TAKEAWAYS

IFRS 15 Revenue from Contracts with Customers defers the disclosures of onerous contracts to IAS 37 Provisions, Contingent Liabilities and Contingent Assets.1 Under IFRS 15 para 31, an entity recognises revenue when it satisfies a performance obligation – the unit of account being a performance obligation. Under IAS 37 para 66, an entity provides for the present obligation of a contract if it is onerous – the unit of account being a contract. How should an entity reconcile the different units of account in IFRS 15 and IAS 37 when determining whether contracts with customers are onerous?

In this article, we discuss the assessment and measurement of onerous contracts containing satisfied, unsatisfied, and partially unsatisfied performance obligations.

For revenue recognition under IFRS 15, an entity will need to (a) identify the contract with a customer, (b) determine the performance obligations within the contract, (c) establish the transaction price, (d) allocate the transaction price to the performance obligations, and (e) recognise revenue when each performance obligation is satisfied. Revenue is recognised over time when a performance obligation is satisfied over time based on meeting any of the three conditions stated in IFRS 15 para 35. Otherwise, an entity recognises revenue when a performance obligation is satisfied at a point in time.

Under IAS 37, a contract is onerous when the unavoidable costs exceed the expected economic benefits from fulfilling the obligations in the contract. IAS 37 para 68 defines unavoidable costs as the lower of the fulfilling costs and the penalties arising from non-fulfilment of the contractual obligations. Thus, when a contract turns onerous, an entity will measure and recognise a provision for the present obligation under the contract.

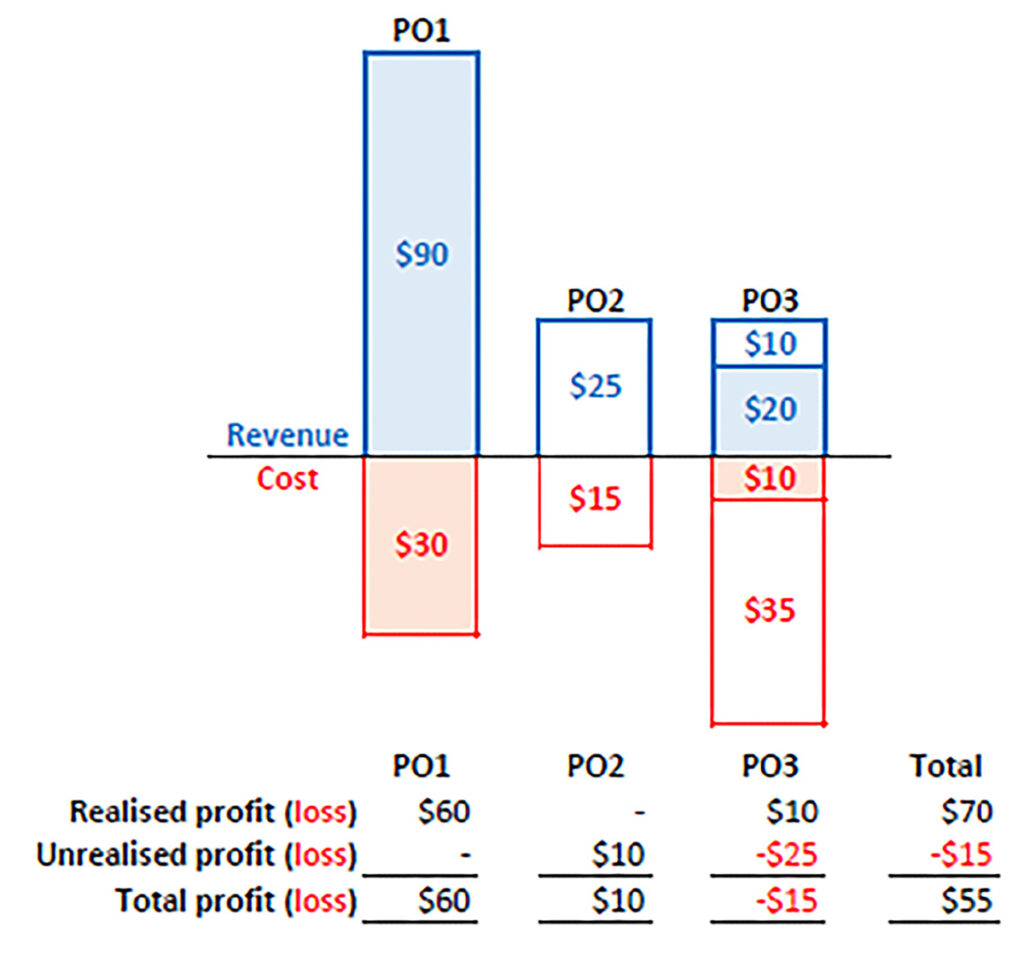

Assume Entity A signs a contract with customers that has three performance obligations and a total transaction price of $145 at the beginning of the reporting period. At the inception of the contract, Entity A expects all performance obligations to be profitable. Figure 1 shows the allocated transaction price and fulfilment costs of the performance obligations in the contract at the end of Entity A’s reporting period.

In Figure 1, the first performance obligation (PO1) is fully satisfied with an allocated transaction price of $90 and incurred fulfilment cost of $30, resulting in a realised profit of $60. The second performance obligation (PO2) is fully unsatisfied with an allocated transaction price of $25 and an expected fulfilment cost of $15, resulting in an expected profit of $10. The third performance obligation (PO3) is partially unsatisfied with an allocated transaction price of $30, of which $20 has been recognised as revenue. PO3 has a total expected fulfilment cost of $45, of which $10 has been incurred and recognised as expense. Hence, PO3 has a recognised profit of $10 and an unrealised loss of $25, resulting in an overall expected loss of $15.

Figure 1 Contract with satisfied, unsatisfied, and partially unsatisfied performance obligations

ASSESSMENT OF ONEROUS CONTRACT

Onerous contract assessment under IAS 37 can potentially be interpreted in two ways depending on whether (1) fully satisfied, unsatisfied and partially unsatisfied performance obligations are included, and (2) only unsatisfied and partially unsatisfied performance obligations are included. If we include all satisfied, unsatisfied, and partially unsatisfied performance obligations to date (that is, PO1, PO2 and PO3), Entity A’s contract is not onerous because there is an expected overall profit of $55. However, if we include only unsatisfied and partially unsatisfied performance obligations (that is, PO2 and PO3), Entity A’s contract is onerous because of the expected loss of $5 arising from the unsatisfied and partially unsatisfied performance obligations in PO2 and PO3 (we will discuss the measurement issue of whether realised revenues and costs of partially unsatisfied performance obligation should be excluded in the computation of onerous loss provision later in the article). Which of these two interpretations is more consistent with IAS 37 requirements?

IAS 37 para 66 requires an entity to provide for the present obligation under an onerous contract, which constitutes a liability. Per the Conceptual Framework for Financial Reporting (para 4.43), a present obligation arises from past events where an entity has already acted or obtained economic benefits and consequently, the entity is expected to transfer economic resources that it would not otherwise need to transfer. In addition, the discussion in IAS 37 on unavoidable costs exceeding revenue from meeting the obligations under the contract seemingly requires onerous contract assessment to be forward looking. Hence, realised profits from satisfied performance obligations in prior periods should not be used to offset future expected losses from unsatisfied and partially unsatisfied performance obligations that remain on a contract. As such, we conclude that onerous contract assessment under IAS 37 should be based only on unsatisfied and partially unsatisfied performance obligations remaining in the contract on reporting date.

A further question arises as to whether to exclude non-onerous unsatisfied and partially unsatisfied performance obligations in onerous contract assessment as their inclusion will lead to a smaller or no onerous loss. As noted, IFRS 15 measures and recognises revenue at a performance obligation level while IAS 37, which is issued prior to IFRS 15, assesses and measures onerous loss at a contract level. In Entity A’s example, the expected loss of $5 is based on unsatisfied and partially unsatisfied performance obligations, which is the sum of an expected profit of $10 from PO2 and an expected loss of $15 from PO3. However, at a performance-obligation level, only PO3 is onerous but not PO2. If Entity A were to structure PO2 and PO3 as separate contracts, it will need to recognise a larger provision for onerous loss of $15 for the contract containing PO3. This difference in the amount of provision seems to be driven by form rather than substance. To ensure consistency between IAS 37 and IFRS 15, the International Accounting Standards Board (IASB) should (re)consider aligning the unit of account for assessment of onerous contract in IAS 37 and IFRS 15, and provide explicit guidance on whether non-onerous unsatisfied and partially unsatisfied performance obligations should be excluded in onerous contract assessment.2

The measurement of onerous loss of fully unsatisfied performance obligation (that is, PO2) is straightforward. However, the measurement of onerous loss for partially unsatisfied performance obligation (that is, PO3) can differ if realised profit to date exceeds expected loss and whether realised profit is considered in the measurement of onerous loss.

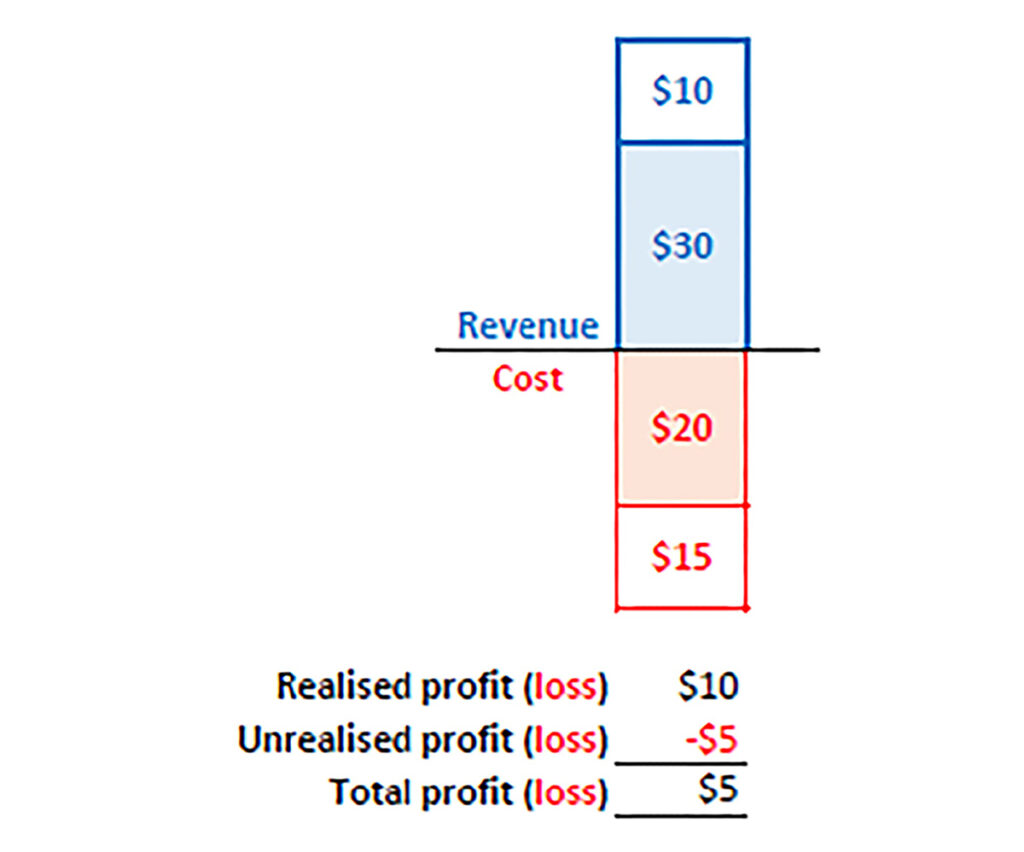

Consider the following example of a contract with only a partially unsatisfied performance obligation at the end of the reporting period. The allocated transaction price is $40, of which $30 has been recognised as revenue. Its total expected fulfilment cost is $35, of which $20 has been recognised as expense. Hence, the partially unsatisfied performance obligation has a recognised profit of $10 and an unrealised loss of $5, resulting in a net expected profit of $5.

Figure 2 Contract with only a partially unsatisfied performance obligation

In this example, the computation of onerous loss can vary depending on whether the recognised revenue and incurred costs to date are included. Excluding realised revenue and incurred costs to date in the assessment of onerous loss is consistent with IAS 37 requirements to be forward looking in the assessment of onerous contracts. Based on this, the amount of onerous loss will be $5 for this contract. However, we believe an argument can be made for including the realised revenue and incurred costs to date in the measurement of onerous loss. Note that in this instance, the revenue recognition process is ongoing (that is, over time) as opposed to fully completed and realised.

Recognition of revenue over time is based on an estimated measure of progress towards complete satisfaction of the performance obligation, which is calculated using either output or input methods. IFRS 15 para 43 requires an entity to update the measure of progress over time to reflect changes in the outcome of a performance obligation according to IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. Revenue to be recognised in the current reporting period is then based on an updated measure of completion progress and the amount of revenue recognised to date. Extending this computational requirement to the measurement of onerous loss, including the recognised revenue of $30 and incurred costs of $20 to date in the computation of the expected profit or loss for the contract, will lead to an expected profit of $5 instead of an onerous loss of $5. Hence, based on this argument, the contract will be assessed as non-onerous.

Currently, the unit of account differs between IFRS 15 (based on performance obligation) and IAS 37 (based on contract). Consequently, there may be different interpretations of how onerous contracts with customers are assessed and measured depending on whether to consider (1) fully satisfied, unsatisfied and partially unsatisfied performance obligations or only unsatisfied and partially unsatisfied performance obligations, (2) both onerous and non-onerous or only onerous unsatisfied and partially unsatisfied performance obligations, and (3) the recognised revenue and incurred costs to date of partially unsatisfied performance obligations. While we have discussed and recommended certain treatments of these ambiguities, IASB can consider clarifying and providing more specific guidance on them.

Low Kin Yew is Associate Professor (Practice), Nanyang Business School-Nanyang Technological University (NBS-NTU); Deputy Associate Provost (Programmes) and Co-Director, Interdisciplinary Collaborative Core Office, NTU. Tong Yen Hee is Associate Professor and Head of Accounting Division, NBS-NTU. Choo Teck Min is Associate Professor and Academic Director of the MSc (Accountancy) programme, NBS-NTU.

1 See IFRS 15 Basis for Conclusions para BC268.

2 In the early Exposure Draft on Revenue from Contracts with Customers, IASB initially included guidance on the assessment of onerous contracts using performance obligation as the unit of account for contracts with recognition of revenue over time. Subsequently, the proposed requirement was withdrawn and IASB instead referred to IAS 37 requirements for onerous contract assessment.