimed to be unaware of the GST registration rules even though multiple educational letters had been sent to them. When audited by IRAS, the business was found to have registered four years late. This resulted in $405,000 in backdated GST payments plus $3,000 in penalties.

Businesses can avoid these costly GST oversights by registering on time. As a financial professional and tax practitioner, you should advise your clients who are late in GST registration to register immediately and voluntarily disclose the delay. IRAS may waive the late notification fine and penalties if all the qualifying conditions in the e-tax guide IRAS’ Voluntary Disclosure Programme are met.

1) Regular monitoring

Ensure that your clients establish proper systems to track their taxable turnover on an ongoing basis. Conduct a timely review of the past turnover at the end of every calendar year, as well as quarterly reviews of projected revenue to identify potential registration triggers, such as signing of significant contracts or orders.

2) Recordkeeping

Comprehensive and accurate financial records form the foundation of GST compliance. Advise your clients to maintain supporting documents for revenue projections, including contracts, quotations, and purchase orders that substantiate their turnover forecasts. Document business changes affecting turnover calculations, such as new product lines or market expansions.

3) Available resources

Businesses should ensure that staff are aware of the GST registration requirement and apply for registration on time when the threshold is met. Guide your clients to use the GST Registration Calculator to check whether they are required to register for GST.

As financial professionals and tax practitioners, you can support your clients in establishing regular turnover monitoring and robust documentation practices to effectively mitigate any risk of late GST registration.

This article was contributed by IRAS.