TAKEAWAYS

In April 2024, the International Accounting Standards Board (IASB) published a new accounting standard – IFRS 18 Presentation and Disclosure in Financial Statements – which is effective for annual reporting periods beginning on or after 1 January 2027, but companies can apply it earlier. IFRS 18 is the culmination of IASB’s Primary Financial Statements project, initiated to address investors’ concerns about the comparability and transparency of companies’ performance reporting.

This new standard will impact all entities reporting under IFRS as it replaces IAS 1 Presentation of Financial Statements, the accounting standard which has been the cornerstone of financial statement preparation and presentation. IAS 1 sets out the fundamentals, including what a complete set of financial statements comprises, the underlying principles of preparing the financial statements, the minimum line items and the frequency of reporting.

IASB Chair Andreas Barckow said, “IFRS 18 represents the most significant change to companies’ presentation of financial performance since IFRS Accounting Standards were introduced more than 20 years ago. It will give investors better information about companies’ financial performance and consistent anchor points for their analysis.”

The big question on everyone’s mind is: Is IFRS 18 going to be a gamechanger standard like IFRS 9 Financial Instruments, IFRS 15 Revenue from Contracts with Customers or IFRS 16 Leases?

Fortunately, the answer is “no”, as IFRS 18 retains many of the requirements of IAS 11. But, it will not be “business as usual” either, as IFRS 18 marks the advent of more structured financial statements, and entities will need to gear up for it.

IFRS 18 introduces changes in the following key areas:

1) Structure of the statement of profit or loss

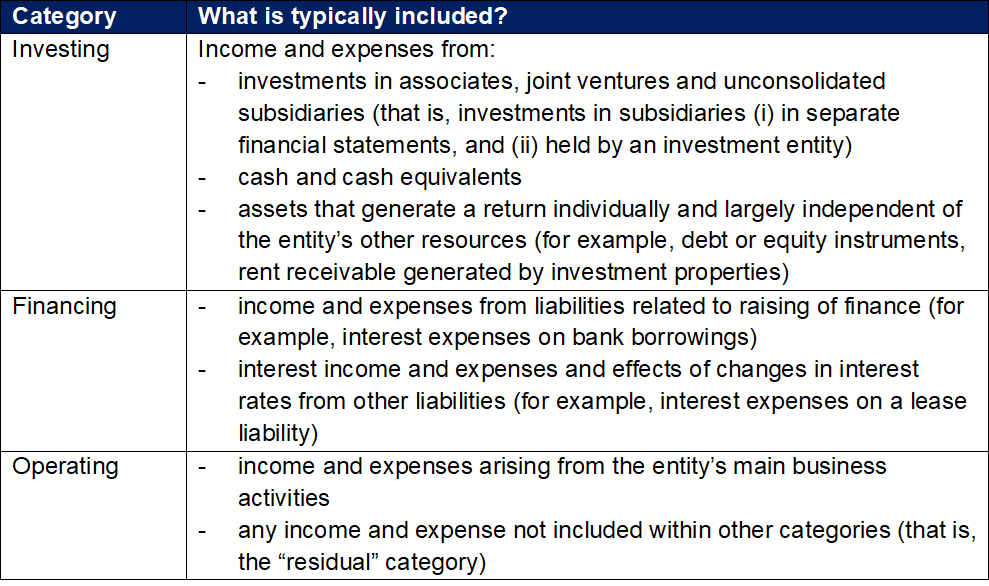

Income and expenses included in the statement of profit or loss are to be classified into one of five categories – operating, investing, financing, income taxes and discontinued operations. The first three categories (operating, investing and financing) are new and the classification of income and expenses into these categories will depend on the entity’s main business activities.

Entities with specified main business activities – (i) investing in assets* (for example, investment property companies, insurers), and (ii) providing financing to customers (for example, banks and other lending institutions) – would classify certain income and expenses in the operating category which would otherwise be classified in investing or financing categories.

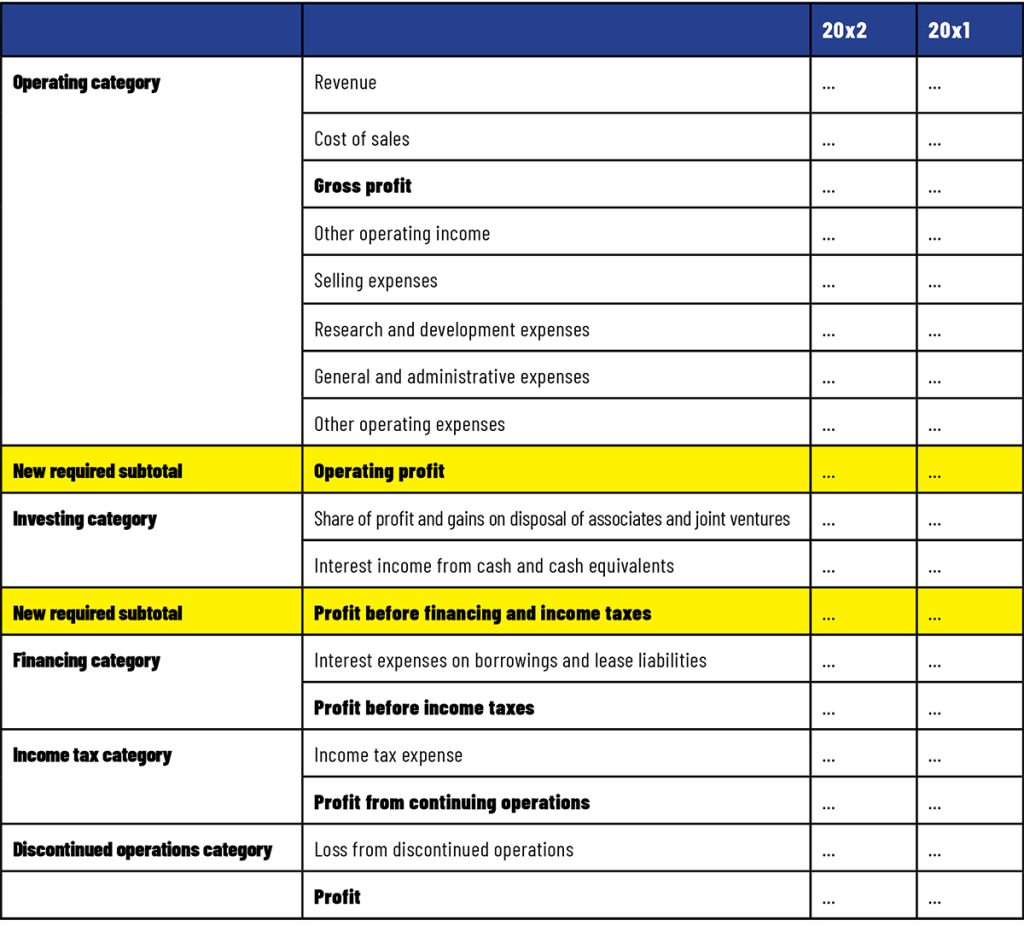

In addition, entities are required to present new subtotals – “operating profit or loss” and “profit or loss before financing and income taxes” – in the statement of profit or loss.

Below is an illustrative statement of profit or loss (with presentation of operating expenses by function) of an entity that does not invest in particular types of assets (see above * for examples of such entities) as a main business activity, nor provide financing to customers as a main business activity2:

IFRS 18 requires entities to present their operating expenses in a way that provides the most useful structured summary of their expenses, either by:

When operating expenses are presented by function, additional disclosure by nature for specific expenses is required.

2) Management-defined performance measures

When communicating management’s perspective on the entity’s financial performance, entities often use performance measures which are not defined by Generally Accepted Accounting Principles (GAAP) (that is, non-GAAP measures) beyond the financial statements. Examples include customer satisfaction survey results, earnings before interest, taxes, depreciation and amortisation (EBITDA), and free cash flows.

IFRS 18 requires those non-GAAP measures which meet the definition of management-defined performance measures (MPM) to be included in the financial statements. Entities are to disclose the following in a single note:

3) Aggregation and disaggregation of information in the financial statements

Although the principle of aggregation can be found under the existing IAS 1, IFRS 18 provides enhanced requirements on aggregation and disaggregation of information in the financial statements to help entities provide useful information. The requirements include general principles of aggregation and disaggregation, as well as guidance on determining meaningful labels or descriptions for items that are aggregated and require additional disclosures, to discourage entities from simply labelling items as “others”.

4) Other changes to the primary financial statements

IFRS 18 also introduces other changes to the primary financial statements including:

Entities should begin preparing for the changes by:

Felicia Tay is Associate Director, Professional Standards, ISCA.

1 The reference material contains a comparison table of requirements in IAS 1 and IFRS 18, with changes to each paragraph of IAS 1 highlighted.

2 Adapted from IFRS 18 Illustrative Examples on Presentation and Disclosure in Financial Statements

📢 New ISCAccountify Video on SFRS(I) 18 Presentation and Disclosures in Financial Statements: New Frontiers in Reporting

This new course explains the impact of IFRS 18 on the presentation and disclosures of the Statement of Profit or Loss and disclosures of management-defined performance measures.

Sign in to your ISCAccountify to enrol now!