Businesses are neutral in their outlook for the Singapore economy, with around half (49%) of those surveyed expecting economic conditions to stay flat in the next 12 months. However, more businesses (27%) are confident that the economy will improve, compared to 24% which expect it to worsen, in the same 12-month period. Fewer than one in three businesses (30%) is satisfied with the current economic climate, a decrease from 37% in 2023. These are some of the findings from the National Business Survey 2024 Manpower & Wages Edition by the Singapore Business Federation (SBF).

Businesses in the Logistics & Transport, and Banking & Insurance sectors polled more optimistically, while those in the Hotels, Restaurants & Accommodations, and Administrative & Support Services sectors were more pessimistic.

The growing sense of confidence is reflected in hiring decisions, with 40% of businesses saying they expect to expand hiring in the next 12 months, up from 29% in the same period last year. Forty-eight per cent (48%) say they will maintain their current staffing levels (down by seven percentage points from last year), while 12% intend to reduce manpower (down four percentage points).

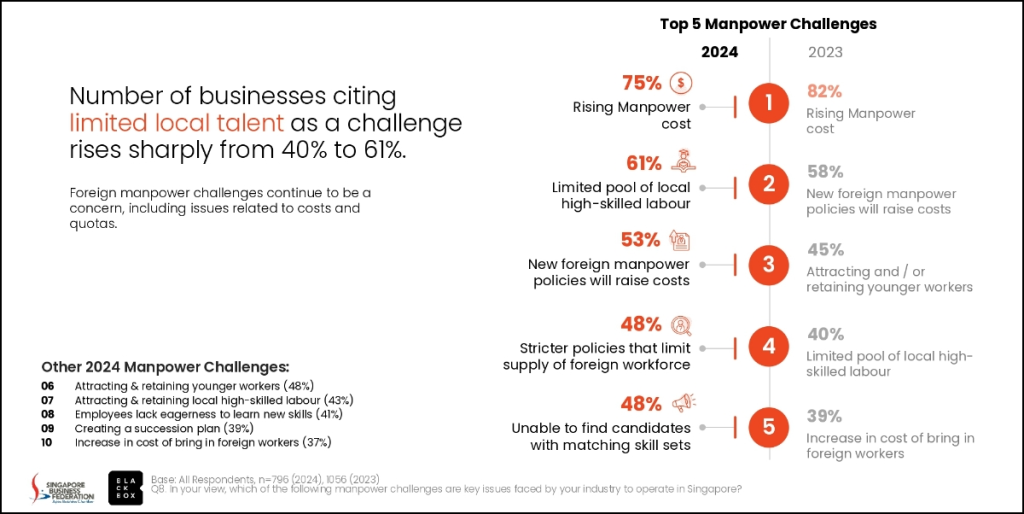

Manpower cost continues to be the top challenge faced by 75% of businesses. The number of businesses citing limited local talent as a challenge has jumped from 40% to 61%, and is now the top manpower challenge after cost. However, there remains room for businesses to tap on government support programmes to hire near-fit employees – seven in 10 businesses which face challenges in hiring candidates with the right skills say that they have not tapped on such government schemes, citing the lack of suitable applicants as the key reason.

Compared to the last 12 months, fewer businesses plan to increase salaries (49%, down from 58%) and non-salary staff costs (16%, down from 34%) over the next 12 months. Instead, more businesses will increase investment in staff training (34%, up from 27%) and provide flexible work arrangements (24%, up from 22%).

Pushed by the need to stay competitive, nine in 10 businesses recognise the need to upskill employees, and seven in 10 businesses report that they have upskilled/reskilled their employees in the last 12 months, using a combination of formal and informal training. But upskilling and reskilling come with their own set of challenges, including having limited manpower to cover the work of those who are undergoing training (55%), high training costs (48%), and the fear that employees may not stay long enough for the training to be beneficial (35%).

According to the findings, the three top government support programmes for training and development are SkillsFuture Course Fee subsidies, SkillsFuture Enterprise Credit and WSG Career Conversion Programmes.

Manpower policies relating to foreigners are affecting businesses negatively, with businesses in the Banking and Insurance sector most impacted by the increased qualifying salaries for Employment Pass (EP) holders, and those in the Retail and Hotels, Restaurants & Accommodations sectors, by the increased qualifying salaries for S Pass holders. In response to tightened foreign workforce policies, 46% of businesses are enhancing the recruitment of local workers, 35% are outsourcing to third-party contractors, and 29% indicate they will delay business expansion plans. A review of foreign worker quotas and work permit regulations is the top manpower support request by 63% of businesses, higher than the support they want for training and development (51%).

“While there are signs of a more positive employment outlook with some businesses seeking to expand hiring and raise wages, a sizeable proportion of businesses continue to be cautious about the future,” says Kok Ping Soon, CEO of SBF. “It is heartening to note that businesses recognise the need to upskill/reskill their workers, and more plan to increase investment in staff training in the next 12 months. This is critical for the long-term competitiveness of our businesses.”

Mr Kok calls on businesses to do more on these fronts, in particular, investing in technology, job redesign, career planning and talent attraction. “SBF is also working through the Alliance for Action on Business Competitiveness, along with industry stakeholders, to review flexibilities in foreign workforce policies to better support our enterprise and workforce transformation.”

The survey was carried out from 18 June to 16 July 2024, and drew responses from 798 businesses across all key industries. The respondents comprised both small and medium-sized enterprises (82%) and larger companies (18%), and largely mirrors SBF’s membership base.