TAKEAWAYS

While the CFO role has grown more complex, it has also become one of the most rewarding positions in the C-suite, according to the 2023 EY Global DNA of the CFO study. It is no wonder that finance professionals in Southeast Asia increasingly see the CFO role as a stepping stone to the CEO position. The study, which covered 1,000 CFOs and senior finance leaders worldwide, found that 48% of respondents in the region are targeting the top job in the long term. Only 42% in Southeast Asia were content with the CFO role as their long-term goal, lower than the global average of 47%.

To help achieve their CEO ambitions, CFOs will need to embrace boldness, unlock value for their teams and drive success across their organisations. Those who step up to the challenge have important opportunities to demonstrate vision and enterprise-wide leadership. They should address the following priorities:

Balancing short- and long-term investments is a defining challenge of the CFO role, particularly in Southeast Asia. Compared with 76% of global peers, 84% of respondents in the region agreed that today’s challenging market environment is increasing pressure on finance leaders to drive cost efficiencies and hit short-term earnings targets.

Long-term efforts focus on building sustainable growth, innovation and competitive advantage, while short-term efforts address immediate operational needs, financial targets and customer demands. Getting the balance right requires a collective C-suite effort. However, Southeast Asian finance leaders reported disagreements in the top leadership team like their global peers.

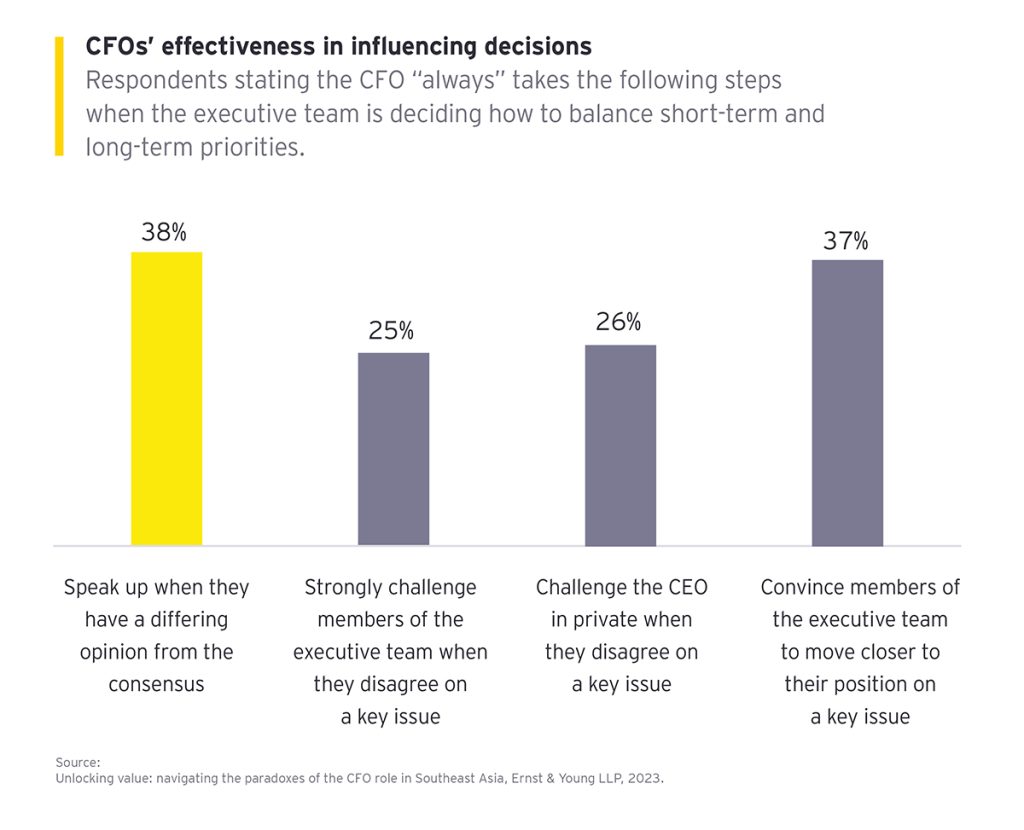

CFOs are well-positioned to build consensus across the C-suite’s different perspectives by providing valuable insights to inform decision-making, navigating tradeoffs and helping to align decisions with the long-term value strategy.

Building consensus will require a CFO with the credibility and influence to challenge the CEO and executive team. Respondents in Southeast Asia identified the top two abilities that CFOs need to effectively influence the executive team’s decision-making:

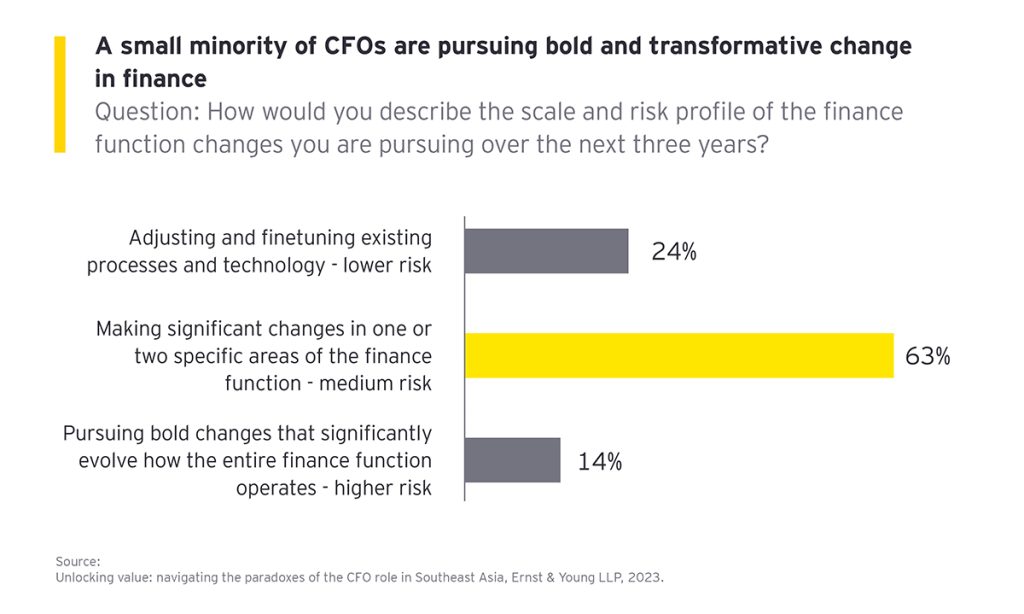

The study found that only 14% of CFOs in Southeast Asia are making bold, holistic changes to transform the function for the future, despite significant room for improvement.

CFOs recognise they need to build digitised finance functions to help their organisation achieve long-term growth. Their priorities are technology transformation, ESG data capture and assurance, and advanced data analytics. But the majority of the Southeast Asian respondents are taking a medium-risk approach by making significant changes in one or two specific areas of the finance function, but not embracing holistic digital transformation.

With many enterprise resource planning systems approaching end of life, CFOs have a perfect opportunity to drive transformation. By successfully rationalising, harmonising and streamlining their technology ecosystem, CFOs can create an efficient and agile finance operating model, which will achieve much-needed cost reductions and provide data and commercial insights to elevate finance as a better business partner.

Shrinking the finance technology footprint is important in optimising costs as running too many systems results in higher maintenance costs. CFOs can leverage unified solutions that allow the integration of data used for different reporting across the enterprise to support the accuracy and agility that businesses need in the current reporting environment.

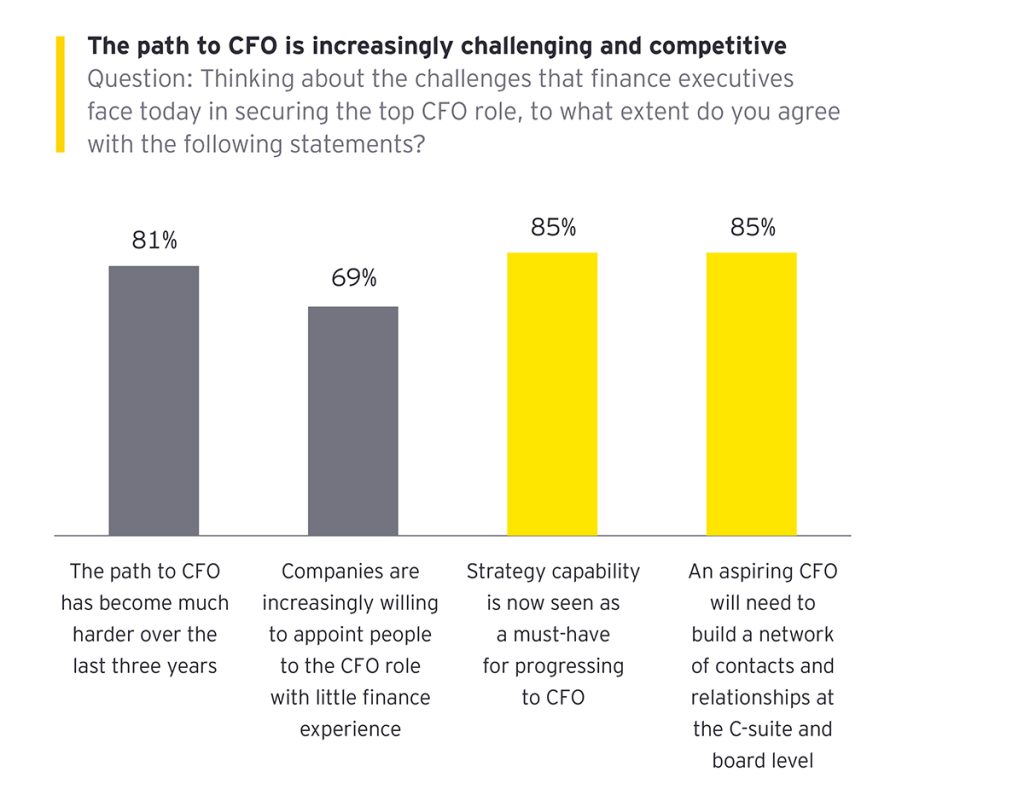

The aspiration of many CFOs for the CEO role raises two key considerations: the need for finance leaders to stretch their skills, and the importance of developing new talent to fill the CFO role when incumbents move to a CEO position.

The study found that CFOs will be increasingly chosen for their strategic and inspirational leadership rather than pure finance domain expertise. More than two-thirds of Southeast Asian finance leaders said their companies are willing to appoint CFOs with limited finance experience and consider candidates from business development, investment, analytics, operations management, or legal and compliance pathways. Required skill sets are also changing, with many respondents considering highly developed emotional intelligence as the top attribute for successful CFOs of the future.

When it comes to prioritising development of the next generation of leaders, almost two-thirds said they are investing enough time in mentoring aspiring finance leaders, compared with less than half of global peers.

As CFOs prepare for the CEO role, respondents said their greatest challenge is finding time to build knowledge and skills through exposure to external expertise and access to thought leadership. To free up more time, CFOs could delegate more responsibilities to the next tier of emerging finance leaders. As financial reporting becomes largely automated, some finance roles could be repurposed to support the CFO in partnering with the business.

Despite the challenges of the finance function, there has never been a better time for CFOs in Southeast Asia to showcase their leadership skills and commercial acumen. By delivering strategic results for their organisations and continuing to mentor future finance leaders, CFOs could find themselves in strong contention for the top job down the track.

The report, Unlocking value: navigating the paradoxes of the CFO role in Southeast Asia, is available here.

Ronald Wong is EY Asean and Singapore Financial Accounting Advisory Services Leader; and Partner, Assurance at Ernst & Young LLP. This article was first published on the EY website. Republished with permission.