Hong Kong has recorded its strongest first half year IPO performance since 2021, with a sevenfold increase in funds raised from January to June 2025 (1H 2025), compared to the same period in 2024, according to KPMG’s latest Chinese Mainland and Hong Kong IPO Markets: 2025 mid-year review, released on 3 July 2025.

The exceptional performance was driven by a surge in A+H listings, including the listing of the world’s largest manufacturer of batteries for electric vehicles (EVs), which collectively accounted for over 70% of total funds raised in Hong Kong during the period. This has positioned Hong Kong as the global IPO market leader in terms of funds raised for 1H 2025. With the number of active Main Board applications exceeding 200 – a record high – Hong Kong is expected to sustain its IPO momentum well into 2H 2025.

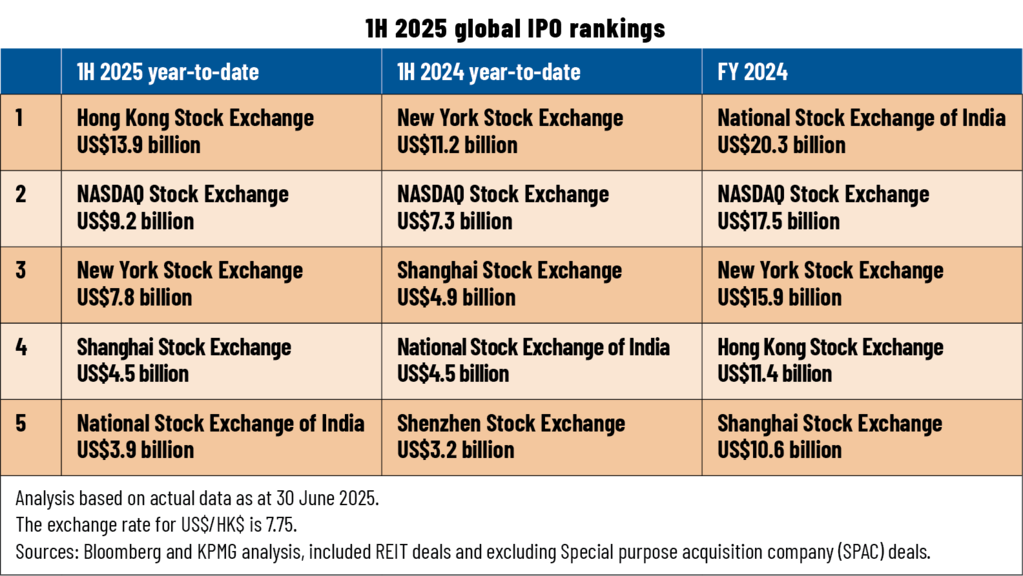

Global IPO markets raised a total of US$60.9 billion across 544 deals in 1H 2025. Overall results were stable compared to 1H 2024, as total funds raised increased by 5% while deal volume fell 6%. NASDAQ Stock Exchange and New York Stock Exchange ranked second and third after Hong Kong Stock Exchange, with an 8% decrease in combined fundraising year-on-year; Shanghai Stock Exchange and National Stock Exchange of India ranked fourth and fifth, respectively.

While artificial intelligence (AI) and other high-tech industries continue to attract significant investments, the high uncertainties caused by US trade policies have brought a series of negative impacts on the capital market and corporate operations; the long-term consequences of these impacts are still being gradually revealed.

During 1H 2025, A-share market listings remained stable, raising RMB53.7 billion across 61 deals. This represents a 5% decrease in funds raised but a 15% increase in deal volume compared to 1H 2024. Ten REITs debuted, raising RMB16.3 billion, accounting for 30% of total A-share proceeds in 1H 2025.

In June 2025, Chinese Mainland authorities unveiled a new reform to support companies from the Greater Bay Area which are listed in Hong Kong to also list on the Shenzhen Stock Exchange (H+A Listings). Shortly after, Shanghai Stock Exchange announced the addition of a growth tier for the STAR Market, supporting the listing of rapidly growing but not yet profitable technology companies.

The new reforms represent another significant milestone for the A-share IPO markets. By introducing a growth tier to the STAR Market, regulators will have the flexibility to implement innovative reforms within this subset of the market. This approach not only provides substantial support to the fundraising efforts of early-stage technology companies, it allows investors to better understand and manage the associate risks.

Additional reform measures to be implemented for the STAR Market include a pilot programme that allows high-quality technology companies to undergo pre-IPO reviews, as well as the expansion of the fifth listing criterion to include sectors such as AI, commercial aviation and low-altitude economy.

Hong Kong also ramped up efforts to support early-stage technology companies recently, with the launch of the Technology Enterprise Channel (TECH), to facilitate new listing applications from Specialist Technology Companies (Chapter 18C) and Biotech Companies (Chapter 18A). The initiative includes a confidential filing option to safeguard sensitive information and a presumption for these companies to have satisfied certain requirements for listing with a weighted voting right structure.

Hong Kong’s IPO market rebounded sharply in 1H 2025, raising HK$107.1 billion across 42 listings, representing a 700% increase in funds raised and a 40% rise in deal volume. The strong momentum is further reflected in the IPO pipeline, which now has 219 applicants, including a record-breaking 210 Main Board applicants, and more than double the 86 applicants as at 31 December 2024.

A record seven A+H listings were completed during the period, accounting for 72% of total IPO funds raised. Notably, the world’s largest EV battery manufacturer raised HK$41.0 billion in its A+H listing, making it the largest global IPO in 1H 2025, and also the largest Hong Kong IPO since 2021.

The A+H listing trend is expected to continue, as there were already 47 new A+H listing applications during 1H 2025, compared to only five during the entire 2024. Of the 44 A+H listing applicants in the pipeline as at 30 June 2025, 43 are sizeable A-share companies with market capitalisations exceeding RMB10 billion, providing a significant boost to Hong Kong’s efforts to maintain its leadership in global IPO markets by year-end.

Unlike Hong Kong, Singapore’s equities market performance has been lacklustre in recent years. The number of listed companies dropped 20% in five years, from 782 to 622 by January 2025. Singapore Exchange (SGX) has also experienced consistently higher numbers of delisting than new IPOs in the past few years.

In 2024, SGX’s IPO proceeds of US$31.4 million were just a fraction of Hong Kong Stock Exchange’s US$11.4 billion. To enhance the development of Singapore’s equities market, in August last year, the Monetary Authority of Singapore (MAS) established the Equities Market Review Group (EMRG), to recommend suitable measures.

In February 2025, MAS and the Financial Sector Development Fund (FSDF) announced a S$5-billion Equity Market Development Programme (EQDP), aimed at strengthening the local asset management and research ecosystem, and increase investor interest in Singapore’s equities market. This is one of a series of measures announced by EMRG to strengthen the competitiveness of Singapore’s equities market. The full set of measures considered by EMRG are grouped under the pillars of supply, demand, connectivity/trading, and regulatory measures.

Under EQDP, a combined initial sum of S$1.1 billion will be managed by three appointed asset managers comprising:

MAS will announce the appointment of additional asset managers by 4Q 2025, to manage the remaining funds under the S$5-billion EQDP.