TAKEAWAYS

The dramatic collapse of Silicon Valley Bank (SVB) triggered much speculation and debate as many sought to unravel the cause behind the bank’s sudden downfall. Among the factors and explanations raised, there were criticisms levelled at how SVB was able to carry a portion of its bond portfolio at amortised cost. The deep paper losses suffered by these bonds were not reflected in their carrying amounts in the financial statements.

In SVB’s annual report for the year ended 31 December 2022, the above-mentioned bonds were carried at their amortised cost of US$91 billion, but their fair value was only US$76 billion. This indicated an unrecorded loss of $15 billion, which critics have blamed on the accounting method used – “amortised cost” instead of “fair value”. Although SVB did disclose the fair value of these bonds, there were some who felt that that was not enough. The argument was that “fair value” should be the only measure for all financial assets as it is more reflective of their “true value”. We will examine this argument in this article.

Under the international accounting standard IFRS 9 Financial Instruments, the following classification and measurement bases are allowed:

(i) Amortised cost

(ii) Fair value through other comprehensive income (FVOCI) – where fair value changes are recorded in other comprehensive income

(iii) Fair value through profit or loss (FVTPL) – where fair value changes are recorded in profit or loss.

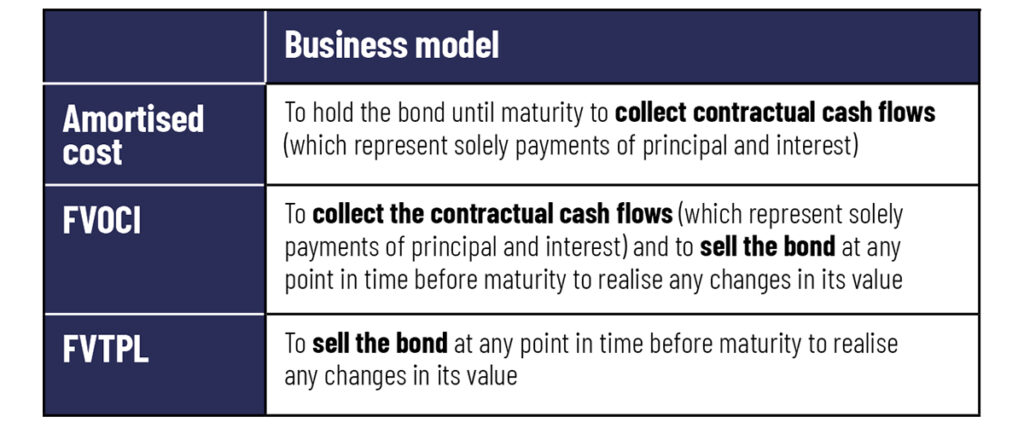

The key difference lies in the entity’s business model under which the financial assets are being held. Reclassification between the different categories will happen only if the entity changes its business model for managing the financial asset.

Table 1 demonstrates how a financial asset such as a bond could be treated very differently, depending on the business model under which it is held:

Table 1 Classification of a financial asset held under different business models

Figure 1 is an example to illustrate the financial impact (value of bond, interest income and fair value changes) of the earlier classifications (Table 1) on the balance sheet and profit or loss.

Fact pattern

Figure 1 Financial impact of the different classifications of the financial asset

We can analogise the above three accounting methods to clothing sizes in the fashion industry: size S for amortised cost, size M for FVOCI, and size L for FVTPL, to cater to people of different physiques (that is, different business models under which the financial asset is being held).

Proponents of fair value accounting are of the view that the fluctuations in the value of the financial asset in the financial statements aptly reflect the market conditions and provide stakeholders with relevant and timely information. This is particularly so if the fluctuations are promptly reflected in the profit or loss (that is, only FVTPL should be allowed). In fashion speak, there should only be size L clothing which everyone should wear.

Imagine a world full of people who are all wearing size L regardless of their physique. Would that make sense? Consider the following.

FVTPL assumes that the realisation of the value of the financial asset is by sale instead of collection of the contractual cash flows. Using the bond example above, if the entity’s business model is to hold the bond and collect the contractual cash flows until maturity and it has accounted for that bond using FVTPL, the entity’s financial statements will see short-term fluctuations in the value of the bond and profit or loss arising from fair value changes during the three years.

But what if the entity plans to hold the bond until its maturity date? Would the short-term fluctuations in the fair value of the bond provide stakeholders with meaningful information? Would it make sense for the entity to record paper gains or losses throughout the three years when it already knows upfront that it would receive a total of $106 by 31 December 2024, unless there is a default by the bond issuer?

Fair value accounting can be straightforward if the financial asset is highly liquid and easy to value at observable market prices. Otherwise, the determination of fair value could be highly subjective and may not be highly reliable depending on the inputs and assumptions used. During times of financial crisis or high market volatility, fair value becomes hard to estimate as markets can quickly become illiquid and there may be little to no observable transaction prices. For financial assets which are intended to be held to maturity, is it worth the extra effort to determine the fair value if the changes are neither realised nor planned to be realised?

On the other end of the spectrum, there is the amortised cost model. It is a tested and proven accounting method that is well understood by investors and stakeholders and is used to account for assets which are used by entities to generate returns. In such cases, the cost is amortised over the useful lives of the assets and valuation concerns are addressed via impairment requirements.

In the middle of the spectrum, there is the FVOCI model. It is meant for financial assets which are held to collect contractual cash flows and can be sold any time before maturity to realise changes in value. Therefore, it makes sense for such a financial asset to be measured at fair value with fair value changes recorded in equity until it is sold. However, as the fair value changes are recorded as a “lump sum figure” in equity, users are unable to distinguish how much of the fair value changes are unrealised gains and how much are unrealised losses.

Given the above factors, it can be seen why the accounting standards continue to accommodate three different measurement methods, including amortised cost.

However, there are times when measurement at fair value is necessary. When an entity faces going concern or severe liquidity issues, it may not have the ability to hold its investments to maturity, such as in the case of SVB. In such situations, the fair value of the entity’s financial assets would better reflect what it would be able to realise immediately. This is akin to how one may have to put aside fashion preferences and switch to firefighting gear when there is a fire. But one cannot be wearing firefighting gear all the time, right?

There are pros and cons to each of the three measurement methods for financial assets and a one-size-fits-all approach may not be the solution. There may be areas which could be improved, such as more explicit disclosures of unrealised fair value gains and losses in the financial statements. But there are clear benefits of having different accounting methods catering to different business models. If business models change, such as in a crisis situation, the accounting may have to change. But, this may be hard to anticipate at times. After all, how does one predict when a bank run would happen?

Terence Lam is Head, Professional Standards, ISCA; and Felicia Tay is Associate Director, Professional Standards, ISCA.

1 Required under paragraph 25 of SFRS(I) 7 Financial Instruments: Disclosures and paragraph 97 of SFRS(I) 13 Fair Value Measurement