The Asia-Pacific region is marked by both resilient growth and disinflation but the region remains “inherently dynamic and will contribute over 60% of global growth this year”, according to Krishna Srinivasan, Director of Asia and Pacific Department, International Monetary Fund (IMF). Regional growth will slow to 4.5% in 2024, after the 5% registered in 2023.

The drivers of growth are as diverse as the region, and range from resilient domestic consumption in most ASEAN countries to strong public investment in China and most notably in India, and to a sharp uptick in tourism in the Pacific island-nations, he adds. Mr Srinivasan was speaking at the launch of IMF’s Regional Economic Outlook for Asia and Pacific report in Singapore on April 30.

Across the region, inflation has been generally declining, albeit at varying speeds; some countries are still experiencing sustained price pressures while others are facing deflationary risks. The report indicates that near-term risks are “broadly balanced”, as global disinflation and the prospect of monetary easing have increased the likelihood of a soft landing. Spillovers from a deeper property sector correction in China remain an important risk, while geoeconomic fragmentation is putting a dampener on medium-term prospects. Given the diverse inflationary landscape, “Asian central banks should continue to focus on domestic price stability and avoid making policy decisions overly dependent on anticipated interest rate moves by the Federal Reserves,” says Mr Srinivasan. The report indicates that fiscal consolidation should accelerate to contain debt burdens and debt-servicing costs, in order to preserve budgetary space for addressing structural challenges, including population aging and climate change.

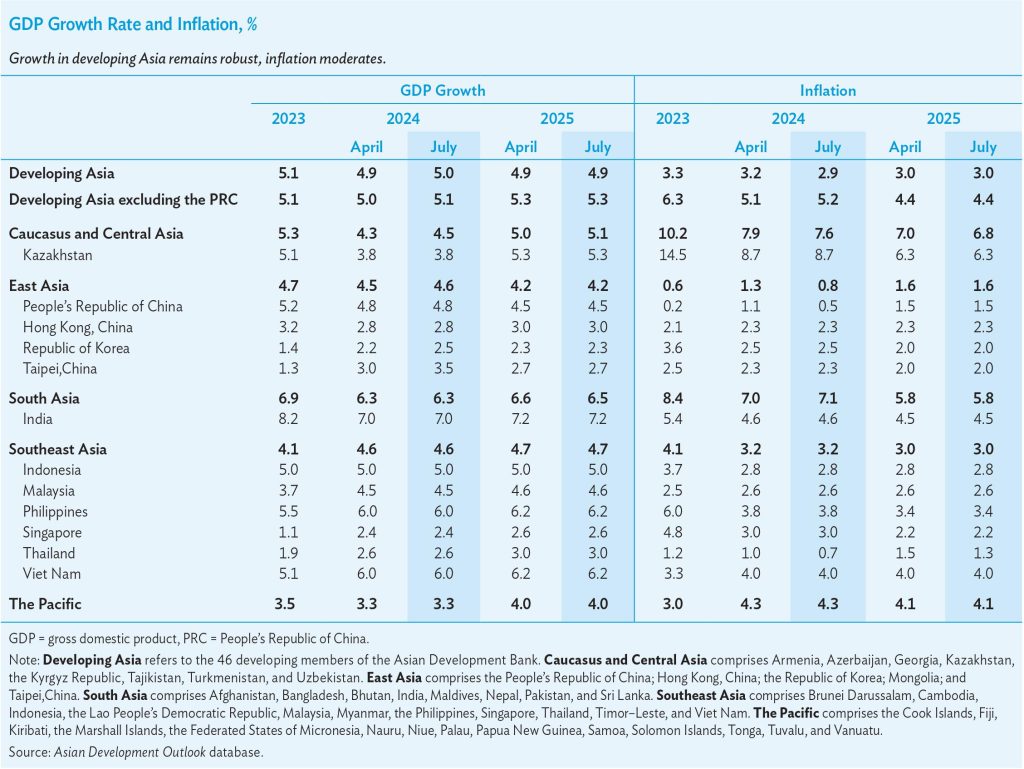

Separately, the Asian Development Bank (ADB), in its Asian Development Outlook July 2024 (ADO July), points to growth in developing Asia in the first quarter of 2024 on the back of resilient domestic demand and strong export growth, particularly in electronics. The growth forecast for the region is increased slightly to 5%, while the 2025 projection remains at 4.9%. Headline inflation in developing Asia is forecast to ease further to 2.9%, from 3.3% last year, and to stabilise at 3% in 2025.

The regional outlook continues to be shaped by external factors, including interest rates in the US and other advanced economies, and is subject to several downside risks. The uncertainties around the US election outcome, elevated geopolitical tensions and trade fragmentation, property market fragility in China, and weather-related events could hurt growth. Meanwhile, La Niña is an upside risk due to the expected higher rainfall and cooler temperatures, indicates ADO July.

GDP growth: Asia

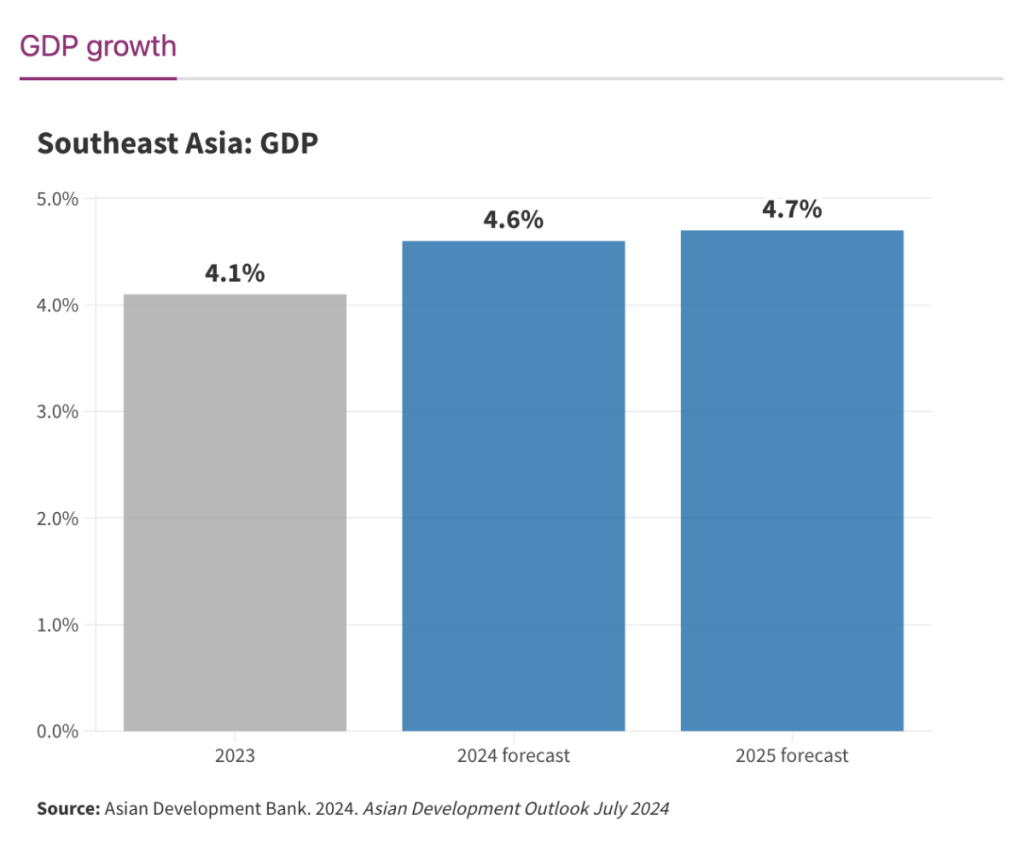

Closer to home, the growth forecasts for Southeast Asia remain at 4.6% in 2024 and 4.7% in 2025, supported by the solid improvement in both domestic and external demand, according to ADO July.

Consumption, fuelled in part by stable prices and increasing tourism-related activities, continue to buoy the Southeast Asian economies, though it is tempered by a tight monetary environment. Higher spending on infrastructure projects in the subregion’s big economies are driving investment demand and growth. The expected export recovery is also accelerating growth, with the manufacturing purchasing managers (PMI) indexes remaining positive for major exporting economies, signalling increasing production. Except for Lao PDR, growth forecasts are unchanged, from ADO April, for all economies in 2024 and 2025.

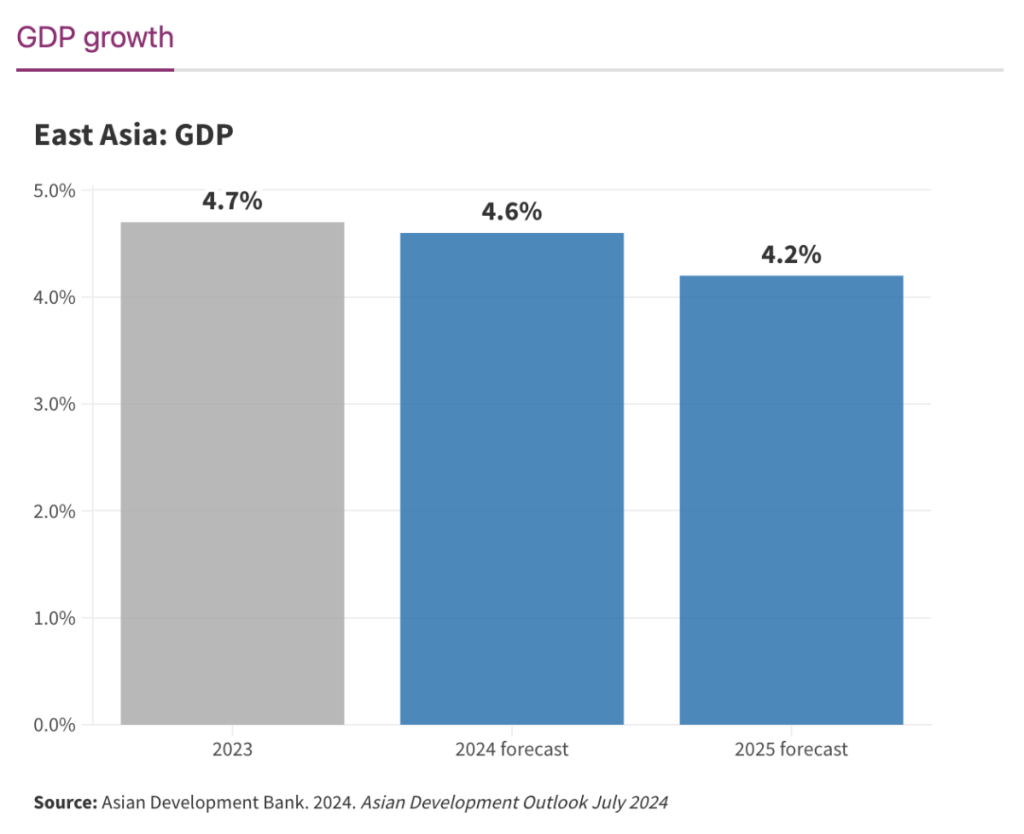

The 2024 growth outlook for East Asia has been revised to 4.6% and remains at 4.2% for 2025 (from ADO April). The upward adjustments in the 2024 forecasts for South Korea and Taiwan are due to the strong exports of semiconductors and artificial intelligence (AI)-related goods, which in turn lead to a slight increase in the subregional average. GDP projections for China are unchanged, supported by a recovery in services consumption and robust exports, which counterbalances the continued property market downturn.

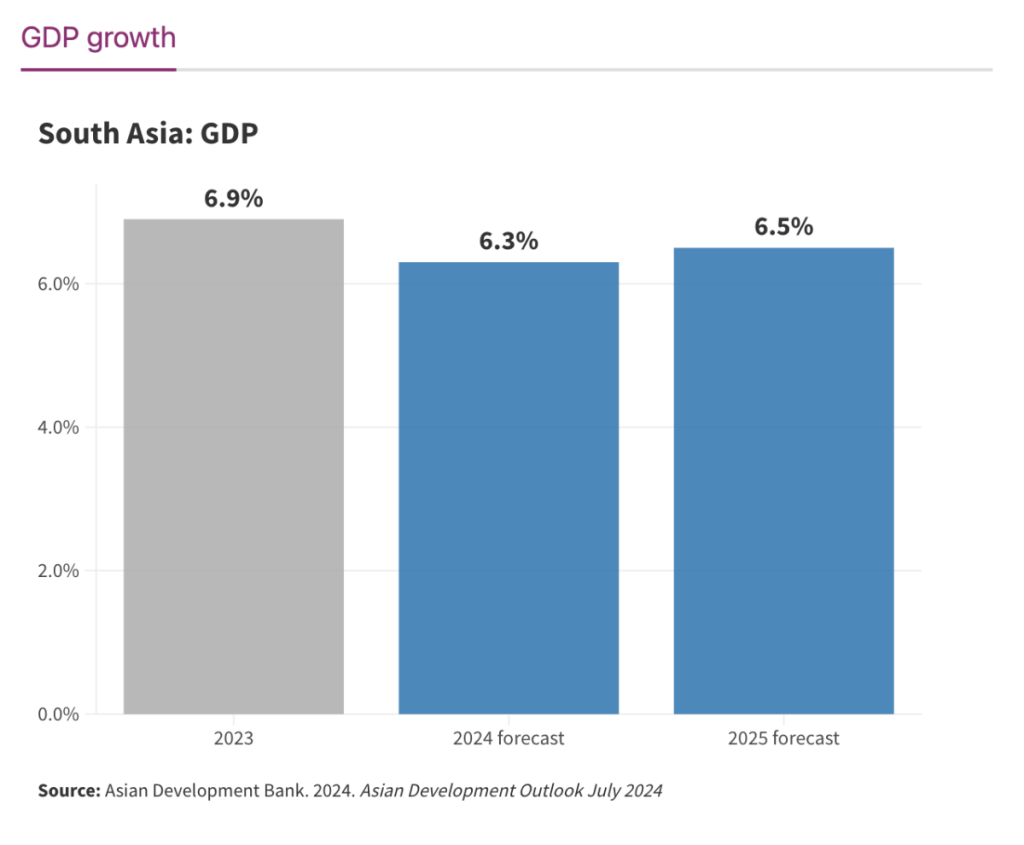

South Asia is on course to achieve 6.3% for 2024, and 6.5% for 2025. The downward revisions for GDP growth for Bangladesh and Maldives over the forecast period are offset in 2024 by upward revisions for Bhutan, Nepal, and Pakistan, leaving the region’s 2024 growth forecast unchanged at 6.3%. The growth forecast for 2025 is revised down marginally to 6.5%.

For Bangladesh, the lower growth forecasts for fiscal year 2024 (FY2024, ending 30 June 2024) and FY2025 come mainly from the downward revisions to growth in industry. For the Maldives, dampened performance of the construction sector is the main reason for lower growth forecasts in 2024 and 2025, with lower-than-expected growth in the fisheries sector this year also contributing to the numbers.

Bhutan’s GDP growth forecast for 2024 is adjusted upward due to a greater-than-expected increase in the government budget for FY2024 (ending 30 June 2024) and better tourism prospects. Nepal’s GDP projection for FY2024 (ending mid-July 2024) is also revised up due to higher-than-expected growth in agriculture and services.

The provisional government estimate of GDP growth in Pakistan for FY2024 (ending 30 June 2024) stands at 2.4%, reflecting robust agricultural output due to improved weather conditions and subsidised government credit, among other factors. Although the economic performance in Q1 2024 for Sri Lanka exceeded ADO April 2024 expectations, growth forecasts for 2024 and 2025 are retained as there remain uncertainties, as the election cycle begins in the latter half of the year.

While Afghanistan’s economy is showing signs of recovery, the weak investment climate, tight fiscal space, and waning international humanitarian and basic needs support underline its fragility.