TAKEAWAYS

The onslaught of inflation has been a global phenomenon after the lingering COVID-19 pandemic, fuelled by increasing prices for natural gas and electricity due to the Russia-Ukraine war, supply chain disruptions and tightening financial conditions in most countries. According to the Eurostat statistics published in October 2022, the reported annual inflation in the European Union reached 10.9% in September 2022, while the United States recorded an 8.2% inflation rate in September 2022.

The International Monetary Fund’s ‘World Economic Outlook Update’, published in October 2022, showed an uptick in the headline inflation as well as in the underlying inflation. Global economic activity has also begun experiencing a broad-based and sharper-than-expected slowdown, with inflation higher than seen in several decades. Global growth is forecast to slow from 6% in 2021 to 3.2% in 2022, and 2.7% in 2023. This is the weakest growth profile since 2001, except for the global financial crisis and the acute phase of the COVID-19 pandemic.

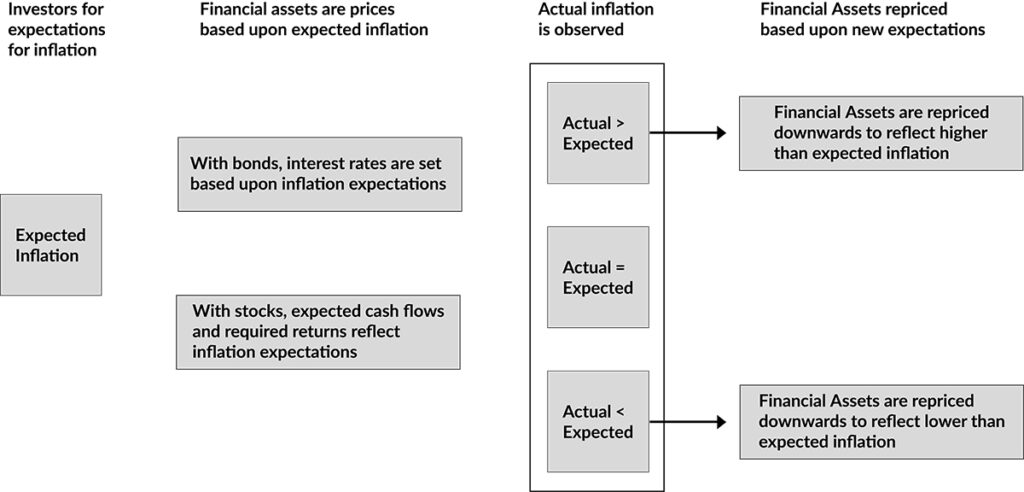

The impact on prices of asset classes on account of inflation is mainly due to the difference in actual inflation versus expected inflation. While expected inflation is always priced in the asset’s value, the repricing happens to account for the actual inflation, as illustrated in Figure 1, according to Professor Aswath Damodaran, Professor of Finance, Stern School of Business, New York University.

Figure 1

Based on the historical data, with inflation at its peak and interest rates on the rise, it is reasonably expected that the energy, healthcare and financial sector may continue to perform well, while the consumer discretionary, utilities and materials sector may suffer. Companies will need to respond to, and manage, these risks which could lead to changes in risk assessment, business plans and even longer-term strategy. Now, one of the major considerations for companies are the risks associated with financial reporting, particularly relating to fair value measurement. The reasonableness and appropriateness of the estimates and inputs plugged into the fair value measurement process which need to factor in the inflation will be crucial.

To understand these risks better, below is an example of how rising interest rates and inflation will have an impact on financial reporting and operational decisions. In connection with goodwill impairment testing, let us divide inputs into two categories:

1) Internal inputs

2) Market inputs

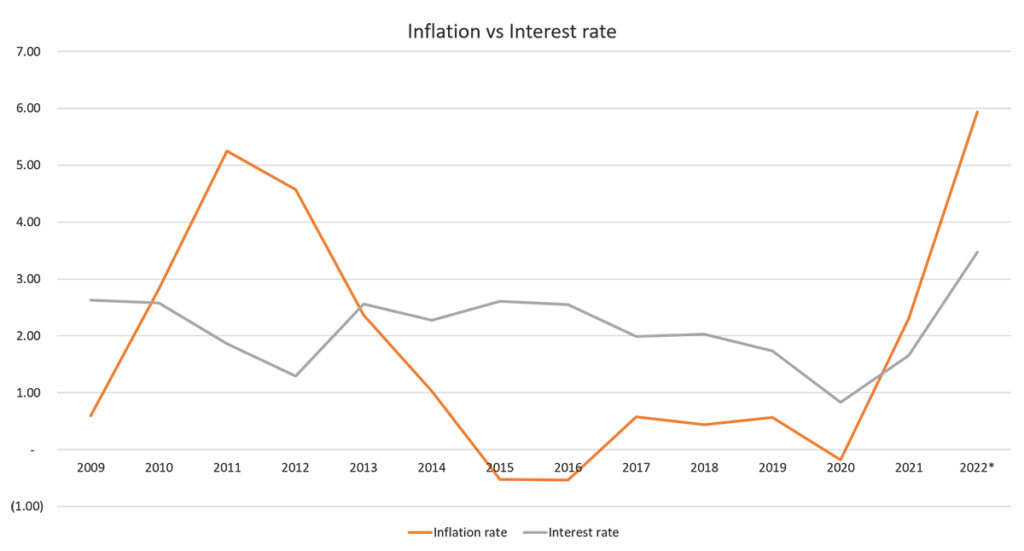

Figure 2

*Till 30 September 2022

Source: World Bank, S&P Capital IQ

Typically, the risk-free rate forms the basis of discount rate in the Discounted Cash Flow (DCF) method under the income approach for valuation. Therefore, an increase in the interest rate (shown in Figure 2), would usually lead to an increase in the overall discount rate. Additionally, in terms of cross-border operations, the associated risks are largely characterised as financial, economic, and political risks.

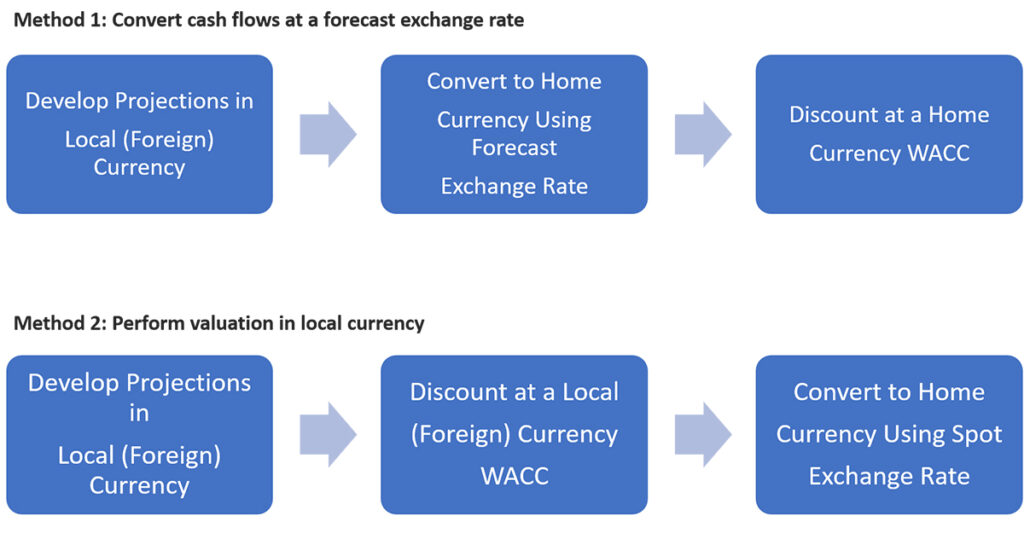

Under the financial risk, currency risk is the risk that exchange rates (the value of one currency versus another) will change unexpectedly. Under the normal circumstances, the currency of the projections should always be consistent with the currency of the discount rate. This implies that the inputs used to derive a discount rate (the denominator) should be in the same currency used to project cash flows (the numerator). There are two basic methods to address foreign currency cash flows in the valuation, assuming the analysis is being conducted in nominal terms, as illustrated in Figure 3.

Figure 3

Furthermore, due to rising inflation, the revenue growth rate may be reduced as a result of lower demand. At the same time, the increasing cost of production and other operating expenses would cause the margins to contract if they cannot be passed on to the customers. This, in turn, will decrease the overall value under the DCF method while testing for goodwill impairment. It will impact the headroom between the carrying amount and the fair value of the cash generating units if the decrease in fair value is not offset by improved cash flow assumptions. There are also various risks to consider, such as businesses’ ability to leverage and repay loans in a timely manner, credit-rating impacts and increasing cost of capital.

Amid a flurry of geopolitical concerns, the most prominent risk for C-suite personnel, particularly the Chief Financial Officer (CFO), is to determine the possible impact on business and impending risk of impairment of assets.

IAS 36 Impairment of Assets requires a company to assess at each reporting date whether there is any indication of impairment (or an indication that a previously recognised impairment loss has reversed).

Sustained inflation could be an indicator of impairment for a company that is negatively affected by the high inflation rate. A likely candidate for such damage would be a company in the consumer discretionary space, whereby consumer demand is severely impacted due to the lower purchasing power and the elasticity of demand for discretionary products or services. The likelihood for an impairment testing increases significantly for such companies.

According to Prof Damodaran, it has been demonstrated that inflation affects a company’s value in the following ways:

In a nutshell, the effect of inflation on the value of assets or businesses is dependent on the impact it has on the expected cash flows, growth rate and risk associated with the assets or businesses. In the event that the inflation stays elevated for an extended period, the impact to the valuation will be increasingly significant, and the assumptions or inputs used in the valuation process will have to be critically assessed to derive the appropriate valuation conclusion for the purpose of financial reporting or transactions, such as mergers and acquisitions.

Jason Pang is Associate Partner, Valuation Services, KNAV. Snehal Pawar and Kinjal Shah are Senior Manager and Manager respectively, Valuation Services, KNAV.