TAKEAWAYS

FRS 119 Subsidiaries without Public Accountability: Disclosures, a voluntary Standard issued by the Accounting Standards Committee (ASC) under the Accounting and Corporate Regulatory Authority (ACRA) in 2024, specifies the disclosure requirements that apply to a subsidiary which does not have public accountability and whose parent produces consolidated financial statements that are available for public use. A subsidiary that elects to apply FRS 119, which is substantially aligned with IFRS 19 Subsidiaries without Public Accountability: Disclosures issued by the International Accounting Standards Board (IASB), prepares financial statements in accordance with the recognition, measurement and presentation requirements in the full Singapore Financial Reporting Standards (FRSs) and the reduced disclosure requirements in FRS 119.

IASB performed an analysis of the effects of IFRS 19, which can be found here, and noted from its field test that IFRS 19 results in:

We closely followed the IASB project on Subsidiaries without Public Accountability: Disclosures since its commencement as we saw an opportunity for entities other than subsidiaries, which were already within the project scope, to reap the benefits of preparing financial statements with reduced disclosure requirements. At the same time, the take-up rates of FRSs and Singapore Financial Reporting Standard for Small Entities (SFRS for Small Entities) by Singapore-incorporated companies filing XBRL financial statements with ACRA were also closely monitored. It was observed that despite the introduction of SFRS for Small Entities as an alternative financial reporting framework more than a decade ago, its take-up rate stayed very low. In comparison, the take-up rate of FRSs remained high over the years at an estimated four out of five Singapore-incorporated companies filing XBRL financial statements1 .

The first group of Singapore-incorporated companies identified to be able to benefit from a set of reduced disclosure requirements in FRSs were those currently using SFRS for Small Entities. In 2025, IASB issued a major update to the IFRS for SMEs Accounting Standard to enhance alignment with full IFRS Accounting Standards, effective for annual reporting periods beginning on or after 1 January 2027. A similar update was issued by ASC to SFRS for Small Entities to mirror the alignment to full FRSs. It may be more cost-effective in the longer term for these companies to transition to FRSs before 2027 and benefit from reduced disclosure requirements rather than incurring time and effort to assess the implications of the new and amended requirements in this major update, especially since future updates to SFRS for Small Entities are expected to introduce requirements that would be more closely aligned with those of full FRSs.

A further analysis of the take-up rate of FRSs revealed that about a quarter of Singapore-incorporated companies that filed XBRL financial statements were estimated to be non-subsidiary companies that use FRSs with full disclosure requirements despite meeting the criteria to be eligible to apply SFRS for Small Entities1. These companies, which made up a considerable proportion of Singapore-incorporated companies, could likewise benefit from a set of reduced disclosure requirements in FRSs.

Jurisdictions, such as Australia and New Zealand, utilised tiering systems whereby entities, usually those without public accountability and below a specified size threshold, could prepare financial statements in accordance with the recognition, measurement and presentation requirements similar to full IFRS Accounting Standards, but with reduced disclosure requirements.

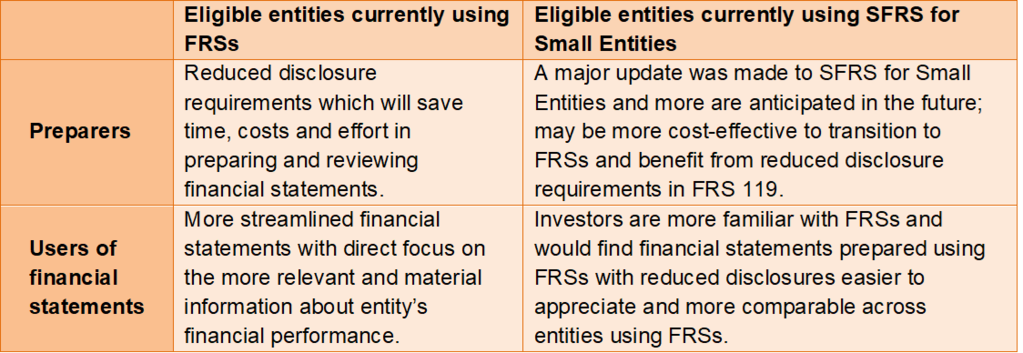

While the actual effects and benefits will vary among entities, it is anticipated that eligible entities will experience a reduction in the costs of preparing financial statements, while still maintaining the usefulness of the information for users of these financial statements. Therefore, we would like to extend this option to a broader range of entities outlined below.

In August 2025, ASC amended the title of FRS 119 to Subsidiaries and Small Entities without Public Accountability: Disclosures, and made it available as an option to Singapore entities that prepare their financial statements in accordance with FRSs and fulfil the criteria to be small entities without public accountability. The amended FRS 119 is effective for annual reporting periods beginning on or after 1 January 2027, with earlier application permitted.

The objective of the amendments is to extend the benefits of preparing financial statements with reduced disclosures to more entities.

As FRS 119 is a voluntary Standard, eligible entities should make their own assessment of the expected benefits versus the associated costs of applying FRS 119. Overall, ASC expects the amendments to FRS 119 to result in the following benefits:

Under the amended FRS 119, an entity is a small entity without public accountability if it satisfies (1) all of the qualitative criteria and (2) at least two quantitative criteria:

In addition to the above, the following criteria for applying FRS 119 have to be met:

Where FRS 119 ceases to be applicable to a small entity without public accountability, FRS 119 may be applicable to that small entity without public accountability again if it subsequently meets the criteria for initial application.

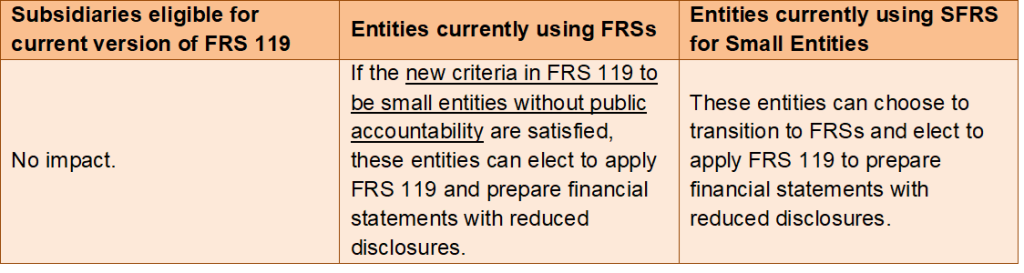

The following were considered before FRS 119 was amended to be available to small entities without public accountability, that is, entities eligible to use SFRS for Small Entities:

FRS 119 is available for download here. The following are useful resources pertaining to IFRS 19 which FRS 119 is substantially aligned to:

This article was contributed by the Secretariat of the Accounting Standards Committee, Accounting and Corporate Regulatory Authority.

1 Estimations based on XBRL filings made as at February 2025 for the financial years ended in 2022 and 2023.

2 An entity has public accountability if: