TAKEAWAYS

Jason is the Head of the Human Capital Management (Postgraduate) Programme at the Singapore University of Social Sciences. I received a call from him one day. He asked, “Do you think human resource (HR) folks should know how to read financial statements?” Jason felt that students in his programme should know more than just HR. I replied, rather intuitively, “Of course!” As I hung up the phone, I pondered, “Why should HR Champions be financially literate?”

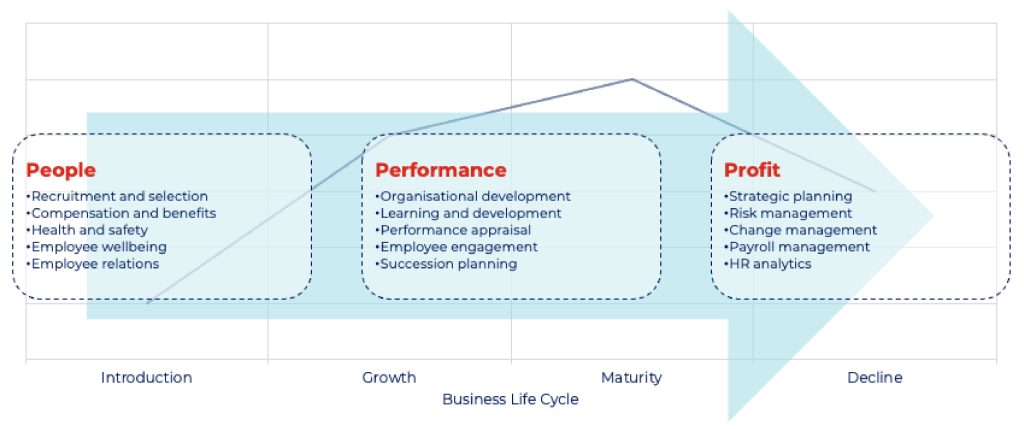

HR Champions journey with businesses through all stages of the business life cycle: introduction, growth, maturity and decline. In doing so, they would progress in their careers from being an administrator to a business partner. Expanding on this, an administrator ensures the smooth operation of the HR function in day-to-day business, while a business partner aligns HR strategy with business strategy in decision-making.

As HR Champions progress with their businesses, their foci at work evolve (Figure 1). At the introduction phase, they tend to focus on “People”, such as (a) recruitment and selection; (b) compensation and benefits; (c) health and safety; (d) employee wellbeing; and (e) employee relations, among others. The elephant in the room is essentially getting the right people to do the appropriate work.

Figure 1 Foci of HR Champions across the business life cycle

Next, at the growth and maturity phases, HR Champions tend to focus on “Performance” (in addition to “People”), such as (a) organisational development; (b) learning and development; (c) performance appraisal; (d) employee engagement; and (e) succession planning, among others. The crux of the matter is essentially getting the right people to perform to and beyond their potential.

Finally, at the decline phase (alternatively referred to in practice as the “extension” or “renewal” phase), HR Champions tend to focus on “Profit” (in addition to “People” and “Performance”), such as (a) strategic planning; (b) risk management; (c) change management; (d) payroll management; and (e) HR analytics. The task at hand is essentially driving financial growth and sustainability through HR.

As can be seen from Figure 1, HR Champions are increasingly required to understand financial matters, and to manage them effectively. This is where financial literacy comes into play. In fact, when I spoke on this topic in Jason’s class, 100% of his students agreed that HR professionals should be literate, financially. However, opinions vary as to when they should work on financial literacy.

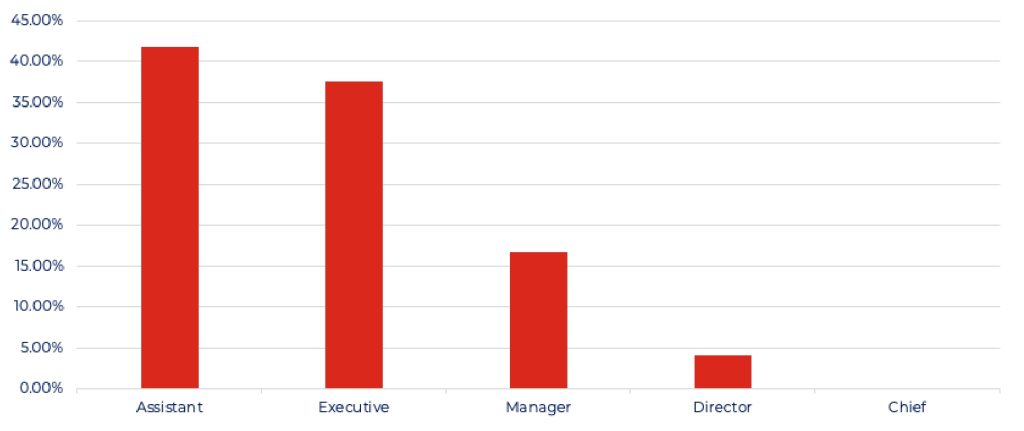

In Jason’s class, students were asked, “When should one work towards financial literacy?” Forty-two per cent (42%) of the students surveyed were of the opinion that one should start working towards financial literacy at the “Assistant” level of their careers, 37% at the “Executive” level, 17% at the “Manager” level, 4% at the “Director” level and, last but not least, 0% at the “Chief” level (Figure 2).

Figure 2 When should one work towards financial literacy?

Clearly, students prefer to start early when it comes to honing their financial literacy skills. They want to “start small, start simple”, so as to lay a strong foundation to add value once they reach the right position in hierarchy. Students who prefer to start mid-way through their careers opined that they would then be in the right position to apply financial literacy with oversight over the HR function.

To sum it up, students were able to justify their opinions with their differing circumstances and experiences. They were not wrong per se, but my challenge to them was, why not start now? It would never be too early or too late to start working towards financial literacy, agree? At the end of the day, financial literacy does add value in both tactical and strategic HR operations.

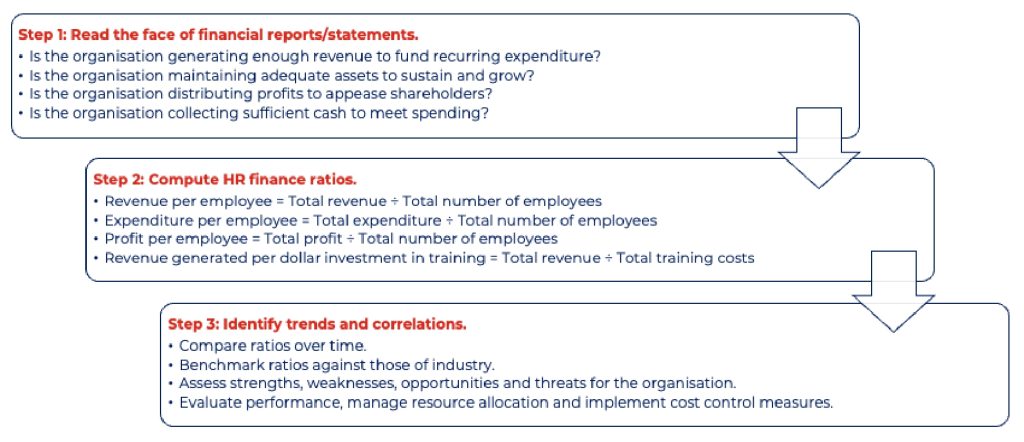

Here are my proposed steps to help HR Champions add value with financial literacy (Figure 3). They are as simple as one-two-three.

Figure 3 Proposed steps to add value with financial literacy in HR

Step 1: Read the face of financial reports and statements (to get a glimpse of the business’ strategic direction and financial health, and to ascertain whether the business is able to operate as a going concern in the foreseeable future). This would, for example, enable HR Champions to prepare the right messaging in bad times to manage expectations, and to budget cash flows for bonus payouts in good times to prevent payment delays.

Step 2: Compute HR finance ratios, including but not limited to (a) revenue or profit per employee – these are productivity ratios which measure outputs generated by each employee; (b) expenditure per employee – this is a cost-management ratio which reflects inputs incurred on each employee; and (c) revenue per training cost – this is a return-on-investment ratio which indicates the effectiveness of training investments.

Step 3: Compare ratios over time and benchmark ratios against those of industry to identify trends and correlations. This would enable HR Champions to assess strengths, weaknesses, opportunities and threats of their businesses. Findings in these areas would then empower HR Champions to evaluate performance, manage resource allocation and implement cost control measures, where applicable.

In connection with the above, HR Champions should be mindful of the following in carrying out their analyses: (a) the past may not necessarily be reflective of the future; (b) ratios suggest correlations, but not causal relationships; and (c) quantitative data usually ignores qualitative nuances. In a nutshell, HR finance ratios need to be interpreted in context for them to be meaningful.

Financial literacy allows HR Champions to track performance, engage in evidence-based planning, reveal red flags in HR operations, and improve HR operations. As one of Jason’s students correctly pointed out, financial literacy is a nice-to-have as an assistant or executive, a good-to-have as a manager, and definitely a must-have as a director or chief. HR Champions can no longer work in silos but must work with Finance, going forward.

Benny E. Chwee, FCA (Singapore) and ATA (Income Tax), teaches the Accountancy Programme, School of Business, and the Taxation Programme, School of Law, Singapore University of Social Sciences.