In Singapore, more businesses are looking at stablecoins as viable alternatives to traditional cross-border payments, to support their overseas expansion plans, according to a poll by payment services provider Stripe, at its annual conference in Singapore on August 20.

“Asia is showing extraordinary resilience and focusing on international growth,” said Sarita Singh, Regional Head and Managing Director for Southeast Asia, India, and Greater China, Stripe. “Between July 2024 and June 2025, over half of our users in the region (54%) sold internationally and we’re seeing cross-border payments surge by over 30% in hubs like Singapore. Stripe is helping businesses to go global, faster, and we expect new technologies like stablecoins and AI to accelerate their growth.” Ms Singh was speaking at Stripe Tour Singapore 2025.

For businesses, stablecoins offer a host of advantages including speed – transactions are settled in minutes, versus days if done through legacy systems like banks; cost efficient – fees are a small fraction of those for traditional cross-border transfers; accessible – all that is needed is an internet connection; and transparent – transactions can be audited on blockchain ledgers.

In a study conducted by YouGov and Stripe in July 2025 that surveyed 2,330 business owners and senior decision-makers across China, India, Japan, and Singapore, almost half (46%) of surveyed businesses reported that they are planning to start using stablecoins within 24 months. By 2030, 82% expect to utilise artificial intelligence-driven sales channels, and 50% expect at least a portion of their sales to occur through these new channels.

In a separate July poll conducted by Strip of 400 business owners and senior decision-makers in Singapore, 85% of respondents were confident of reaching new international customers within the next 12 months. The same poll shows that 62% plan to adopt stablecoins for payments, and 19% are already doing so; 25% said they are not familiar with stablecoins. Given that differing regulations across markets are a major hurdle for businesses looking to expand overseas, stablecoins may just be a solution to address this problem.

Stablecoins are different from traditional cryptocurrencies as they are designed to maintain a stable value relative to a specific asset or basket of assets. Unlike traditional cryptocurrencies which can experience significant price fluctuations, stablecoins aim to provide a consistent store of value and medium of exchange, usually achieved through mechanisms like asset backing, algorithmic control or a combination of both.

The supply of stablecoins is around US$239 billion, having grown from under US$10 billion five years ago, according to a new Artemis report released in May 2025. Approximately 10 million blockchain addresses make a stablecoin transaction every day.

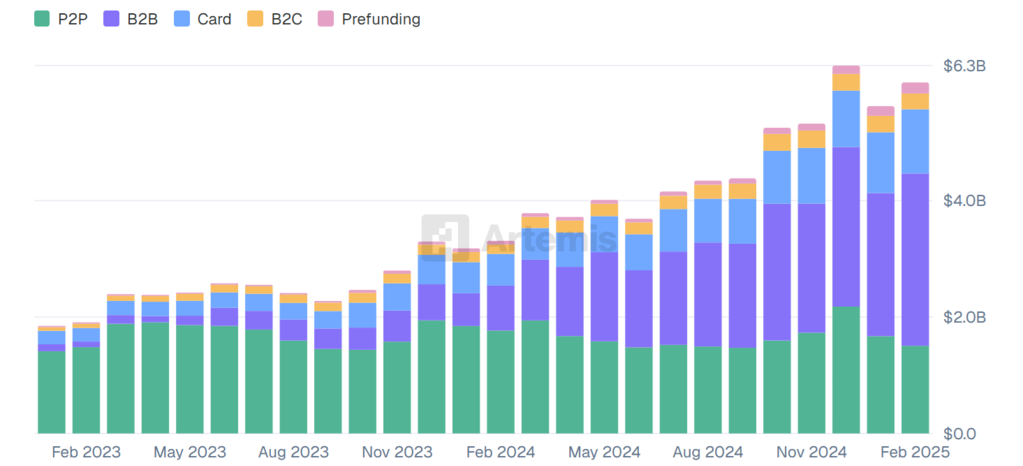

The Artemis study reveals that US$94.2 billion of stablecoin payments were settled for various payments between January 2023 and February 2025, with the majority settling on blockchains directly. The annual run rate pace for settlement is approximately US$72.3 billion in February 2025. Business-to-business (B2B) payments represented the majority of the flows, followed by peer-to-peer transfers, card payments (typically debit or prepaid cards linked to a stablecoin wallet), and business-to-customer payments.

Stablecoin payments by type (US$)

Related articles on CA Lab: