TAKEAWAYS

ISCA’s Code of Professional Conduct and Ethics (EP 100 or the Code) revised on 30 August 2023 contains a new Section 405 which holistically addresses independence considerations in a group audit.

Part 1 of the article, published in CA Lab Week 3, set out the independence considerations for the group auditor and its network firms and the new considerations for component auditors outside the group auditor’s network.

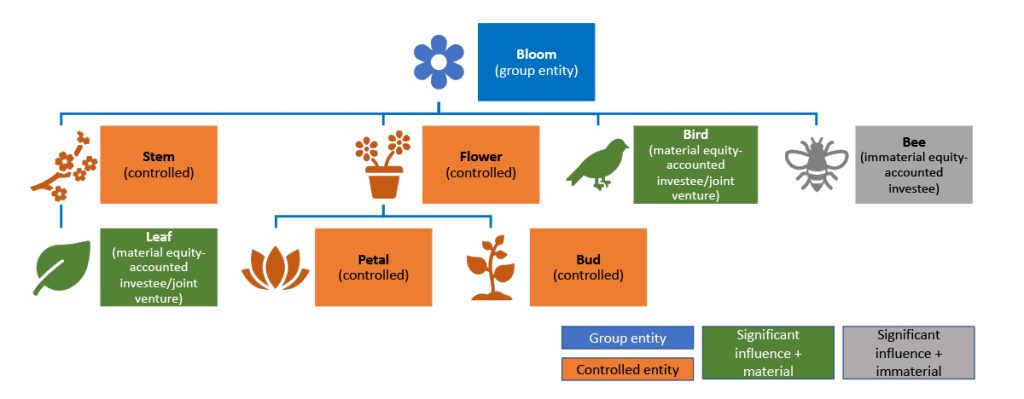

Practically, what are the implications for a group auditor and its network firms, as well as a component auditor outside the group auditor’s network? Let’s illustrate with a hypothetical group below.

Prior to the introduction of Section 405, in practice:

With the introduction of Section 405, for purposes of the group audit:

Time and resources are required to identify interests and relationships with the component audit client that might present a threat to independence. In evaluating identified threats, the conclusion might be that threats are at an acceptable level, and no safeguard or action is required to address the threat. Nevertheless, the scope of identification is wider for the group auditor and its network firms, requiring more time and effort not only upfront but also as and when changes in scope of the group audit are made.

As an entity may become a component audit client during the course of a group audit or may fall in and out of the group audit client definition from year to year, careful thought needs to be given to identifying pre-existing interests and relationships that threaten independence, including the period during which independence is required, the period covered by the group financial statements, the timing of the audit work and the timing of the relationship. If there was a non-assurance service (NAS) that was provided, consideration ought to be given to any transitional provisions.

Where the group entity Bloom is a public interest entity (PIE), even if the component, such as Petal, is a non-PIE audit client, the component auditor would need to apply PIE independence requirements as it relates to the provision of NAS1. For example, if audit work is performed on an account balance at a non-PIE component audit client, such as Bee, accounting and bookkeeping services and certain other NAS that the component auditor provides to Bee would need to be terminated. The component audit client, Bee in this case, would need to engage an alternative service provider. Exiting relationships at short notice could lead to significant incremental cost to the entity.

If Bird is a PIE, partner rotation requirements apply to the engagement partner auditing the financial statements of Bird. Should the group auditor of Bloom determine that Bird’s engagement partner, as a component auditor for purposes of the group audit, is a key audit partner, that component auditor would need to overlay two sets of partner rotation requirements to ensure full compliance.

Inadvertent independence breaches are more likely to arise and, even if the threat to auditor independence is evaluated to be at an acceptable level, communication with those charged with governance is required.

The entities for which the group auditor and its network or the component auditor outside the group auditor’s network need to be independent may vary depending on the circumstances, driven by the relationship and whether audit work is performed on one or more underlying account balance or disclosure. Group auditors ought to carefully consider and clearly communicate independence requirements to component auditors. They also ought to discuss independence considerations and breaches with those charged with governance.

Caroline Lee is Partner of KPMG Singapore. The ISCA Ethics Committee develops the ISCA Code of Professional Conduct and Ethics by adopting the International Code of Ethics for Professional Accountants issued by the International Ethics Standards Board for Accountants (IESBA), with local adaptations as are necessary to serve the public interest in Singapore and to conform with Singapore’s regulatory environment and statutory requirements.

1 The component auditor of a non-PIE audit client has to comply with stricter PIE requirements on the provision of NAS except for those relating to communication with those charged with governance of the group audit client regarding NAS.