TAKEAWAYS

Companies looking to list on the Singapore Exchange (issuers) must include pro forma financial statements in the prospectus if certain rules apply under the 5th Schedule of the Securities and Futures Act (Cap. 289) (the “Regulation”) and Singapore Exchange (SGX) Listing Rules (LR). These statements benefit investors by providing a more complete overview of the issuer’s historical financial statements (HFS) when making investment decisions.

In this article, we take a closer look at the preparation of pro forma financial information (PFI).

PFI are special financial data related to historical periods that supplement an issuer’s historical financial information assuming that certain events or transactions occurred at an earlier date. The objective of PFI is to provide investors with information about the continuing impact of a particular event or transaction by indicating how the event or transaction might have affected HFS had it occurred at an earlier date.

When should issuers prepare PFI?

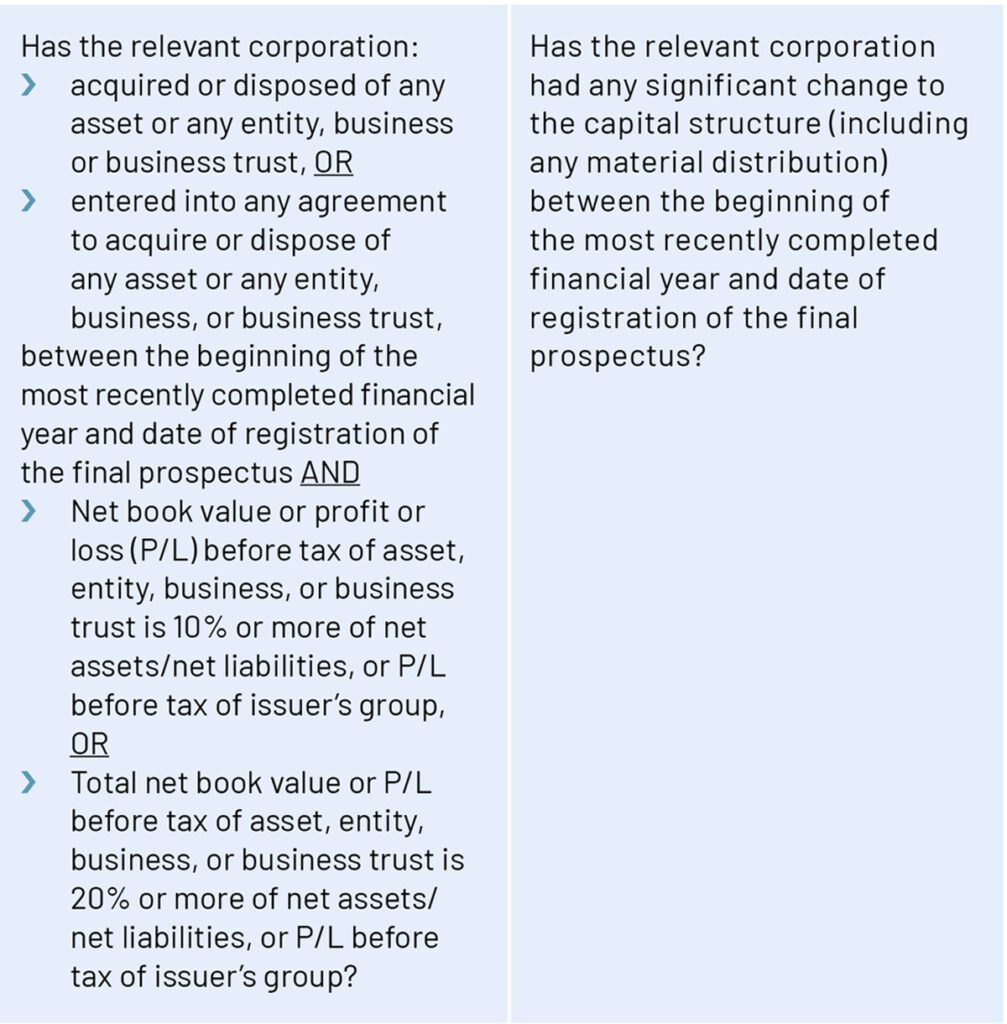

Based on the Regulation, PFI must be disclosed in the prospectus if the answer to one of the questions in Table 1 is “yes”.

Table 1

What are the typical events triggering significant changes in capital structure?

Which statements and periods are required to be presented?

Based on the Regulation, pro forma income statement, cash flow statement and balance sheet must be prepared for the most recently completed financial year. If interim financial statements of the relevant corporation have been included in the prospectus, pro forma financial statements must be disclosed for the period covered by the interim financial statements too.

The pro forma income statement and cash flow statement will be prepared on the assumption as if the acquisition, disposal or significant change had occurred at the beginning of the most recently completed financial year. The pro forma balance sheet will be prepared on the assumption that the acquisition, disposal or significant change had occurred at the end of the financial year and the end of interim period (if interim financial statements have been provided in the prospectus).

Based on SGX LR, PFI must be presented for reverse takeover where there have been material changes to the group structure of the issuer, or in the case of a listing of a REIT or a business trust. Under SGX LR, pro forma income statement or statement of comprehensive income should be presented for the latest three financial years and for the most recent interim period (if applicable) as if the restructured group had been in existence at the beginning of the period reported on. The pro forma statement of financial position should be presented as at the date to which the most recent pro forma income statement or statement of comprehensive income was made up.

Can the issuer request a waiver for PFI disclosure?

There are specific circumstances where the issuer can request the Monetary Authority of Singapore (MAS) for a waiver, and each request is singularly examined. A common request for waiver is often due to the non-availability of information for the compilation of PFI by the issuer.

Are disclosure exemptions possible?

Pro forma profit and loss and cash flow statements may not be required to be disclosed if the acquisition or disposal relates to an inactive business. In addition, PFI can be exempted if the prospectus includes an opinion from the auditor that the PFI is the same in all material respects with the audited financial statements of the issuer that have been included in the prospectus. While the Regulation requires a pro forma opinion from the auditor, there is no specific auditing standard for it. As the reasons for not presenting pro forma profit and loss or cash flow statements would be disclosed in the pro forma financial statements, the auditor’s pro forma opinion would indirectly cover this.

What type of pro forma adjustments can be adjusted?

Adjustments should be given to events that are (all conditions to be met):

Common pro forma adjustments include material charges, credits and related tax effects. These may include:

How should PFI be presented?

The prospectus must include:

Who is involved in the preparation of PFI?

The preparation of PFI requires cooperation and assistance between the issuer and other parties involved in the transaction, such as the respective auditor.

Another important collaboration is between the issuer and its auditor, as the issuer is required to include, in the prospectus, the auditor’s opinion on the compilation of pro forma financial statements. The auditor conducts its engagement in accordance with Singapore Standard on Assurance Engagements (SSAE) 3420, Assurance Engagements to Report on the Compilation of Pro Forma Financial Information Included in a Prospectus (SSAE 3420). The auditor’s responsibility is to report on whether the PFI have been compiled, in all material respects, by the responsible party based on the applicable criteria.

A successful preparation of PFI requires time and expertise by the finance team of the issuer. The issuer should ensure alignment of the accounting policies of acquired businesses when preparing the PFI, as well as sufficient disclosure of the nature of the pro forma adjustments made. Equipped with knowledge of relevant requirements and considerations set out in this article, issuers may plan a transaction in advance to avoid preparation of the PFI.

This article was written by Jimmy Seet, Director, Assurance – Capital Markets Services Group, PwC, and the ISCA Corporate Finance Committee.