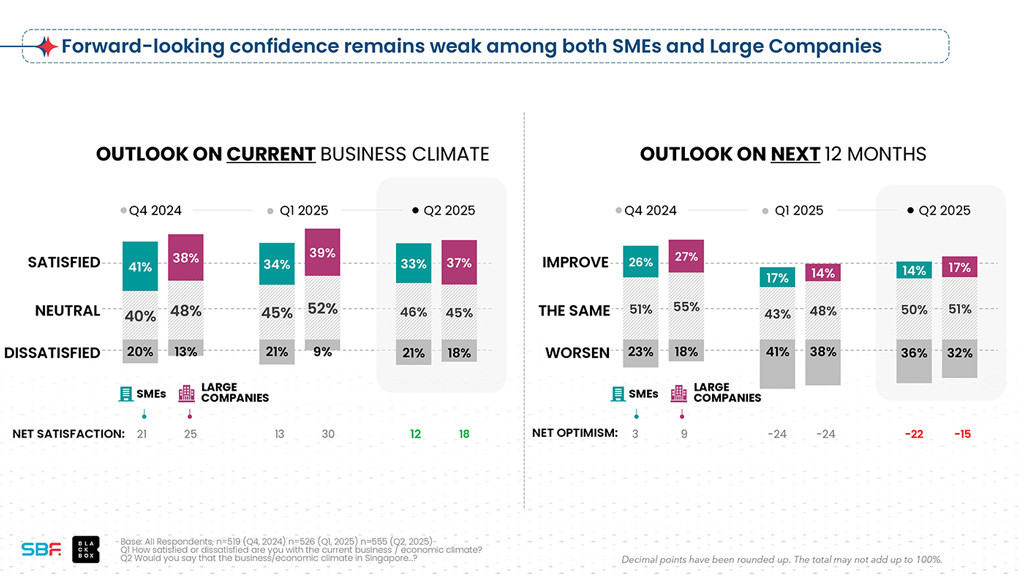

The Singapore Business Federation’s (SBF) National Business Survey 2025 – Manpower and Wages Edition, released on August 28, reveals Singapore businesses’ bearish outlook on the current state of the economy. Businesses are lowering revenue and profitability expectations, and holding off expansion and hiring due to the uncertain macroeconomic outlook. More companies expect conditions to worsen (35%) than improve (14%) over the next 12 months. The overall Business Sentiment Index (BSI), which measures business confidence, softened by 1.1 points – from 56.5 in the first quarter of 2025 (Q1 2025) to 55.4 in the second quarter (Q2 2025).

The survey, administered quarterly, was carried out from June 25 to July 18. It drew responses from 555 businesses across all key industries. The sample included both small and medium-sized enterprises (SMEs), comprising 85%, and large companies, making up the balance 15%. The ratio largely mirrors SBF’s membership base.

At the sectoral level, businesses in the Hotels, Restaurants & Accommodations, Administrative & Support Services, and IT & Related Services sectors hold a more negative outlook, while those in Health & Social Services, and Education are slightly more optimistic. Notably, the Hotels, Restaurants & Accommodations sector recorded the lowest overall BSI score among all sectors, with its hiring outlook indicator falling sharply from 67.4 in Q1 2025 to 51.6 in Q2 2025.

Many businesses are bracing for more turbulent conditions ahead, amid the US tariff changes. This comes on the back of uncertainty, given the lack of clarity on the trade front, and how ongoing developments might impact business margins going forward. Although the initial shock from the US tariffs appears to be easing, 59% of businesses (down from 81% in April 2025) still reported that they were “negatively” exposed to the evolving tariff situation.

Hiring and wages set to slow down, with an exception for lower-wage workers

The same survey indicates that hiring and wage outlook has softened amid cautious business sentiment. Only 36% of businesses plan to expand their full-time employee base in the next 12 months, down from 40% in 2024. This is consistent with the findings on tapering growth sentiments, and business operations being at near-optimal levels, with larger companies maintaining a more optimistic outlook than SMEs.

Wage growth is also set to slow in the coming year, as fewer businesses (59% vs 64% in 2024) intend to raise salaries. The proportion of companies planning wage freezes has risen from 35% to 41%, driven largely by SMEs. An exception lies with lower-wage workers, whereby two in three businesses (66%) intend to raise their salaries in the next 12 months, up from 64% in 2024. This reflects an alignment with the National Wages Council’s recommendations, though businesses cite market-rate wages (42%), weak business performance (36%), and cost pressures (34%) as barriers to further increases.

Manpower costs and talent development emerge as key challenges; more needs to be done to promote skills-first hiring

Rising manpower costs remain the top manpower challenge but the proportion citing it as a concern has declined from 75% in 2024 to 65% in 2025. However, the proportion of businesses citing talent upskilling and reskilling as a challenge almost doubled – from 25% in 2024 to 47% in this survey. The cost burden, a lack of manpower to cover staff who undergo training amid optimised business operations, and difficulty in measuring the return on investment (ROI) are the biggest challenges faced when investing in employee training. With informal and non-structured training as the increasingly preferred mode of employee training by SMEs and large companies alike, there is scope to evolve support programmes to meet business needs while augmenting the link between training and business outcomes.

Only 18% of businesses have fully adopted skills-first hiring practices. Among businesses that had not fully implemented skills-first hiring, key barriers include uncertainty over whether candidates with adjacent skills can perform the required tasks (42%), and the need for more training compared to candidates hired based on experience (32%).

Removal of maximum employment period for foreign workers welcomed, but increases in S Pass qualifying salaries are a concern

Businesses welcomed the removal of the maximum employment period and the raising of the maximum employment age for work permit holders, with about one in three firms anticipating benefits to their operations. But the increases in S pass qualifying salaries for both new and renewal applications are hurting businesses. Companies are adjusting their manpower strategies in response, including expanding recruitment of locals (43%), increasing wages to attract locals (40%), and outsourcing to local third-party contractors (35%).

Around one in three businesses (31%) has provided career planning to their employees in the last 12 months. Businesses that have offered structured career planning in the last 12 months reported better employee morale or engagement (77%), more effective workforce planning (62%), and higher retention rates (58%).

Some 30% of businesses have implemented job redesign in the last 12 months. Among these businesses, job redesign has been implemented in areas such as productivity/innovation (63%), digitalisation (40%), sustainability (34%), and internationalisation (15%).

The survey findings reflect a more cautious business outlook, reinforcing the need for companies to adapt quickly to cost pressures and shifting market dynamics. Going forward, Singapore businesses could leverage the strong public-private support and available schemes to help alleviate the challenges, to remain competitive.