TAKEAWAYS

Crypto accounts receivable/accounts payable (AR/AP) software allows companies to bill crypto invoices and pay crypto suppliers easily. With so many different tokens on different chains, it is not easy to collect and pay in crypto.

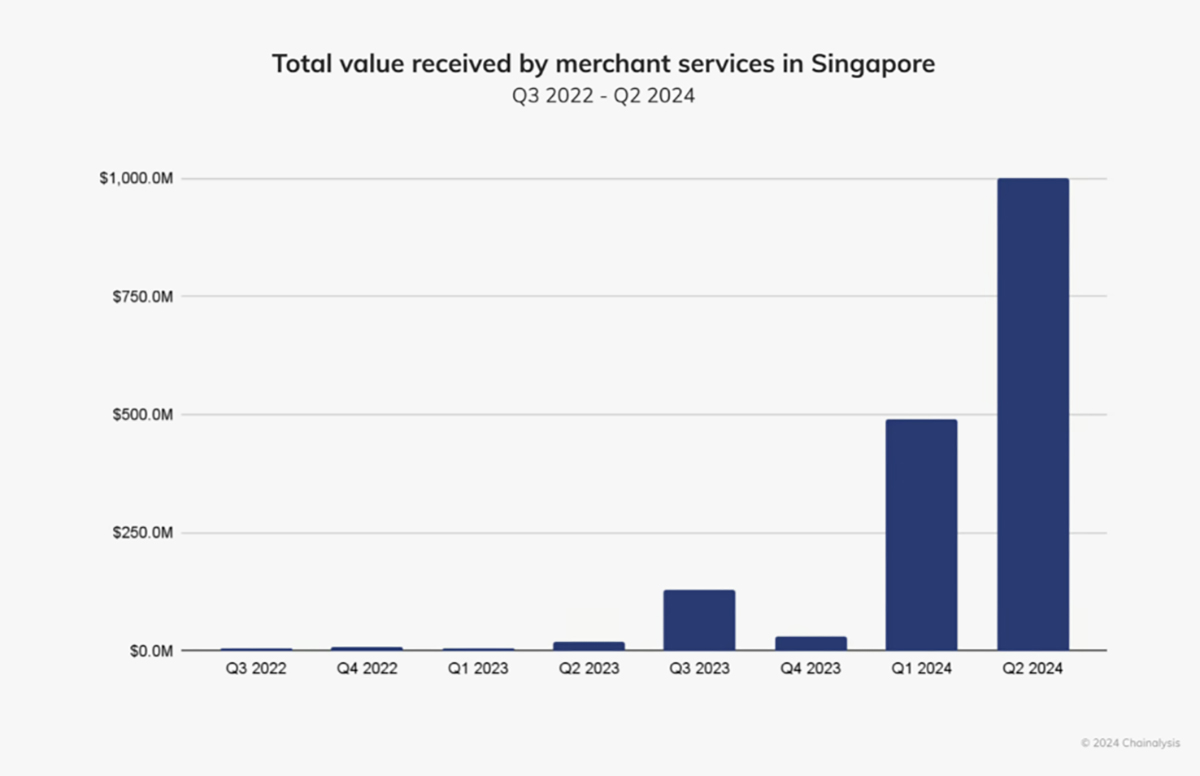

Singapore’s cryptocurrency market has seen a notable increase in crypto payments, with merchant services receiving nearly US$1 billion (S$1.34 billion) in crypto during the second quarter of 2024. This surge reflects growing adoption of digital assets as a payment method across various industries, including services offered by local startups like dtcpay and the super-app Grab.

Major companies like McDonald’s, Starbucks, AMC, Pizza Hut, and many others have begun to welcome crypto payments. Self-employed people, experts, sports personalities, and even politicians, are also adapting to the thought of embracing crypto payments.

The impact of crypto invoicing on business operations and global commerce is significant. As more companies and individuals adopt crypto payments, the landscape of financial transactions will continue to evolve. Small businesses, freelancers, and accountants can easily leverage crypto invoicing tools to streamline their billing processes and facilitate smooth cross-border transactions.

Overall, adopting crypto invoicing represents a paradigm shift in how businesses operate and interact with their clients, paving the way for a more efficient and secure financial future.

In the recent Web3 industry, many companies have faced challenges managing their crypto payments and invoicing. Traditional spend management tools don’t offer solutions to label invoices in cryptocurrencies or convert invoices labelled in fiat to pay in crypto. Those challenges prevent businesses with crypto treasury from using their funds to settle invoices, to have compliant receipts like in traditional finance, and to have accurate financial records.

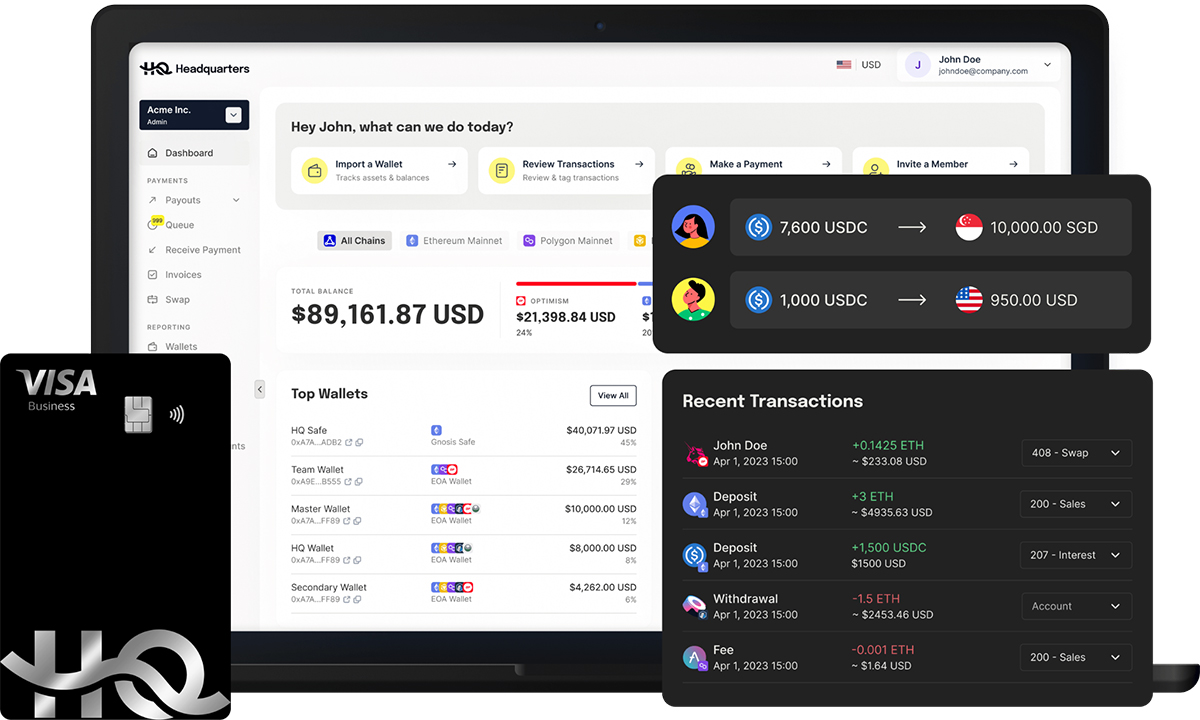

HQ.xyz is founded by veterans who have been building the foundation of onchain finance since 2019. Indeed, this is what sets the team apart – members are crypto natives and yet have an appreciation for traditional finance. The balance is a much-needed ingredient to bridge the onchain economy with the highly-regulated world of payments and banking.

Their mantra, “Banking without the bank”, empowers businesses to maintain the integrity of cryptocurrency’s ethos of self-custody, while enjoying an intuitive, unified platform for all financial operations.

As of November 2024, HQ.xyz has tracked close to US$1 billion for leading onchain businesses, including Mantle, Mandala Club, and Pixelmon. It has also achieved both SOC 1 and SOC 2 Type 2 certification and was recognised as First Runner-Up at the Singapore Fintech Festival Global Fintech Awards 2023.

Key features of HQ.xyz:

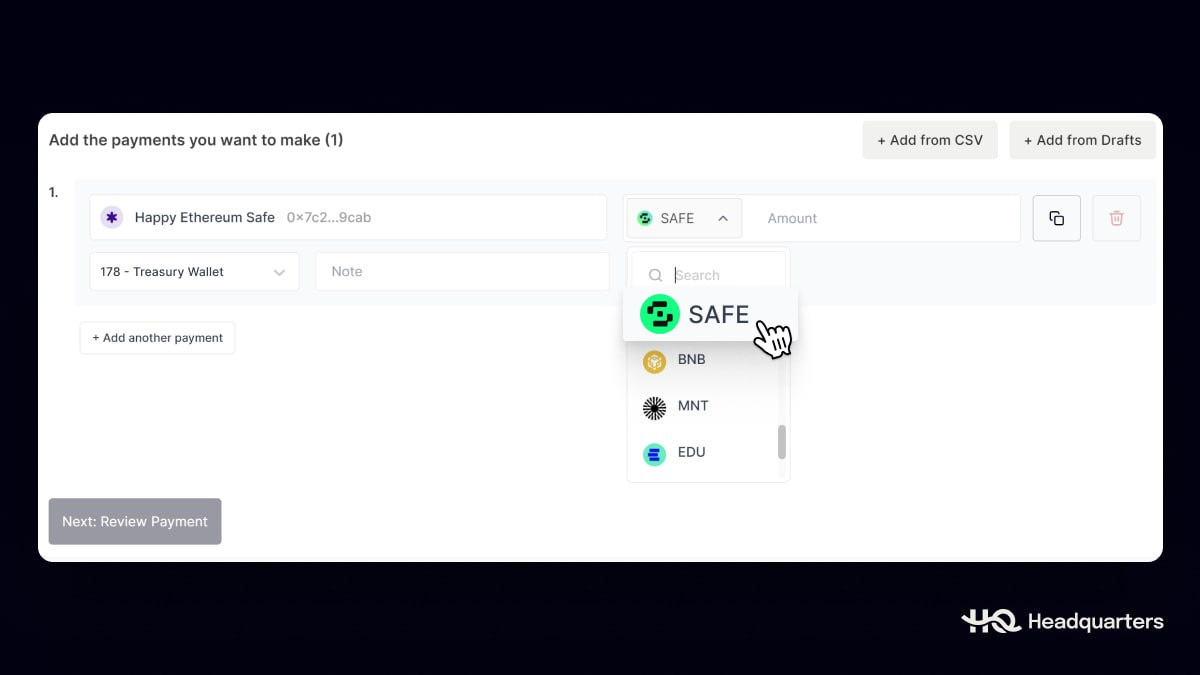

1. Pay any way you want, securely

Onchain businesses can perform batch payouts, making token transfers for payroll, vendor payments and treasury management more efficient. HQ.xyz has a strong focus on customers keeping their own funds, and yet having unrestricted access to the payment methods of their choice.

Imagine paying your staff and vendors directly from the stablecoins in your crypto wallet. Headquarters sets itself apart from conventional OTC or fiat off-ramps by enabling you to pay third parties in stablecoins, which it receives as fiat in its bank.

HQ.xyz is also introducing corporate Visa debit cards, enabling Web3 businesses to spend stablecoins anywhere Visa is accepted. While teams typically face a disconnect between their onchain treasuries and real-world spending, HQ.xyz’s self-custodial card allows you to make payments to more than 130 million vendors worldwide (including AWS and travel fares), while holding full control of your funds.

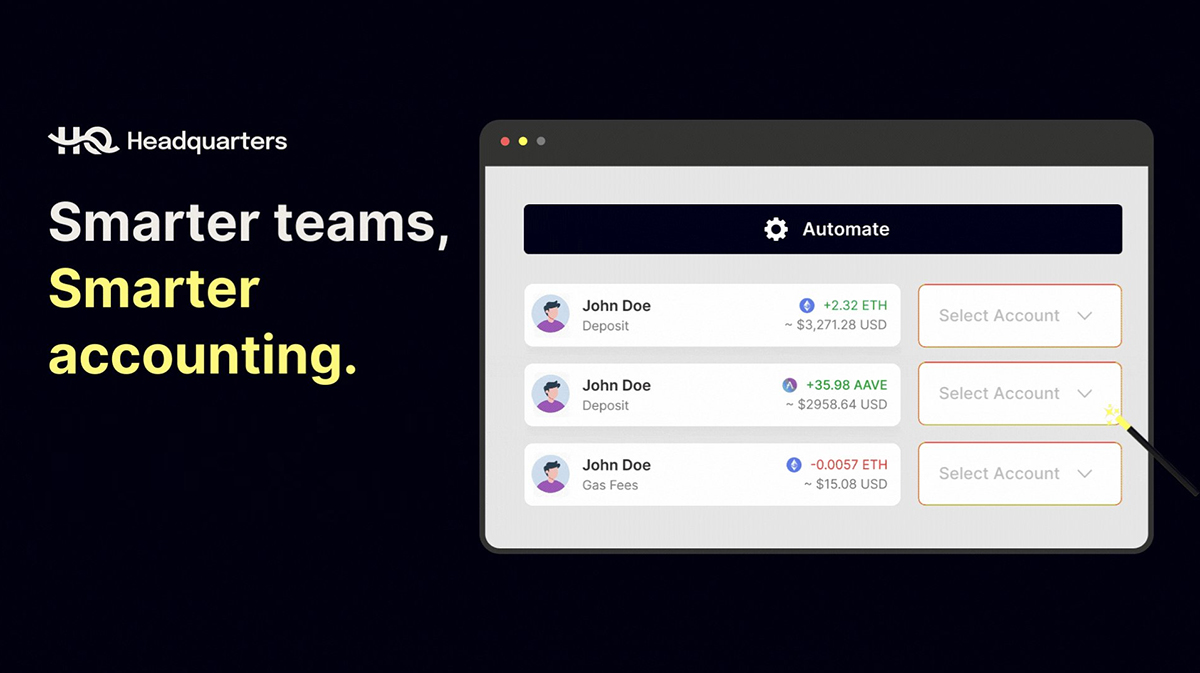

2. Instant reconciliation and accounting

As a business, it is common to have financial reporting, at least for one’s own management. With HQ.xyz, all payments made using the platform, as well as all onchain transactions to date, are neatly captured. These transaction reports are displayed in a way that is easily understandable for any layman, and is compatible with leading accounting tools such as Xero and Quickbooks Online.

Users start with a 30-day free trial and can integrate their existing wallets and accounting tools into HQ.xyz.

HQ.xyz adheres to regulatory requirements, and ensures secure transactions through self-custody solutions and multi-sig support, with dedicated support for each account and continuous updates.

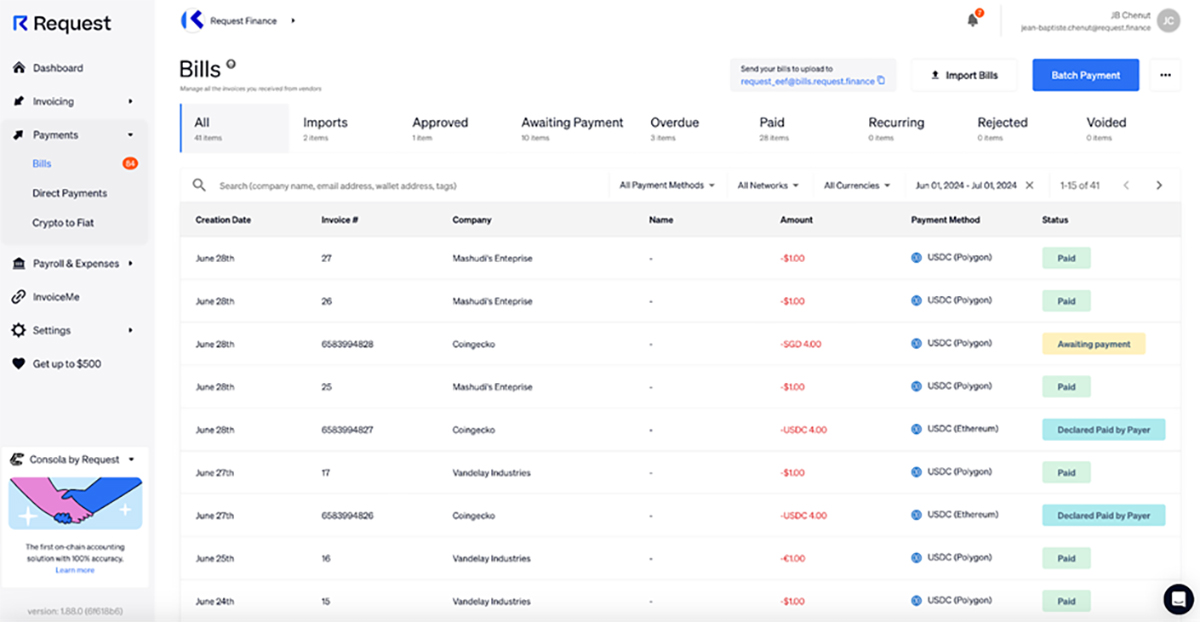

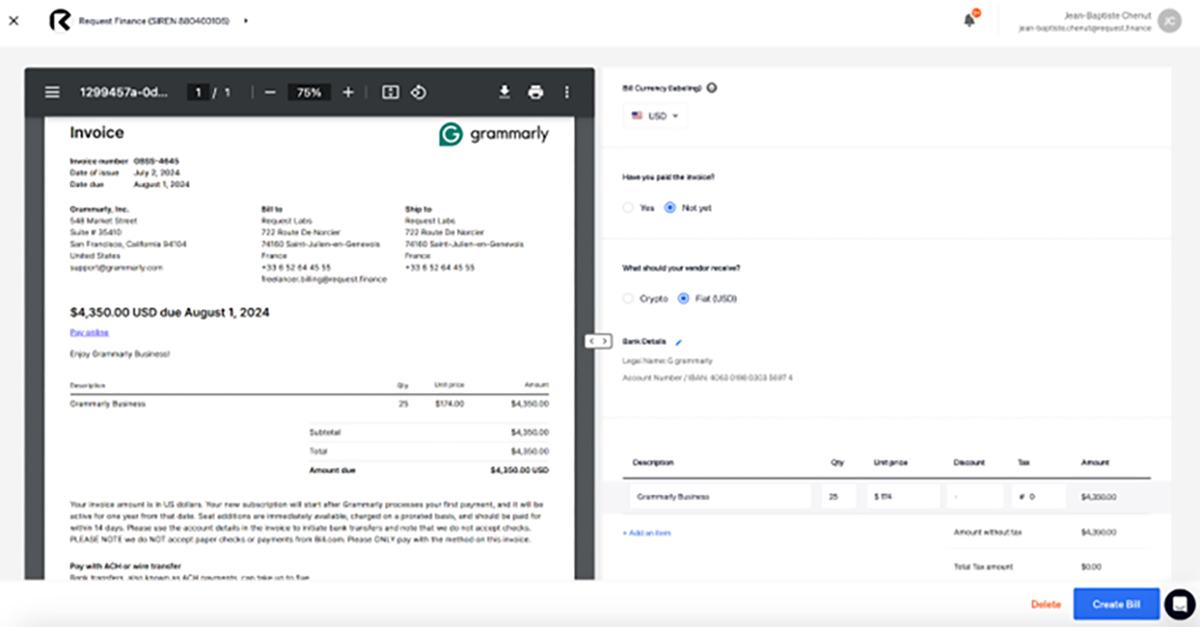

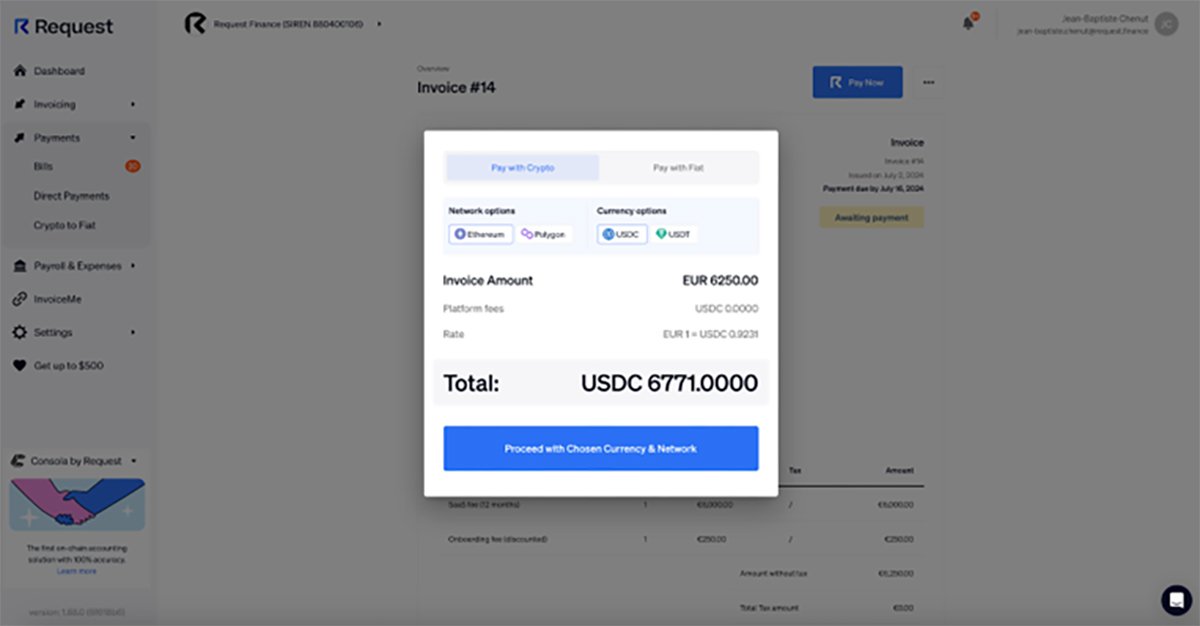

Request Finance is designed to tackle Web3 financial challenges by simplifying and automating the entire crypto invoicing process, making it easier for businesses to handle cryptocurrency payments.

Blockchain will likely be the technology on which all future payments will run. Request Finance aims to increase digital currency adoption for the first 100,000 or so Web3-friendly businesses with its all-in-one finance solution for crypto and fiat AP, AR, and accounting, plus payments to more than 190 countries.

The platform offers a user-friendly interface for creating and managing invoices, and processing payroll and expenses, all while ensuring compliance with invoices converted between crypto and fiat currencies. By integrating with multiple crypto wallets, Request Finance provides a seamless and secure solution for Web3 businesses.

Blockchain technology goes further: by paying an invoice created on Request Finance in crypto, reconciliation is automatically done between the invoice and the payment. You no longer need to reconcile them manually in your accounting system.

Benefits: Improve your financial operations

Request Finance offers several key benefits that can transform how Web3 businesses manage their finances and Web2 companies that have already adopted cryptocurrencies.

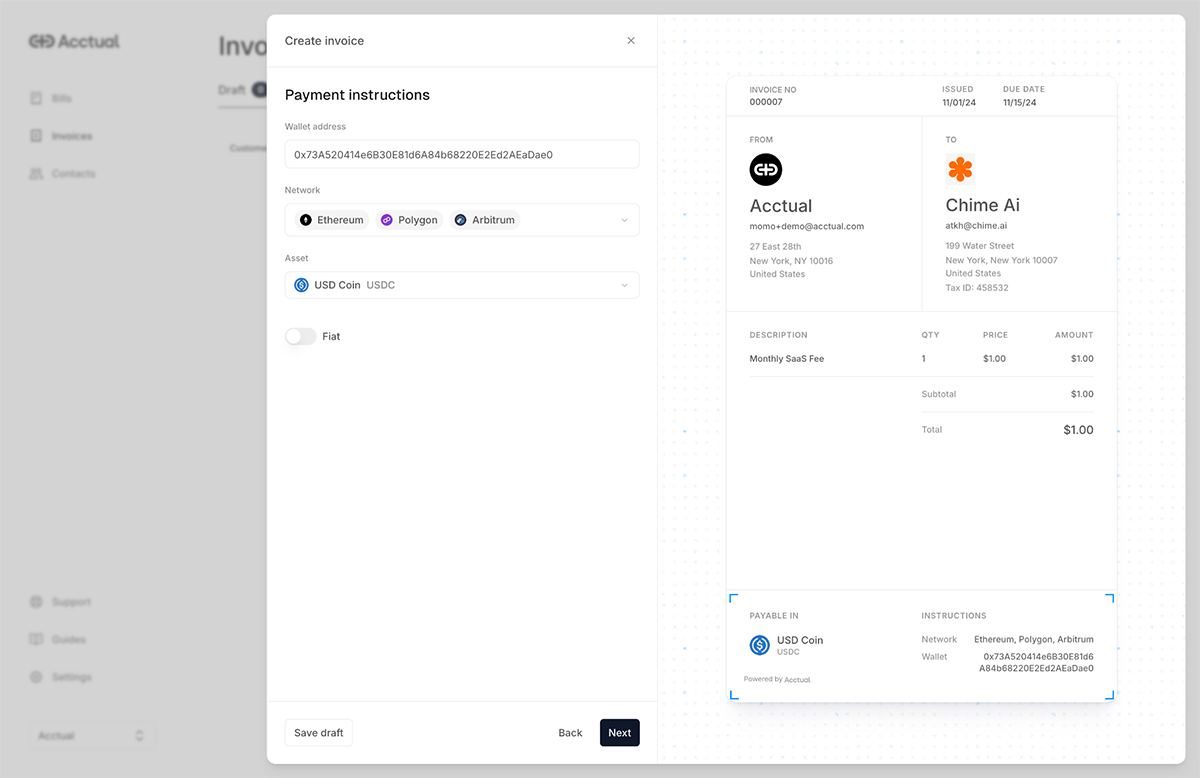

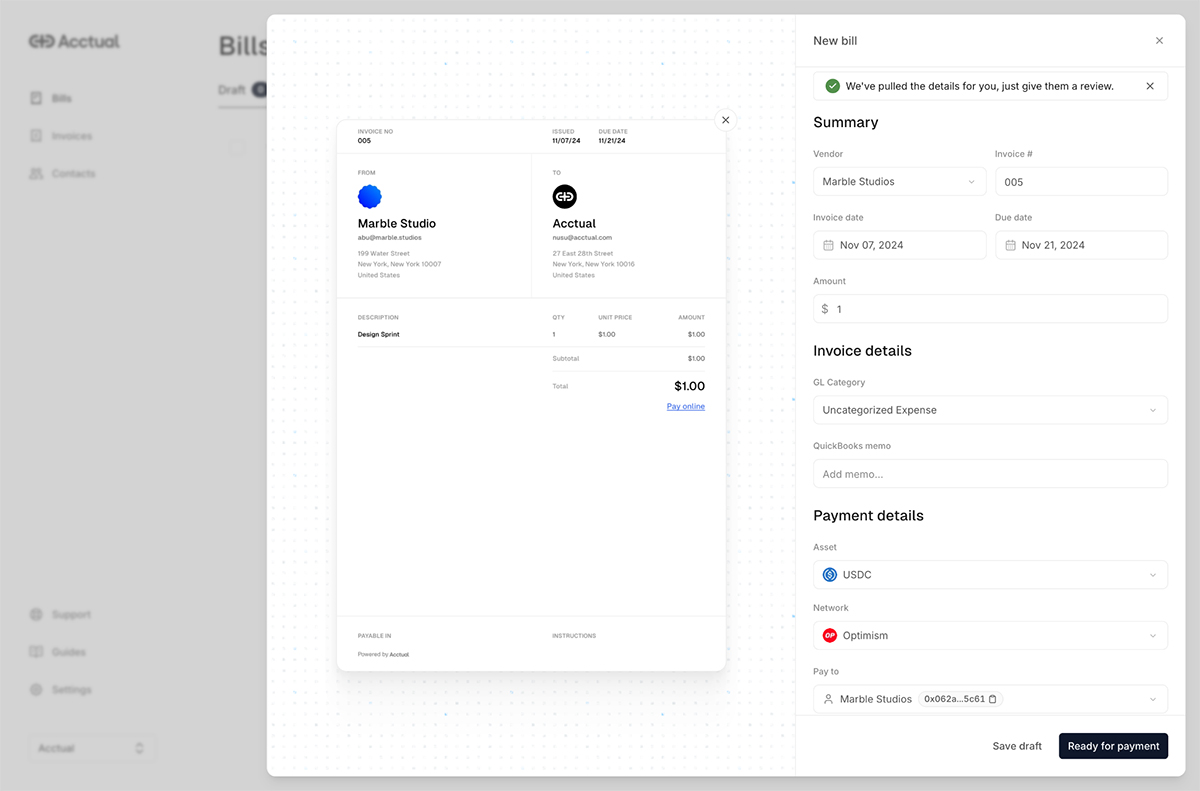

Acctual is a crypto accounting software for businesses and freelancers transacting in digital assets. It simplifies AP and AR, making it easy to pay bills and send invoices in crypto. The flexible options let you pay in crypto while vendors receive fiat, receive crypto while clients pay in fiat, or receive fiat while clients pay in crypto. It also integrates with your accounting system, saving you time on month-end reconciliation.

1. Issue crypto invoice with Acctual

Key features:

2. Accounts payable

Acctual helps you create, manage and collaborate on bill pay so that you can:

3. Pay crypto bills with Acctual

Accounts receivable

Acctual helps you create and manage invoices so that you can:

Chan Wei Xiang, CA (Singapore), is Chief Growth Officer, SOAS.