TAKEAWAYS

By nature, finance is a forward-looking process, and the CFO plays a pivotal role in charting the course for the year ahead. And, in an era of innovation, there’s no better time than now to set your sights on moving onward and upward.

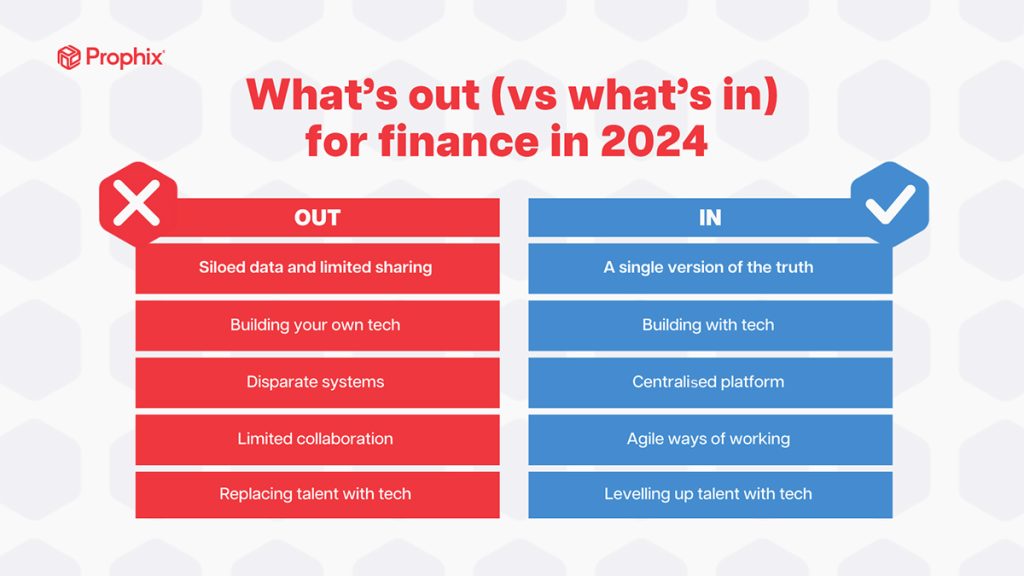

But, to harness the next generation of finance, what do teams need to commit to? And what do they need to officially let go of?

Staying loyal to “the way it’s always been done” is holding teams back from embracing the next generation of finance. So, finance teams are faced with a choice: Do you want to adapt to and embrace the next generation of finance, or do you want to stay put in the past?

As a finance leader, there’s only one right answer: you need to be in – in action, and in the here and now, with an eye on the future. While moving forward is a commitment to progress, it’s important that you also know what’s out, so you can truly leave it behind and embrace the next generation of finance.

OUT - Siloed data and limited sharing

When your company relies on siloed data, it means everyone has a different version of the truth. Data living in different applications – or worse, across multiple spreadsheets – means that at any given time, anyone on the team could be looking at old or outdated data. This creates a risk as different versions of the truth or outdated data are making their way into your financial statements or reports (we’re looking at you, spreadsheets!).

To put this in perspective, imagine a scenario where your sales department operates on one set of revenue figures while the finance team uses another. The discrepancies in the data not only lead to confusion and inefficiency during strategy meetings, they also have the potential to skew budgets and forecasts, putting your company’s financial health at risk.

IN - A single version of the truth

When you bring all your data together onto one central platform, you can guarantee that your team is using the same data across all your key finance processes. This means that someone creating the budget and someone who’s working on a forecast are using the same up-to-date data pulled directly from the source – your next-gen finance platform. A single source of truth instils trust and confidence not only in your data but with each other too.

OUT - Building your own tech

When you have many inhouse processes and procedures, it can be tempting to create an internal system that can manage them for you. There are a lot of downsides to this approach. Often, inhouse systems are maintained by one individual and, if he/she leaves the company, the knowledge of how to operate that system is lost. Additionally, many of these inhouse systems lack data validation and automation tools, so they may not be saving as much time for your teams as you think.

IN - Building with tech

The best way to prepare your team for the next generation of finance is to develop your processes using a finance platform from a reputable vendor. You’ll reap the rewards of automation, data integration, and collaboration, while having a vendor who can handle security, compliance, and optimisation.

OUT - Disparate systems

When you have disparate systems, it can be a challenge to manage all the different applications, including logins, data management, and security. The more you login to different systems, the more often you’re at risk of errors, disruptions, and headaches.

Finance needs systems that talk to each other. With disparate systems, you have to do the manual work of extracting data, setting up user admins and security parameters in each different application.

IN - One platform

A next-gen finance platform has the power to eliminate your disparate systems. With a central place to access all your finance and accounting applications, it’s easier to execute your processes with speed and accuracy.

Teams that can seamlessly switch between different finance and accounting functions – from financial planning & analysis to disclosure management, and back to financial consolidation – can use the insights from each to boost performance

OUT - Limited collaboration

Collaboration is the key to success. Being able to seamlessly work with your team or cross-functional colleagues is an essential part of decision making. But disparate systems and disjointed data can make collaboration a challenge. When systems can’t talk to each other to share data or automate workflows, it adds additional manual effort for teams. When a lack of collaboration is combined with systems that don’t sync together, you can spend more time clarifying your results than driving them.

IN - Agile ways of working

Bringing all your data onto an integrated platform is a recipe for successful collaboration. This is key to ensuring your team is using a single version of the truth to drive decision making. An integrated platform not only allows for data integration, it enables integrated workflows too.

OUT - Replacing talent with tech

When AI-enabled finance tools were first introduced, there was speculation that you may be able to replace your entire team with technology. However, the reality is that your tools are only as valuable as your teams’ talents. You need someone to support the setup, maintenance, and optimisation of your next-gen platform, which is still more efficient than doing everything manually.

IN - Levelling up talent with tech

The best way to set up your team for success, now and in the future, is to train them on a next-gen finance platform. Not only will they be better equipped to support your corporate objectives, you’ll be setting them up for their future endeavours, no matter the role they’re in. This approach fosters a culture where technology and talent pave the way for more agile, innovative, and adaptable finance processes that benefit everyone involved.

Manual work, disjointed data, and disparate systems slow down your processes. Automated and integrated processes and data allow you to buy back time for the work that drives your business forward.

Out with inaccurate data, limited collaboration, and low confidence. In with hyper precision, ultra adaptability, and dramatic performance.

Sam Cheo is Managing Director, Asia, Prophix.