TAKEAWAYS

A reinsurance contract is defined in FRS 117 Insurance Contracts (FRS 117) as an insurance contract issued by one entity (the reinsurer) to compensate another entity (the cedant) for claims arising from one or more insurance contracts (underlying insurance contracts) issued by that other entity.

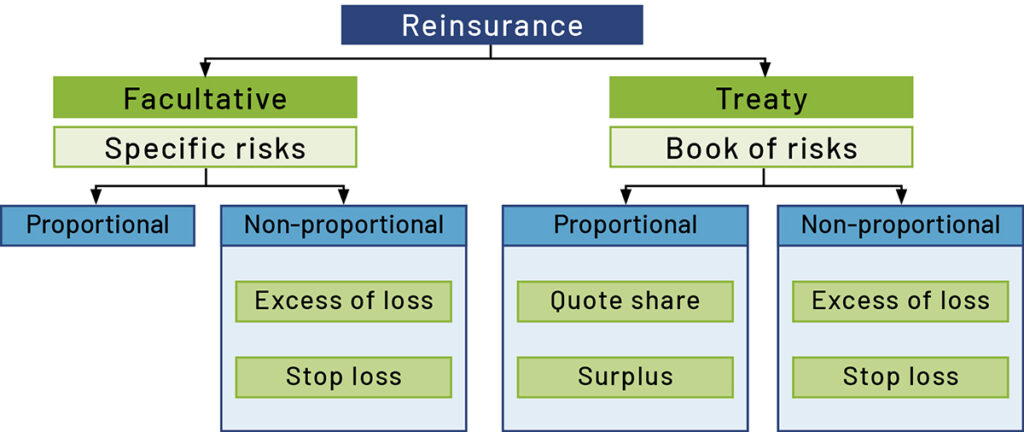

Reinsurance contracts may be grouped into facultative and treaty, and then further categorised into two categories, namely proportional coverage and non-proportional coverage (Figure 1).

Figure 1 Definition of a reinsurance contract

Some contracts that are, in legal form, financial reinsurance contracts, return all significant risks to the policyholder. Such contracts are normally financial instruments or services contracts and would therefore fall outside the scope of FRS 117. In addition, certain parametric contracts that do not have a necessary direct link with an element of risk transfer may also fall outside the scope of FRS 117.

Fulfilment cash flows arising from reinsurance contracts held consist of premiums a cedant pays minus any amounts paid by the reinsurer to the entity for expenses (for example, reinsurance commissions, etc) it incurs. The amount paid for reinsurance coverage by the cedant can be viewed as:

FRS 117 requires a reinsurance contract held to be accounted for separately from the underlying insurance contracts to which it relates. This is because an entity that holds a reinsurance contract does not normally have a right to reduce the amounts it owes to the underlying policyholder by amounts it expects to receive from the reinsurer.

1. Grouping of reinsurance contracts

The level of granularity differs between FRS 117 and MAS’ Risk-Based Capital 2 (RBC 2). At the highest level, under FRS 117, the definition of a portfolio focuses on both similar risks and managing contracts together, while RBC 2 focuses on insurance funds and classes of risk and geographic locations (Singapore, other ASEAN countries, other countries) for reporting purposes. Although in many cases the portfolios will likely be identical, differences could occur.

Next, within these portfolios, FRS 117 requires the division of contracts into annual cohorts (or shorter periods) and, subsequently, further separation into three profitability groups of net gain on initial recognition, no significant possibility of net gain arising subsequent to initial recognition and remaining contracts, such division (into portfolio, cohort, profitability group) requirements do not exist in RBC 2. This will not only have an impact on determining the CSM but possibly affect the identification of the future cash flows for measurement purposes.

2. Commissions and reinstatement premiums

Another key difference between FRS 117 and RBC 2 is the treatment of reinsurance commission and reinstatement premium. Under FRS 117, treatment of such items depends on whether they are claim-contingent (presented together with amounts recovered from reinsurer) or non-claim-contingent (presented together with allocations of reinsurance premiums paid). In addition, certain profit commission might be accounted for as a non-distinct investment component and such cash flows are excluded from insurance revenue and expenses under FRS 117.

In contrast, under RBC 2, profit commission is recognised as an acquisition expense, reinstatement premium is recognised as part of written premium, and reinsurance commission is recognised as a ceded acquisition cost.

3. Contract boundary of reinsurance contracts held

Under FRS 117, the boundary of a contract represents the point beyond which the cedant no longer has substantive rights under the contract to receive services from the reinsurer, and the cedant no longer has a substantive obligation to pay premiums to the reinsurer. Any cash flows beyond the boundary are not recognised in the measurement of the liability. Under RBC 2, contract boundary requirements are only specified for long-term medical policies in life insurance business, whereas contract boundary requirements under FRS 117 are also applicable for general insurance business.

Insurers will need to look closely at the two requirements across their full range of contracts to assess whether the requirements result in different contract boundaries. Determining the contract boundary of a reinsurance contract is challenging under the new FRS 117 framework, as it requires a significant amount of judgement and assessment.

4. Risk of non-performance by issuer of the reinsurance contract

Cedants face the risk that the reinsurer may be unable to meet obligations under the reinsurance contract held. This is accounted for differently under RBC 2 and FRS 117. Under FRS 117, the insurer shall include, in the estimates of the present value of future cash flows for the reinsurance contracts held, the effect of any risk of non-performance by the issuer of the insurance contract, including the effects of collateral and losses from disputes.

Under RBC 2, risk of non-performance by the reinsurer is reflected in the capital requirements of the insurer. In addition, for reinsurers with significant risk of default, insurers may recognise an allowance for impairment losses on reinsurance recoverable on paid claims and/or an adjustment of reinsurers’ share of policy liabilities.

5. Separation and valuation of reinsurance contracts held

Under RBC 2, reinsurance largely follows the grouping of the underlying businesses (such as insurance funds and class of businesses). However, under FRS 117, the lowest unit of account is the individual contract level (that is, reinsurance facultative contract or reinsurance treaty policy). Commonly, a reinsurance treaty policy could provide coverage to underlying businesses from multiple lines of businesses (or classes). Accordingly, unless separation criteria are met, the FRS 117 grouping for such reinsurance treaty policies may not follow the FRS 117 grouping of the underlying businesses.

In addition, under RBC 2, it is common that the valuation of reinsurers’ share of policy liabilities is determined as the difference between the gross and net basis. However, under FRS 117, valuation of the reinsurance contract assets is performed separately from the valuation of the underlying insurance contract liabilities.

Reinsurance is an important component in the operations of many insurance and reinsurance companies. Accounting for reinsurance contracts held is also a material aspect in the accounting operations of many insurance and reinsurance companies. The upcoming application of FRS 117 presents both challenges and opportunities for the insurance industry due to the differences between FRS 117 and RBC 2. Insurance accountants are encouraged to have an awareness of the differences, and plan for potential mitigation measures on the accounting and operational complexities arising from the upcoming concurrent application of FRS 117 and RBC 2, as well as using it as an opportunity to revisit existing reinsurance arrangements.

This is the last of a series of articles from the IFRS 17 Working Group (set up under the ambit of the ISCA Insurance Committee) to help insurers in Singapore navigate through the differences between FRS 117 and RBC 2.

Alvin Chua is Chairman, IFRS 17 Working Group (WG) and Director, KPMG Services Pte Ltd; Chai Siow Peng is a WG member and Asiapac P&C Financial Controller, SCOR Reinsurance Asia-Pacific Pte Ltd; Wang Nan is a WG member and Audit & Assurance Manager, Deloitte & Touche LLP; and Wong Li Keng is a WG member and IFRS Manager, Income Insurance Limited.