TAKEAWAYS

Singapore’s capital markets have a strong long-term outlook as Asia remains a world growth engine with significant capital inflows. The enterprises that intend to seek listing would typically have mostly progressed beyond the start-up phase and have strong attributes, which investors expect issuers seeking to raise funds from the capital markets should have, including:

Due to the above expectations, the experience and expertise of directors, including key management personnel of issuers, play an important part in the listing process. The Singapore Exchange Limited (SGX) will also consider the character and integrity of directors including key management personnel and controlling shareholders prior to listing the entity.

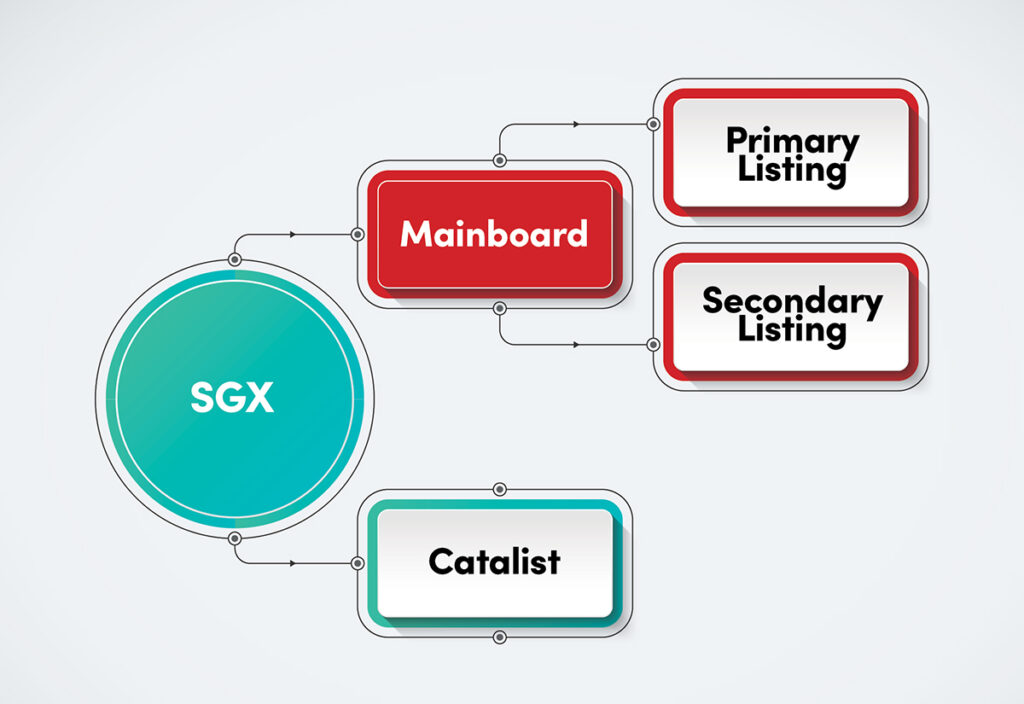

Established enterprises may choose the Mainboard of SGX as a primary listing avenue. Entities seeking a listing on the Mainboard must meet the entry criteria, including quantitative entry requirements relating to minimum profit and/or market capitalisation levels. An issuer already listed on a foreign exchange may choose the Mainboard as a secondary listing venue.

Overview of listing on SGX

Fast-growing enterprises may look towards a primary listing on the Catalist of SGX. Enterprises can only be brought to a listing on the Catalist by Full Sponsors1. SGX does not have a quantitative entry criterion for listing on the Catalist. Instead, Full Sponsors are responsible for determining whether the issuer is suitable to be listed and must provide a confirmation to SGX that it is suitable for listing.

For primary listings on SGX, issuers are required to appoint an auditor approved under the Accountants Act 2004 of Singapore (the “Accountants Act”) to conduct their statutory audits. This enhances Singapore’s regulatory purview over the audits.

For issuers seeking a secondary listing on SGX, SGX will assess them on a case-by-case basis, if an appointment of a joint auditor who is approved under the Accountants Act is required, for example, where they have concerns over a particular business sector or the risk profile of that issuer, and whether their place of primary listing is a “Developed Market”.

The financial statements submitted for a primary listing on the Mainboard or Catalist, and future periodic financial reports, must be prepared in accordance with the Singapore Financial Reporting Standards (International) or SFRS(I); International Financial Reporting Standards or IFRS; or US Generally Accepted Accounting Principles or US GAAP.

This means that foreign issuers who prepare their financial statements in accordance with their local GAAP (that is, other than US GAAP) will be required to restate the local GAAP financial information in accordance with SFRS(I), IFRS or US GAAP. The foreign issuers will need to have competent finance and accounting personnel who are familiar with the requirements under SFRS(I), IFRS or US GAAP. In preparing for the listing, issuers may also engage independent accounting experts to assist them in identifying the differences between the local GAAP and SFRS(I), IFRS or US GAAP. GAAP adjustments will be made to the local GAAP financial statements so that the financial statements submitted for listing application will be compliant with SFRS(I), IFRS or US GAAP.

For a secondary listing on the Mainboard, the financial statements submitted with the listing application, and future periodic financial statements, need only be reconciled with SFRS(I), IFRS or US GAAP.

Where the issuers are required to appoint an auditor approved under the Accountants Act, the local reporting accountants, being equipped with requisite knowledge of SGX listing rules and who keep abreast of local regulatory changes as well as the SFRS(I), IFRS or US GAAP financial reporting framework, would be able to advise and assist the issuers in navigating the complex journey of becoming a publicly listed entity in Singapore, and provide assurance to shareholders on compliance with the relevant financial reporting framework.

Other than the financial reporting and audit requirements, issuers are also expected to maintain good governance practices and strong internal audit function to stay on its capital market journey. The internal audit function is established to help issuers in evaluating and improving the effectiveness of its risk management, control and governance processes. An effective internal audit function shall be adequately resourced and independent of the activities it audits. This can be achieved by hiring adequate internal resources or engaging an external service provider or a combination of both.

In consideration of the requirements and market expectations, it is important for issuers who plan to list on SGX to:

Peter Leong is Senior Partner, Audit & Assurance, BDO LLP; Yeo Siok Yong is Partner, Audit & Assurance, BDO LLP; and Aileen Yap is Director, Knowledge & Professional Development, BDO LLP. The ISCA Corporate Finance Committee works closely with regulatory authorities, corporate finance and investment banking organisations to address issues relating to corporate finance.

1 A Full Sponsor is one authorised by SGX to engage in activities related to bringing an applicant to list on the Catalist.