TAKEAWAYS

As of 11 February 2025, the number of financial institutions licensed by the Monetary Authority of Singapore (MAS) to provide Digital Payment Token services has surpassed 30, and it continues to grow. With Bitcoin reaching an all-time high, there is increasing demand to verify the existence and ownership of cryptocurrencies (crypto) in financial audits and attestation reports.

In Singapore, many entities hold crypto without requiring a licence. These include businesses operating overseas, entities holding crypto for treasury purposes, and non-profits receiving crypto donations.

Unlike traditional financial assets held in banks, crypto assets exist across multiple blockchains, making historical balance verification and ownership confirmation complex. Tokens may evolve, have near-identical counterparts, or exist simultaneously on different chains. In Web3, many entities manage their own wallets, eliminating the need to rely on third-party confirmations.

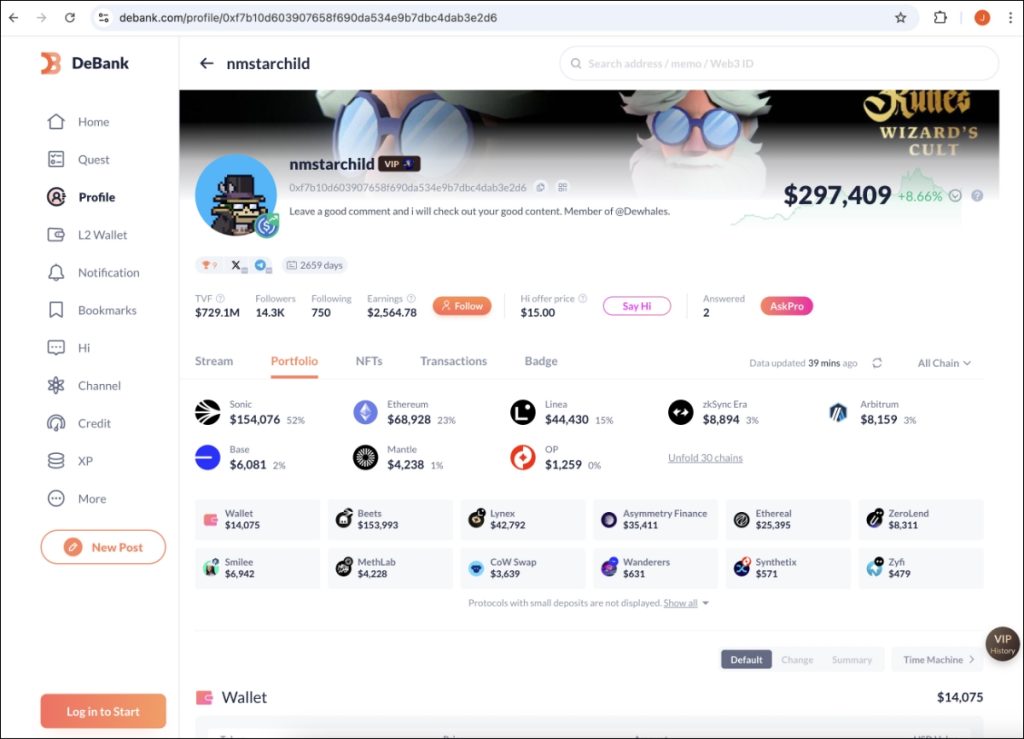

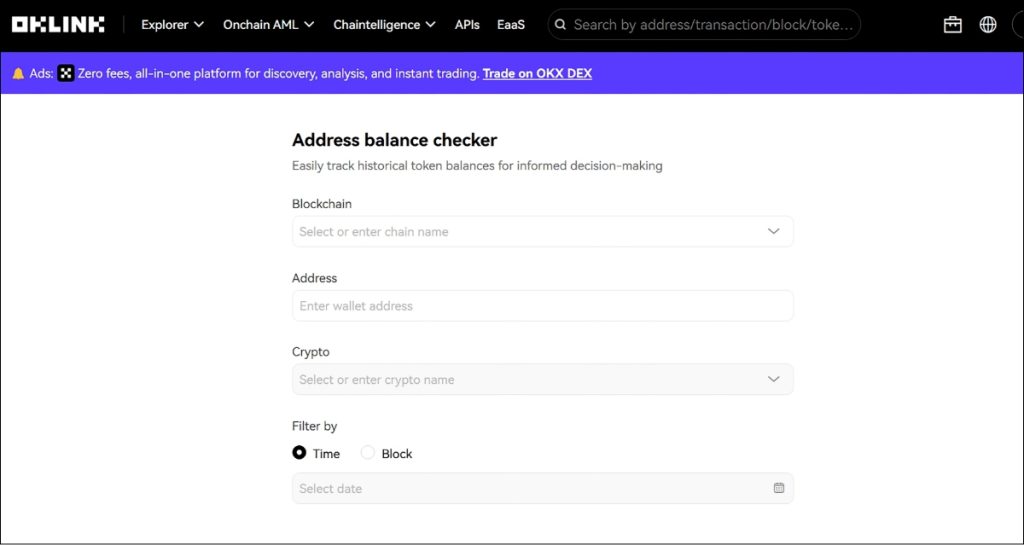

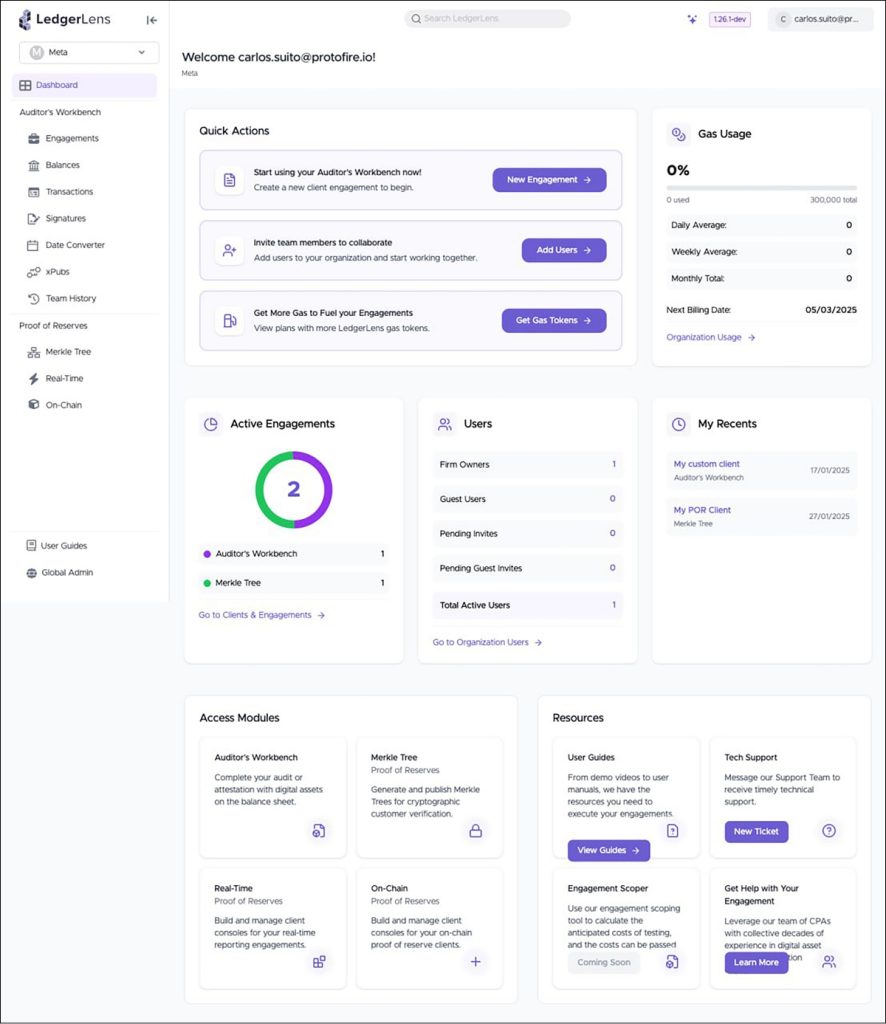

To verify the existence of crypto assets at a specific point in time, auditors can use tools such as:

Selecting the appropriate tool depends on the specific chains and tokens within the audit scope.

Ownership verification is crucial in crypto auditing. Since private keys control crypto holdings, auditors should ensure that clients implement best practices, including multi-signature addresses, encryption and secure storage, to mitigate risks.

Two useful methods to prove crypto ownership are:

As the crypto industry evolves, audit methodologies will continue to develop, with regulatory guidance expected as the market matures. Until then, professional scepticism remains crucial, and auditors must stay informed about emerging technologies and industry best practices.

Chan Wei Xiang, CA (Singapore), is Co-Founder, Web3 Accountant.