TAKEAWAYS

For insurers in Singapore, 1 January 2023 will represent the beginning of a new era as FRS 117 Insurance Contracts (FRS 117) will finally come into effect, which would affect the preparation of statutory financial statements. The new accounting standard brings greater comparability and transparency on the profitability of new and in-force businesses and will give users more insight into an insurer’s financial health than ever before.

While the new accounting standard will bring benefits to the industry, insurers in Singapore still need to follow the reporting and solvency requirements under the Risk-Based Capital 2 (RBC 2) framework prescribed by the Monetary Authority of Singapore (MAS). These requirements are mainly covered in the Insurance (Valuation and Capital) Regulations 2004, MAS Notice 129 Notice on Insurance Returns (Accounts and Statements) and MAS Notice 133 Notice on Valuation and Capital Framework for Insurers. MAS has indicated that it will not be aligning to FRS 117 requirements which in many areas are different from the requirements under RBC 2. This contrasts with current accounting under FRS 104 Insurance Contracts (FRS 104) which, in many ways, are similar to the reporting for MAS purposes, for example, accounting for gross written premiums and premium receivables. Many insurers also leverage on the regulatory reporting requirements and apply similar treatment in their statutory financial statements (for example, measurement of insurance liabilities applying MAS’ requirements). One important area where alignment was achieved is on the valuation of the insurance liabilities where insurers typically follow the MAS requirements which also aligns with the treatment for tax purposes. These alignments have reduced the need to work out different numbers for different purposes and additional reconciliations to ensure that the financial numbers are aligned.

With requirements in FRS 117 more clearly detailed and significantly different from FRS 104, insurers may be required to maintain two or more sets of accounting books for the different reporting purposes (for example, for MAS reporting, statutory financial statements, group reporting under International Financial Reporting Standards (IFRSs) or other accounting standards) as it is no longer a straightforward task to just apply certain reclassification and/or minor adjustments to get from one set of reporting to the other. Maintenance of two or more sets of accounting books will require different processes and data which increases workload and complexities. Insurers will also need to be able to explain the differences to stakeholders who may not be familiar with the requirements under FRS 117. While FRS 117 and MAS reporting requirements are quite different, there are opportunities to seek alignment in certain areas to reduce some complexities and workload.

The ISCA Insurance Committee has set up an IFRS 17 Working Group which comprises practitioners with significant experience in the field of insurance, including representatives from audit firms and relevant industry associations, to consider industry issues arising from the adoption of FRS 117 Insurance Contracts in Singapore.

This is the first article in the IFRS 17 Working Group’s series of articles to help insurers in Singapore navigate through the similarities and differences between FRS 117 and RBC 2.

We will cover the following areas in this article:

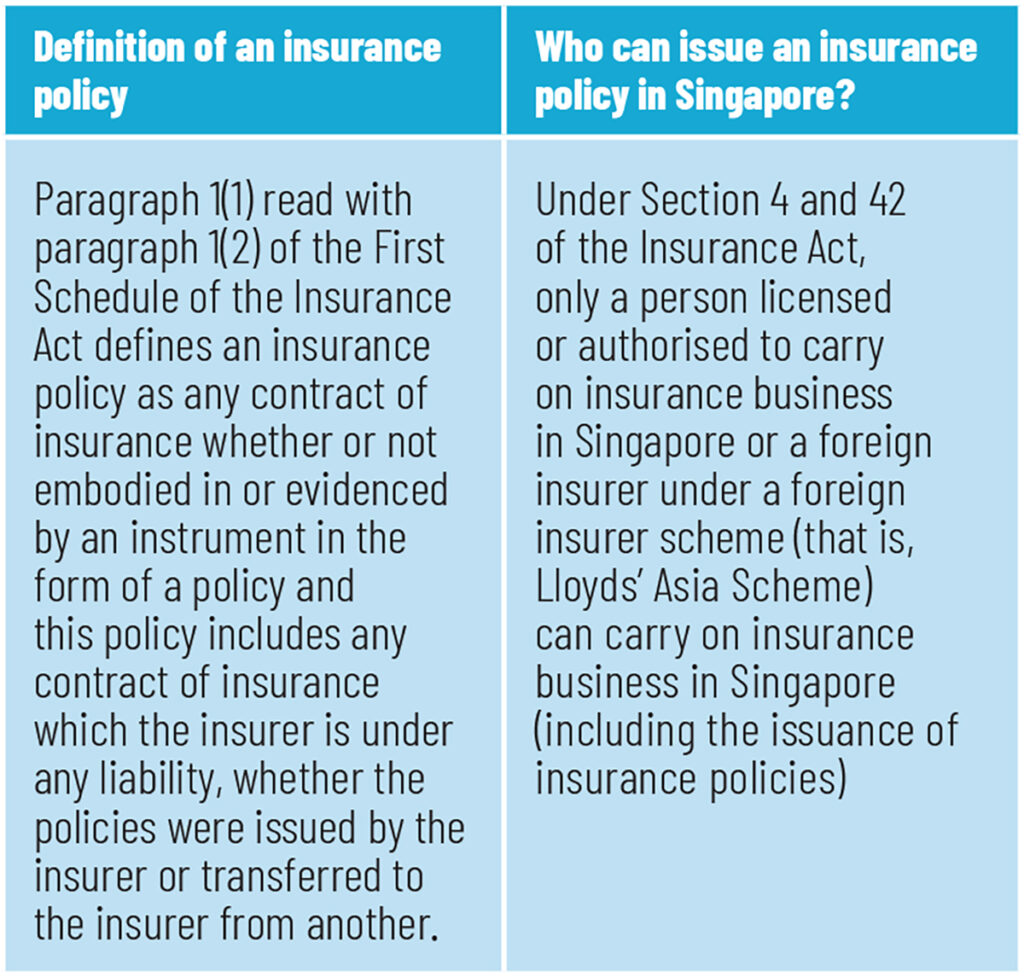

Under FRS 117, an insurance contract is defined as “A contract under which one party (the issuer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder.”

This definition focuses on the transfer of “significant insurance risk” which is defined as any risk other than financial risk that is transferred from the holder of a contract to the issuer. It focuses on the types of contracts rather than the types of entities. Therefore, FRS 117 applies to all entities, regardless of whether they are regulated as an insurer or not. Thus, an entity may be required to apply FRS 117 if the contract it issues meets the definition of an insurance contract. For example, a contract providing warranty for product from an entity that is not a manufacturer, wholesaler or retailer could meet the definition of insurance contract and therefore needs to apply FRS 117. On the other hand, an insurance policy as defined under the Insurance Act is applicable to contracts issued or entered into by insurers.

Comparing the two definitions above, one can see that FRS 117 focuses on the transfer of significant insurance risk to the issuer of the contract by the policyholder, but no such consideration is required for MAS reporting for direct insurance policies. As a result, under FRS 104, there are certain insurance contracts which transfer insignificant insurance risks which are reported as investment contracts but as insurance policies for MAS reporting. This results in a different classification under both bases and necessitate adjustments to be made. This difference will continue under FRS 117.

The Conceptual Framework of the Singapore Financial Reporting Standards contains general requirements that accounting should reflect the substance of the transaction. If the legal form of the arrangement does not reflect the substance, an entity can consider the substance of the transaction for the accounting.

In this regard, an entity applying FRS 117 will need to consider whether the substance of the contract is reflected by its legal form when determining the unit of account. If the substance is not reflected by the legal form, then adjustment to the accounting of the contract is required. It is common for an insurance contract to provide coverage for several different risks, for example, a life insurance policy may cover mortality and morbidity risks, and a general insurance policy may cover fire and liability risks, which are very different in terms of the nature of the risks from each other. This is usually done to provide convenience to customers so that they do not have to purchase multiple contracts or, they reduce the need for customers to shop around to get the best deal for each cover. The entity needs to consider whether it is appropriate to rebut the presumption of the legal contract reflecting the commercial substance. If the entity wants to rebut the presumption, several criteria will need to be considered including whether there are dependencies across the different risks within the contract. Only when the criteria are met can the legal contract be separated into different units of account for accounting purposes.

For MAS purposes, the unit of account is generally the legal contract within the insurance fund although there are instances where a single contract is split into separate units of account because they are classified under different insurance funds, for example, a non-participating rider with either a participating or investment-linked host. The Insurance Act, Insurance (Valuation and Capital) Regulations 2004 and MAS Notice 133 provide high-level specifications on the classification into the various units of account.

Where an insurance contract contains coverage for different insurance risks, alignment with MAS reporting can be achieved by going with the presumption that the legal contract reflects the substance and is therefore the unit of account. In our view, this can be achieved by considering that the inability to terminate one risk, without causing the others to terminate, to be a key determinant of this decision. However, the insurer cannot choose to rebut the presumption for certain contracts and not others as this is not an accounting policy choice. Life insurers which currently sell investment-linked contracts or participating contracts with non-participating riders may consider separating the riders from the host insurance contracts to align with MAS reporting as riders are commonly measured and reported separately from the host contracts in the non-participating insurance fund. This must be carefully thought through as not all riders can meet the criteria to separate under FRS 117, especially if there is dependency between the host contract and rider, for example, accelerating riders or unit-deducting riders. This could result in some riders being separated while others are not, which will result in additional complexities.

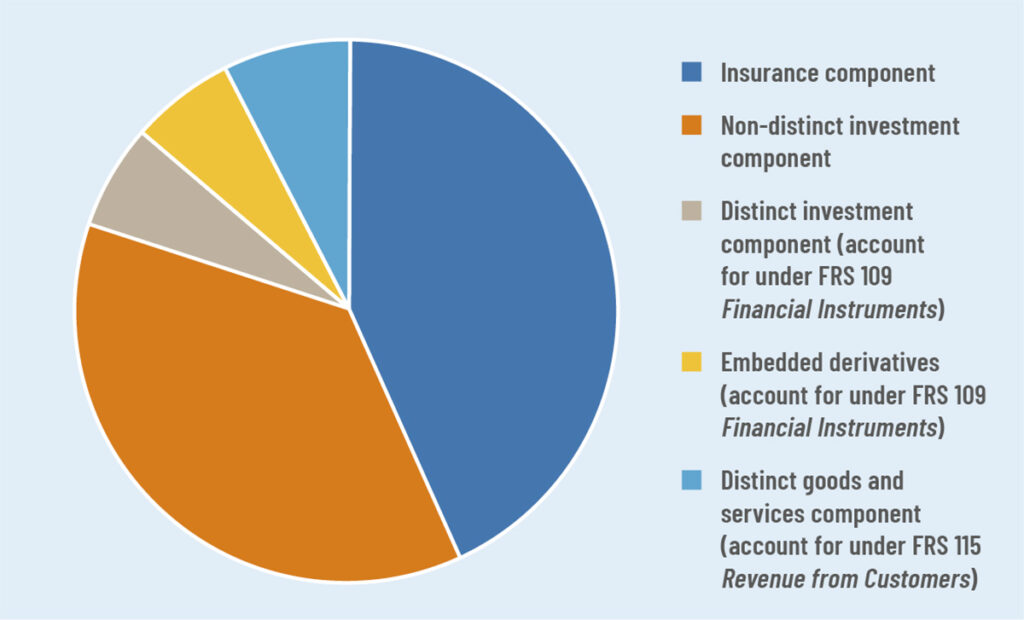

An insurance contract may also contain the following types of non-insurance components which, under FRS 117 paragraph 10, will need to be assessed whether they are distinct and therefore would require to be separated into separate contracts and accounted for under the relevant accounting standards. Such components are:

– Embedded derivatives, as defined under FRS 109 Financial Instruments;

– Investment components, which are the amounts that the entity is required to repay to a policyholder in all circumstances, regardless of whether an insured event occurs; or

– Promises to transfer distinct goods or services, other than insurance contract services.

If such components are present, then the entity will need to consider if such components are required to be separated from the insurance contract based on FRS 117 requirements. Certain conditions will need to be met for the separation to occur. Such requirements do not exist for MAS reporting purposes.

For the investment components, the entity may prefer not to separate them from the insurance contract to align with the unit of account for MAS reporting. However, this will depend on the facts and circumstances and is not a choice. Although many insurance contracts, particularly those issued by life insurers, contain investment components, they are not required to be separated because of the dependency between the insurance component and the investment component, for example, the measurement of the insurance component cannot be done without consideration of the investment component (for example, the claim amount is dependent on the cash value that has accumulated in a participating contract). Therefore, separation of the investment components which are distinct will likely be an exception rather than the norm. Even though there is no need to separate the investment components in most of the cases, the non-distinct investment component will still need to be removed from the profit and loss statement unlike for MAS reporting. This will cause the numbers in the profit and loss statement for MAS reporting to be different as compared to the profit and loss statement under FRS 117.

Promises to transfer distinct goods and services other than insurance services include, for example, roadside assistance, travel assistance, medical assistance, telematics services which are provided regardless of whether claims will be made on the insurance contracts. The policyholder is usually able to enjoy these services on their own. Ideally, the preference will be not to separate these services to apply the accounting to the legal contract, like for MAS reporting. Separation will require premiums to be allocated to these components and removed from the fulfilment cash flows. This not only creates additional work but also results in differences with MAS reporting. However, as separation of this component when the conditions are met is not a choice under FRS 117, the insurer may be faced with the situation where it will need to separate the component. As these services are usually provided at minimal cost, the insurer may want to consider if such components are material to the financial statements.

This article provides an introduction to the differences between FRS 117 and MAS reporting requirements under RBC 2. The IFRS 17 Working Group will go in depth into the key areas of differences between FRS 117 and RBC 2 in the upcoming articles. While it is envisaged that full alignment of FRS 117 and RBC 2 will not be achieved in the shorter term, the upcoming articles will explore and consider those areas where insurers can look to aligning to reduce the complexities in managing different reporting bases and allow for easier understanding of FRS 117 financials.

This is the first of a series of articles from the IFRS 17 Working Group (set up under the ambit of the ISCA Insurance Committee) to help insurers in Singapore navigate through the differences between FRS 117 and RBC 2.

Alvin Chua is Chairman of the IFRS 17 Working Group (WG) and Director, KPMG Services Pte Ltd; Choong Fui Hai is a WG member and Head of Financial Reporting, Prudential Assurance Company Singapore; Lawrence Foo is a WG member and Vice President Group Finance, Great Eastern Life Assurance Co Ltd; and Raymond Tan is a WG member and Operational Controller, Finance & Accounting, AIG Asia Pacific Insurance Pte Ltd.